Close Brothers Seydler Research AG - BVB Aktie - Borussia Dortmund

Close Brothers Seydler Research AG - BVB Aktie - Borussia Dortmund

Close Brothers Seydler Research AG - BVB Aktie - Borussia Dortmund

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Borussia</strong> <strong>Dortmund</strong> GmbH & CO KGaA<br />

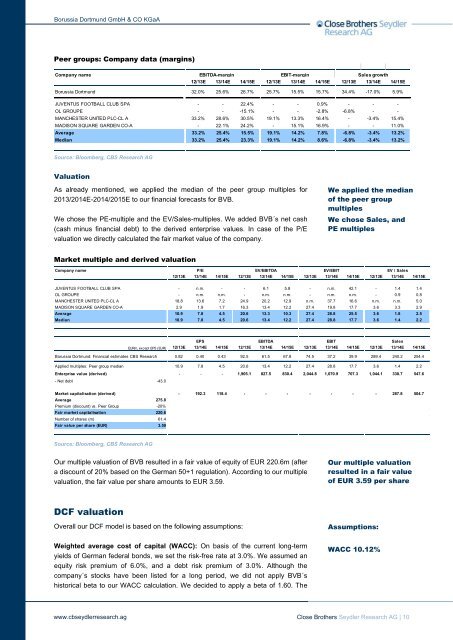

Peer groups: Company data (margins)<br />

Company name<br />

EBITDA-margin<br />

EBIT-margin<br />

Sales growth<br />

12/13E 13/14E 14/15E 12/13E 13/14E 14/15E 12/13E 13/14E 14/15E<br />

<strong>Borussia</strong> <strong>Dortmund</strong> 32.0% 25.6% 26.7% 25.7% 15.5% 15.7% 34.4% -17.0% 5.9%<br />

JUVENTUS FOOTBALL CLUB SPA - - 22.4% - - 0.9% - - -<br />

OL GROUPE - - -15.1% - - -2.8% -6.8% - -<br />

MANCHESTER UNITED PLC-CL A 33.2% 28.6% 30.5% 19.1% 13.3% 16.4% - -3.4% 15.4%<br />

MADISON SQUARE GARDEN CO-A - 22.1% 24.2% - 15.1% 16.9% - - 11.0%<br />

Average 33.2% 25.4% 15.5% 19.1% 14.2% 7.8% -6.8% -3.4% 13.2%<br />

Median 33.2% 25.4% 23.3% 19.1% 14.2% 8.6% -6.8% -3.4% 13.2%<br />

Source: Bloomberg, CBS <strong>Research</strong> <strong>AG</strong><br />

Valuation<br />

As already mentioned, we applied the median of the peer group multiples for<br />

2013/2014E-2014/2015E to our financial forecasts for <strong>BVB</strong>.<br />

We chose the PE-multiple and the EV/Sales-multiples. We added <strong>BVB</strong>´s net cash<br />

(cash minus financial debt) to the derived enterprise values. In case of the P/E<br />

valuation we directly calculated the fair market value of the company.<br />

We applied the median<br />

of the peer group<br />

multiples<br />

We chose Sales, and<br />

PE multiples<br />

Market multiple and derived valuation<br />

Company name<br />

P/E EV/EBITDA EV/EBIT EV / Sales<br />

12/13E 13/14E 14/15E 12/13E 13/14E 14/15E 12/13E 13/14E 14/15E 12/13E 13/14E 14/15E<br />

JUVENTUS FOOTBALL CLUB SPA - n.m. - - 6.1 5.8 - n.m. 42.1 - 1.4 1.4<br />

OL GROUPE - n.m. n.m. - n.m. n.m. - n.m. n.m. - 0.9 0.8<br />

MANCHESTER UNITED PLC-CL A 18.8 13.6 7.2 24.9 20.2 12.9 n.m. 37.7 16.6 n.m. n.m. 5.0<br />

MADISON SQUARE GARDEN CO-A 2.9 1.9 1.7 16.3 13.4 12.2 27.4 19.8 17.7 3.6 3.3 2.9<br />

Average 10.9 7.8 4.5 20.6 13.3 10.3 27.4 28.8 25.5 3.6 1.8 2.5<br />

Median 10.9 7.8 4.5 20.6 13.4 12.2 27.4 28.8 17.7 3.6 1.4 2.2<br />

EPS<br />

EBITDA<br />

EBIT<br />

Sales<br />

EURm, except EPS (EUR) 12/13E 13/14E 14/15E 12/13E 13/14E 14/15E 12/13E 13/14E 14/15E 12/13E 13/14E 14/15E<br />

<strong>Borussia</strong> <strong>Dortmund</strong>: Financial estimates CBS <strong>Research</strong> 0.82 0.40 0.43 92.5 61.5 67.8 74.5 37.2 39.9 289.4 240.2 254.4<br />

Applied multiples: Peer group median 10.9 7.8 4.5 20.6 13.4 12.2 27.4 28.8 17.7 3.6 1.4 2.2<br />

Enterprise value (derived) - - - 1,905.1 827.5 830.4 2,044.8 1,070.9 707.3 1,044.1 330.7 547.6<br />

- Net debt -43.0<br />

Market capitalisation (derived) - 192.3 118.4 - - - - - - - 287.8 504.7<br />

Average 275.8<br />

Premium (discount) vs. Peer Group -20%<br />

Fair market capitalisation 220.6<br />

Number of shares (m) 61.4<br />

Fair value per share (EUR) 3.59<br />

Source: Bloomberg, CBS <strong>Research</strong> <strong>AG</strong><br />

Our multiple valuation of <strong>BVB</strong> resulted in a fair value of equity of EUR 220.6m (after<br />

a discount of 20% based on the German 50+1 regulation). According to our multiple<br />

valuation, the fair value per share amounts to EUR 3.59.<br />

Our multiple valuation<br />

resulted in a fair value<br />

of EUR 3.59 per share<br />

DCF valuation<br />

Overall our DCF model is based on the following assumptions:<br />

Assumptions:<br />

Weighted average cost of capital (WACC): On basis of the current long-term<br />

yields of German federal bonds, we set the risk-free rate at 3.0%. We assumed an<br />

equity risk premium of 6.0%, and a debt risk premium of 3.0%. Although the<br />

company´s stocks have been listed for a long period, we did not apply <strong>BVB</strong>´s<br />

historical beta to our WACC calculation. We decided to apply a beta of 1.60. The<br />

WACC 10.12%<br />

www.cbseydlerresearch.ag <strong>Close</strong> <strong>Brothers</strong> <strong>Seydler</strong> <strong>Research</strong> <strong>AG</strong> | 10