to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

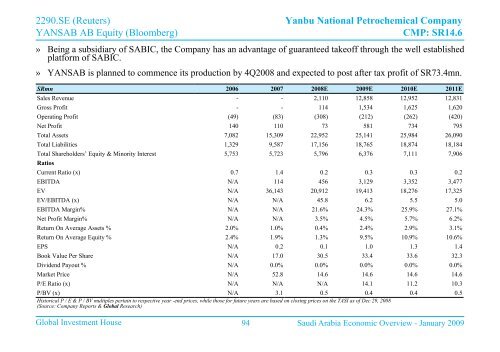

2290.SE (Reuters)<br />

YANSAB AB Equity (Bloomberg)<br />

Yanbu National Petrochemical Company<br />

CMP: SR14.6<br />

» Being a subsidiary of SABIC, <strong>the</strong> Company has an advantage of guaranteed takeoff through <strong>the</strong> well established<br />

platform of SABIC.<br />

» YANSAB is planned <strong>to</strong> <strong>com</strong>mence its production by 4Q2008 and expected <strong>to</strong> post after tax profit of SR73.4mn.<br />

SRmn 2006 2007 2008E 2009E 2010E 2011E<br />

Sales Revenue - - 2,110 12,858 12,952 12,831<br />

Gross Profit - - 114 1,534 1,625 1,620<br />

Operating Profit (49) (83) (308) (212) (262) (420)<br />

Net Profit 140 110 73 581 734 795<br />

Total Assets 7,082 15,309 22,952 25,141 25,984 26,090<br />

Total Liabilities 1,329 9,587 17,156 18,765 18,874 18,184<br />

Total Shareholders’ Equity & Minority Interest 5,753 5,723 5,796 6,376 7,111 7,906<br />

Ratios<br />

Current Ratio (x) 0.7 1.4 0.2 0.3 0.3 0.2<br />

EBITDA N/A 114 456 3,129 3,352 3,477<br />

EV N/A 36,143 20,912 19,413 18,276 17,325<br />

EV/EBITDA (x) N/A N/A 45.8 6.2 5.5 5.0<br />

EBITDA Margin% N/A N/A 21.6% 24.3% 25.9% 27.1%<br />

Net Profit Margin% N/A N/A 3.5% 4.5% 5.7% 6.2%<br />

Return On Average Assets % 2.0% 1.0% 0.4% 2.4% 2.9% 3.1%<br />

Return On Average Equity % 2.4% 1.9% 1.3% 9.5% 10.9% 10.6%<br />

EPS N/A 0.2 0.1 1.0 1.3 1.4<br />

Book Value Per Share N/A 17.0 30.5 33.4 33.6 32.3<br />

Dividend Payout % N/A 0.0% 0.0% 0.0% 0.0% 0.0%<br />

Market Price N/A 52.8 14.6 14.6 14.6 14.6<br />

P/E Ratio (x) N/A N/A N/A 14.1 11.2 10.3<br />

P/BV (x) N/A 3.1 0.5 0.4 0.4 0.5<br />

His<strong>to</strong>rical P / E & P / BV multiples pertain <strong>to</strong> respective year -end prices, while those for future years are based on closing prices on <strong>the</strong> TASI as of Dec 29, 2008<br />

(Source: Company Reports & Global Research)<br />

Global Investment House 94 Saudi Arabia Economic Overview - January 2009