Meridian Annual Report - Meridian Energy

Meridian Annual Report - Meridian Energy

Meridian Annual Report - Meridian Energy

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

66<br />

<strong>Meridian</strong> <strong>Energy</strong> Limited — Notes to the Financial Statements (continued)<br />

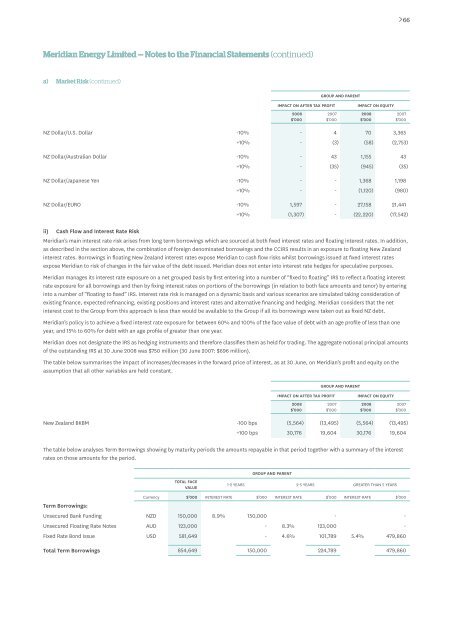

a) Market Risk (continued)<br />

Group and Parent<br />

Impact on After Tax Profit<br />

2008<br />

$’000<br />

2007<br />

$’000<br />

Impact on Equity<br />

2008<br />

$’000<br />

2007<br />

$’000<br />

NZ Dollar/U.S. Dollar -10% - 4 70 3,365<br />

+10% - (3) (58) (2,753)<br />

NZ Dollar/Australian Dollar -10% - 43 1,155 43<br />

+10% - (35) (945) (35)<br />

NZ Dollar/Japanese Yen -10% - - 1,368 1,198<br />

+10% - - (1,120) (980)<br />

NZ Dollar/EURO -10% 1,597 - 27,158 21,441<br />

ii)<br />

Cash Flow and Interest Rate Risk<br />

+10% (1,307) - (22,220) (17,542)<br />

<strong>Meridian</strong>’s main interest rate risk arises from long term borrowings which are sourced at both fixed interest rates and floating interest rates. In addition,<br />

as described in the section above, the combination of foreign denominated borrowings and the CCIRS results in an exposure to floating New Zealand<br />

interest rates. Borrowings in floating New Zealand interest rates expose <strong>Meridian</strong> to cash flow risks whilst borrowings issued at fixed interest rates<br />

expose <strong>Meridian</strong> to risk of changes in the fair value of the debt issued. <strong>Meridian</strong> does not enter into interest rate hedges for speculative purposes.<br />

<strong>Meridian</strong> manages its interest rate exposure on a net grouped basis by first entering into a number of “fixed to floating” IRS to reflect a floating interest<br />

rate exposure for all borrowings and then by fixing interest rates on portions of the borrowings (in relation to both face amounts and tenor) by entering<br />

into a number of “floating to fixed” IRS. Interest rate risk is managed on a dynamic basis and various scenarios are simulated taking consideration of<br />

existing finance, expected refinancing, existing positions and interest rates and alternative financing and hedging. <strong>Meridian</strong> considers that the net<br />

interest cost to the Group from this approach is less than would be available to the Group if all its borrowings were taken out as fixed NZ debt.<br />

<strong>Meridian</strong>’s policy is to achieve a fixed interest rate exposure for between 60% and 100% of the face value of debt with an age profile of less than one<br />

year, and 15% to 60% for debt with an age profile of greater than one year.<br />

<strong>Meridian</strong> does not designate the IRS as hedging instruments and therefore classifies them as held for trading. The aggregate notional principal amounts<br />

of the outstanding IRS at 30 June 2008 was $750 million (30 June 2007: $696 million).<br />

The table below summarises the impact of increases/decreases in the forward price of interest, as at 30 June, on <strong>Meridian</strong>’s profit and equity on the<br />

assumption that all other variables are held constant.<br />

Group and Parent<br />

Impact on After Tax Profit<br />

2008<br />

$’000<br />

2007<br />

$’000<br />

Impact on Equity<br />

2008<br />

$’000<br />

2007<br />

$’000<br />

New Zealand BKBM -100 bps (5,564) (13,495) (5,564) (13,495)<br />

+100 bps 30,176 19,604 30,176 19,604<br />

The table below analyses Term Borrowings showing by maturity periods the amounts repayable in that period together with a summary of the interest<br />

rates on those amounts for the period.<br />

Total Face<br />

value<br />

Group and Parent<br />

1-2 Years 2-5 Years Greater than 5 Years<br />

Currency $’000 Interest Rate $’000 Interest Rate $’000 Interest Rate $’000<br />

Term Borrowings:<br />

Unsecured Bank Funding NZD 150,000 8.9% 150,000 - -<br />

Unsecured Floating Rate Notes AUD 123,000 - 8.3% 123,000 -<br />

Fixed Rate Bond Issue USD 581,649 - 4.6% 101,789 5.4% 479,860<br />

Total Term Borrowings 854,649 150,000 224,789 479,860