disciplinary handbook: volume v - Supreme Court - State of Ohio

disciplinary handbook: volume v - Supreme Court - State of Ohio

disciplinary handbook: volume v - Supreme Court - State of Ohio

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

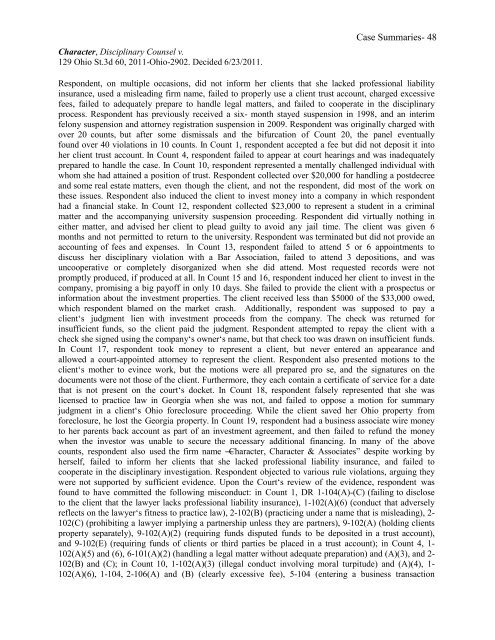

Character, Disciplinary Counsel v.<br />

129 <strong>Ohio</strong> St.3d 60, 2011-<strong>Ohio</strong>-2902. Decided 6/23/2011.<br />

Case Summaries- 48<br />

Respondent, on multiple occasions, did not inform her clients that she lacked pr<strong>of</strong>essional liability<br />

insurance, used a misleading firm name, failed to properly use a client trust account, charged excessive<br />

fees, failed to adequately prepare to handle legal matters, and failed to cooperate in the <strong>disciplinary</strong><br />

process. Respondent has previously received a six- month stayed suspension in 1998, and an interim<br />

felony suspension and attorney registration suspension in 2009. Respondent was originally charged with<br />

over 20 counts, but after some dismissals and the bifurcation <strong>of</strong> Count 20, the panel eventually<br />

found over 40 violations in 10 counts. In Count 1, respondent accepted a fee but did not deposit it into<br />

her client trust account. In Count 4, respondent failed to appear at court hearings and was inadequately<br />

prepared to handle the case. In Count 10, respondent represented a mentally challenged individual with<br />

whom she had attained a position <strong>of</strong> trust. Respondent collected over $20,000 for handling a postdecree<br />

and some real estate matters, even though the client, and not the respondent, did most <strong>of</strong> the work on<br />

these issues. Respondent also induced the client to invest money into a company in which respondent<br />

had a financial stake. In Count 12, respondent collected $23,000 to represent a student in a criminal<br />

matter and the accompanying university suspension proceeding. Respondent did virtually nothing in<br />

either matter, and advised her client to plead guilty to avoid any jail time. The client was given 6<br />

months and not permitted to return to the university. Respondent was terminated but did not provide an<br />

accounting <strong>of</strong> fees and expenses. In Count 13, respondent failed to attend 5 or 6 appointments to<br />

discuss her <strong>disciplinary</strong> violation with a Bar Association, failed to attend 3 depositions, and was<br />

uncooperative or completely disorganized when she did attend. Most requested records were not<br />

promptly produced, if produced at all. In Count 15 and 16, respondent induced her client to invest in the<br />

company, promising a big pay<strong>of</strong>f in only 10 days. She failed to provide the client with a prospectus or<br />

information about the investment properties. The client received less than $5000 <strong>of</strong> the $33,000 owed,<br />

which respondent blamed on the market crash. Additionally, respondent was supposed to pay a<br />

client‘s judgment lien with investment proceeds from the company. The check was returned for<br />

insufficient funds, so the client paid the judgment. Respondent attempted to repay the client with a<br />

check she signed using the company‘s owner‘s name, but that check too was drawn on insufficient funds.<br />

In Count 17, respondent took money to represent a client, but never entered an appearance and<br />

allowed a court-appointed attorney to represent the client. Respondent also presented motions to the<br />

client‘s mother to evince work, but the motions were all prepared pro se, and the signatures on the<br />

documents were not those <strong>of</strong> the client. Furthermore, they each contain a certificate <strong>of</strong> service for a date<br />

that is not present on the court‘s docket. In Count 18, respondent falsely represented that she was<br />

licensed to practice law in Georgia when she was not, and failed to oppose a motion for summary<br />

judgment in a client‘s <strong>Ohio</strong> foreclosure proceeding. While the client saved her <strong>Ohio</strong> property from<br />

foreclosure, he lost the Georgia property. In Count 19, respondent had a business associate wire money<br />

to her parents back account as part <strong>of</strong> an investment agreement, and then failed to refund the money<br />

when the investor was unable to secure the necessary additional financing. In many <strong>of</strong> the above<br />

counts, respondent also used the firm name ―Character, Character & Associates‖ despite working by<br />

herself, failed to inform her clients that she lacked pr<strong>of</strong>essional liability insurance, and failed to<br />

cooperate in the <strong>disciplinary</strong> investigation. Respondent objected to various rule violations, arguing they<br />

were not supported by sufficient evidence. Upon the <strong>Court</strong>‘s review <strong>of</strong> the evidence, respondent was<br />

found to have committed the following misconduct: in Count 1, DR 1-104(A)-(C) (failing to disclose<br />

to the client that the lawyer lacks pr<strong>of</strong>essional liability insurance), 1-102(A)(6) (conduct that adversely<br />

reflects on the lawyer‘s fitness to practice law), 2-102(B) (practicing under a name that is misleading), 2-<br />

102(C) (prohibiting a lawyer implying a partnership unless they are partners), 9-102(A) (holding clients<br />

property separately), 9-102(A)(2) (requiring funds disputed funds to be deposited in a trust account),<br />

and 9-102(E) (requiring funds <strong>of</strong> clients or third parties be placed in a trust account); in Count 4, 1-<br />

102(A)(5) and (6), 6-101(A)(2) (handling a legal matter without adequate preparation) and (A)(3), and 2-<br />

102(B) and (C); in Count 10, 1-102(A)(3) (illegal conduct involving moral turpitude) and (A)(4), 1-<br />

102(A)(6), 1-104, 2-106(A) and (B) (clearly excessive fee), 5-104 (entering a business transaction