Annual Report 2007 - Severstal

Annual Report 2007 - Severstal

Annual Report 2007 - Severstal

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

OAO <strong>Severstal</strong> and subsidiaries<br />

Notes to the consolidated financial statements<br />

for the year ended December 31, <strong>2007</strong><br />

(Amounts expressed in thousands of US dollars, except as otherwise stated)<br />

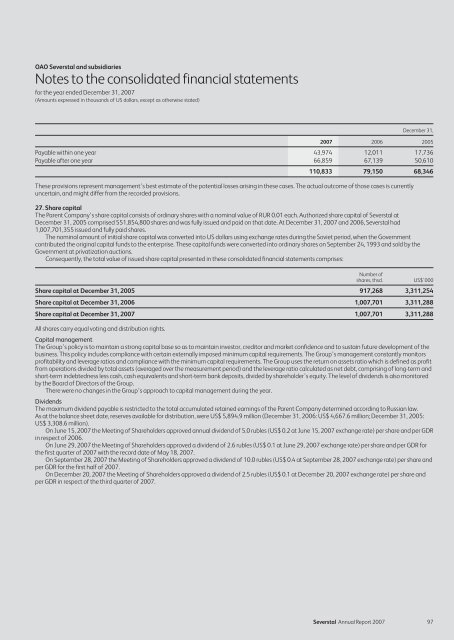

December 31,<br />

<strong>2007</strong> 2006 2005<br />

Payable within one year 43,974 12,011 17,736<br />

Payable after one year 66,859 67,139 50,610<br />

110,833 79,150 68,346<br />

These provisions represent management’s best estimate of the potential losses arising in these cases. The actual outcome of those cases is currently<br />

uncertain, and might differ from the recorded provisions.<br />

27. Share capital<br />

The Parent Company’s share capital consists of ordinary shares with a nominal value of RUR 0.01 each. Authorized share capital of <strong>Severstal</strong> at<br />

December 31, 2005 comprised 551,854,800 shares and was fully issued and paid on that date. At December 31, <strong>2007</strong> and 2006, <strong>Severstal</strong> had<br />

1,007,701,355 issued and fully paid shares.<br />

The nominal amount of initial share capital was converted into US dollars using exchange rates during the Soviet period, when the Government<br />

contributed the original capital funds to the enterprise. These capital funds were converted into ordinary shares on September 24, 1993 and sold by the<br />

Government at privatization auctions.<br />

Consequently, the total value of issued share capital presented in these consolidated financial statements comprises:<br />

Number of<br />

shares, thsd.<br />

Share capital at December 31, 2005 917,268 3,311,254<br />

Share capital at December 31, 2006 1,007,701 3,311,288<br />

Share capital at December 31, <strong>2007</strong> 1,007,701 3,311,288<br />

All shares carry equal voting and distribution rights.<br />

Capital management<br />

The Group’s policy is to maintain a strong capital base so as to maintain investor, creditor and market confidence and to sustain future development of the<br />

business. This policy includes compliance with certain externally imposed minimum capital requirements. The Group’s management constantly monitors<br />

profitability and leverage ratios and compliance with the minimum capital requirements. The Group uses the return on assets ratio which is defined as profit<br />

from operations divided by total assets (averaged over the measurement period) and the leverage ratio calculated as net debt, comprising of long-term and<br />

short-term indebtedness less cash, cash equivalents and short-term bank deposits, divided by shareholder’s equity. The level of dividends is also monitored<br />

by the Board of Directors of the Group.<br />

There were no changes in the Group’s approach to capital management during the year.<br />

Dividends<br />

The maximum dividend payable is restricted to the total accumulated retained earnings of the Parent Company determined according to Russian law.<br />

As at the balance sheet date, reserves available for distribution, were US$ 5,894.9 million (December 31, 2006: US$ 4,667.6 million; December 31, 2005:<br />

US$ 3,308.6 million).<br />

On June 15, <strong>2007</strong> the Meeting of Shareholders approved annual dividend of 5.0 rubles (US$ 0.2 at June 15, <strong>2007</strong> exchange rate) per share and per GDR<br />

in respect of 2006.<br />

On June 29, <strong>2007</strong> the Meeting of Shareholders approved a dividend of 2.6 rubles (US$ 0.1 at June 29, <strong>2007</strong> exchange rate) per share and per GDR for<br />

the first quarter of <strong>2007</strong> with the record date of May 18, <strong>2007</strong>.<br />

On September 28, <strong>2007</strong> the Meeting of Shareholders approved a dividend of 10.0 rubles (US$ 0.4 at September 28, <strong>2007</strong> exchange rate) per share and<br />

per GDR for the first half of <strong>2007</strong>.<br />

On December 20, <strong>2007</strong> the Meeting of Shareholders approved a dividend of 2.5 rubles (US$ 0.1 at December 20, <strong>2007</strong> exchange rate) per share and<br />

per GDR in respect of the third quarter of <strong>2007</strong>.<br />

US$’000<br />

<strong>Severstal</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2007</strong> 97