Meridian Annual Report - Meridian Energy

Meridian Annual Report - Meridian Energy

Meridian Annual Report - Meridian Energy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

64<br />

<strong>Meridian</strong> <strong>Energy</strong> Limited — Notes to the Financial Statements (continued)<br />

20. Borrowings (continued)<br />

The foreign currency denominated borrowings are reported in the financial statements at fair value and are hedged by Cross Currency Interest<br />

Rate Swaps (CCIRS). The NZD equivalent of these borrowings after the effect of foreign exchange hedging of the borrowings is $704.649 million<br />

(30 June 2007 $704.649 million).<br />

The NZD denominated borrowings are reported at amortised cost, which is considered to approximate fair value given their term and nature.<br />

For more information about <strong>Meridian</strong>’s exposure to interest rate and foreign currency risk, see Note 22.<br />

Security<br />

<strong>Meridian</strong> borrows under a negative pledge arrangement, which does not permit it to grant any security interest over its assets, unless it is an<br />

exception permitted within the negative pledge.<br />

Credit Facilities<br />

<strong>Meridian</strong> has committed bank facilities of $700 million of which $450 million were undrawn at 30 June 2008 ($700 million at 30 June 2007).<br />

The expiry of these facilities range from December 2008 to December 2012.<br />

In addition to its borrowings, <strong>Meridian</strong> has entered into a number of letter of credit arrangements which provide credit support of $140 million to<br />

support the collateral requirements of <strong>Meridian</strong>’s trading business. Of the $140 million, $90 million expires in 2012 with the balance having no<br />

expiry date. <strong>Meridian</strong> indemnifies the obligations of the bank in respect of the letters of credit issued by the bank to counterparties of <strong>Meridian</strong>.<br />

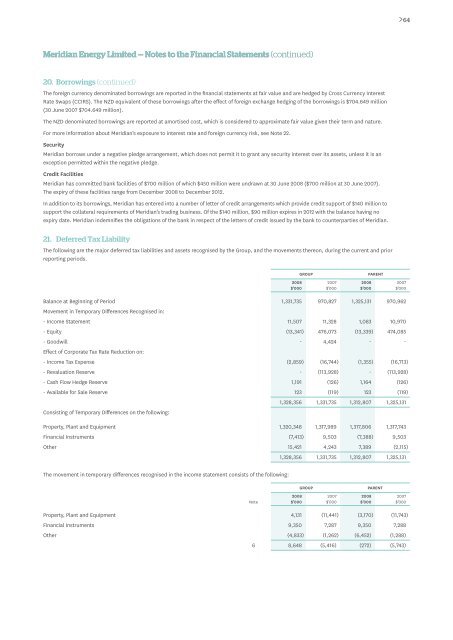

21. Deferred Tax Liability<br />

The following are the major deferred tax liabilities and assets recognised by the Group, and the movements thereon, during the current and prior<br />

reporting periods.<br />

Group<br />

Parent<br />

2008<br />

$’000<br />

2007<br />

$’000<br />

2008<br />

$’000<br />

2007<br />

$’000<br />

Balance at Beginning of Period 1,331,735 970,827 1,325,131 970,962<br />

Movement in Temporary Differences Recognised in:<br />

- Income Statement 11,507 11,328 1,083 10,970<br />

- Equity (13,341) 476,073 (13,339) 474,085<br />

- Goodwill - 4,424 - -<br />

Effect of Corporate Tax Rate Reduction on:<br />

- Income Tax Expense (2,859) (16,744) (1,355) (16,713)<br />

- Revaluation Reserve - (113,928) - (113,928)<br />

- Cash Flow Hedge Reserve 1,191 (126) 1,164 (126)<br />

- Available for Sale Reserve 123 (119) 123 (119)<br />

1,328,356 1,331,735 1,312,807 1,325,131<br />

Consisting of Temporary Differences on the following:<br />

Property, Plant and Equipment 1,320,348 1,317,989 1,317,806 1,317,743<br />

Financial Instruments (7,413) 9,503 (7,388) 9,503<br />

Other 15,421 4,243 7,389 (2,115)<br />

1,328,356 1,331,735 1,312,807 1,325,131<br />

The movement in temporary differences recognised in the income statement consists of the following:<br />

Group<br />

Parent<br />

Note<br />

2008<br />

$’000<br />

2007<br />

$’000<br />

2008<br />

$’000<br />

2007<br />

$’000<br />

Property, Plant and Equipment 4,131 (11,441) (3,170) (11,743)<br />

Financial Instruments 9,350 7,287 9,350 7,288<br />

Other (4,833) (1,262) (6,452) (1,288)<br />

6 8,648 (5,416) (272) (5,743)