BABSc, B.Com & BCA Questions _III - Nalanda Open University

BABSc, B.Com & BCA Questions _III - Nalanda Open University

BABSc, B.Com & BCA Questions _III - Nalanda Open University

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

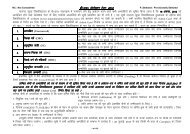

8. lat; vxzoky Hkksiky esa ,d edku dk Lokeh gSA fuEuof.kZr fooj.kksa ls dj&fu/kkZj.k o"kZ<br />

2009&10 ds fy, mldh edku lEifÙk ls vk; dh x.kuk djsa A<br />

Sanjay Agarwal owns a house in Bhopal. <strong>Com</strong>pute his income from house property<br />

for the assessment year 2009-10 from the details given as under:-<br />

(i) mfpr ewY; (Fair Rent) 7,000 :0 izfr ekg<br />

(ii) uxjikfydk ewY;kad (Municipal valuation) 8,000 :0 izfr ekg<br />

(iii) fdjk;s ij mBk;k x;k (Actual Rent) 7,500 :0 izfrekg<br />

(iv) uxjikfydk dj (Muncipal Tax) 600 :0<br />

(v)<br />

xr o"kZ esa edku 02 ekg [kkyh jgk<br />

(The House remained vacant for 02 months in the previous year)<br />

(vi) ejEer vkSj chek (Repairs and Insurance) 6,000 :0<br />

(vii) edku dz; gsrq fy, x, _.k ij C;kt 9,000 :0<br />

(Interest on loan for purchase of house property)<br />

(viii) fdjk;s dh olwyh ij O;; (Expense on recovery of rent) 500 :0<br />

9. ,l0 pUnzk us 1994 esa 300 va'k 120 :i;s izfr va'k dh nj ls dz; fd, A 1999 esa<br />

mls 300 cksul va'k feyk ftldk cktkj ewY; 100 :i;s izfr va'k Fkk A lsIVsEcj 2006<br />

esa mlus lHkh 600 va'k 575 :i;s izfr va'k dh nj csp fn;k vkSj nykyh ij 2]500<br />

:i;s O;; fd, A<br />

fodz; jkf'k esa ls 1]50]000 :i;s mlus vkoklh; edku ds fuekZ.k esa fuosf'kr dj fn;k<br />

tks<br />

twu 2007 esa cudj rS;kj gks x;k A<br />

dj&fu/kkZj.k o"kZ 2009&10 ds fy, ,l0 pUnzk dk dj&;ksX; iwath ykHk Kkr djsa A ;g<br />

eku ysa fd 2006&07 dk LQhfr lwpdkad 447 Fkk A<br />

S.Chandra purchased 300 shares @ Rs 120 per share in 1994. In the year 1999 he<br />

got 300 bonus shares of the market value of Rs 100 per share. He sold all 600<br />

shares in September 2006 @ Rs 575 per share and paid Rs 2,500 as Brokerage.<br />

He invested Rs 150,000 out of the Sale proceeds in the construction of a residential<br />

house which was completed in june 2007.<br />

<strong>Com</strong>pute the taxable Capital gain of S.Chandra for the assessment year 2009- 10<br />

assuming the cost of inflation index in 2006-2007 at 447.<br />

10. fuEufyf[kr esa ls fdUgha rhu ij fVIi.kh fy[ksa<br />

Writes notes on any three of the following:-<br />

(a) xr o"kZ (Previous year)<br />

(b) djnkrk (Assessee)<br />

(c) vYi dkyhu iwath ykHk (Short-term Capital gain)<br />

(d) fn[kkoVh ysu&nsu (Bond washing Transactions)<br />

(e) vuqykHk ( Perquisites)<br />

(f) edku fdjk;k HkÙkk (House Rent Allowance)