Nu Skin 2010 Annual Report - Direct Selling News

Nu Skin 2010 Annual Report - Direct Selling News

Nu Skin 2010 Annual Report - Direct Selling News

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

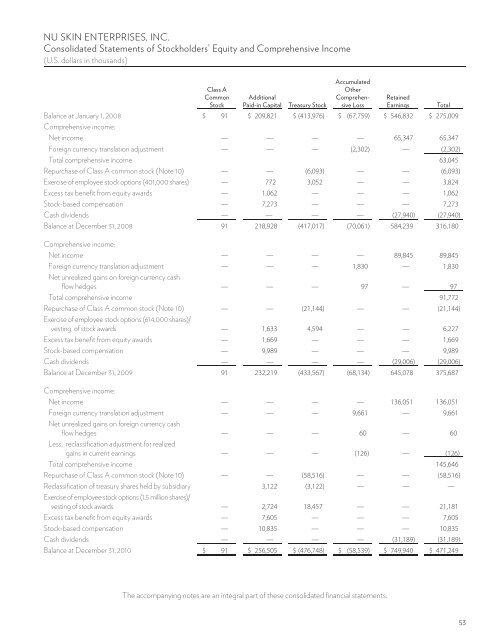

NU SKIN ENTERPRISES, INC.<br />

Consolidated Statements of Stockholders’ Equity and Comprehensive Income<br />

(U.S. dollars in thousands)<br />

Class A<br />

Common<br />

Stock<br />

Additional<br />

Paid-in Capital<br />

Treasury Stock<br />

Accumulated<br />

Other<br />

Comprehensive<br />

Loss<br />

Retained<br />

Earnings<br />

Balance at January 1, 2008 $ 91 $ 209,821 $ (413,976) $ (67,759) $ 546,832 $ 275,009<br />

Comprehensive income:<br />

Net income — — — — 65,347 65,347<br />

Foreign currency translation adjustment — — — (2,302) — (2,302)<br />

Total comprehensive income 63,045<br />

Repurchase of Class A common stock (Note 10) — — (6,093) — — (6,093)<br />

Exercise of employee stock options (401,000 shares) — 772 3,052 — — 3,824<br />

Excess tax benefit from equity awards — 1,062 — — — 1,062<br />

Stock-based compensation — 7,273 — — — 7,273<br />

Cash dividends — — — — (27,940) (27,940)<br />

Balance at December 31, 2008 91 218,928 (417,017) (70,061) 584,239 316,180<br />

Comprehensive income:<br />

Net income — — — — 89,845 89,845<br />

Foreign currency translation adjustment — — — 1,830 — 1,830<br />

Net unrealized gains on foreign currency cash<br />

fl owh e d g e s — — — 97 — 97<br />

Total comprehensive income 91,772<br />

Repurchase of Class A common stock (Note 10) — — (21,144) — — (21,144)<br />

Exercise of employee stock options (614,000 shares)/<br />

vesting of stock awards — 1,633 4,594 — — 6,227<br />

Excess tax benefit from equity awards — 1,669 — — — 1,669<br />

Stock-based compensation — 9,989 — — — 9,989<br />

Cash dividends — — — — (29,006) (29,006)<br />

Balance at December 31, 2009 91 232,219 (433,567) (68,134) 645,078 375,687<br />

Comprehensive income:<br />

Net income — — — — 136,051 136,051<br />

Foreign currency translation adjustment — — — 9,661 — 9,661<br />

Net unrealized gains on foreign currency cash<br />

fl owh e d g e s — — — 60 — 60<br />

Less: reclassification adjustment for realized<br />

gains in current earnings — — — (126) — (126)<br />

Total comprehensive income 145,646<br />

Repurchase of Class A common stock (Note 10) — — (58,516) — — (58,516)<br />

Reclassification of treasury shares held by subsidiary 3,122 (3,122) — — —<br />

Exercise of employee stock options (1.5 million shares)/<br />

vesting of stock awards — 2,724 18,457 — — 21,181<br />

Excess tax benefit from equity awards — 7,605 — — — 7,605<br />

Stock-based compensation — 10,835 — — — 10,835<br />

Cash dividends — — — — (31,189) (31,189)<br />

Balance at December 31, <strong>2010</strong> $ 91 $ 256,505 $ (476,748) $ (58,539) $ 749,940 $ 471,249<br />

Total<br />

The accompanying notes are an integral part of these consolidated financial statements.<br />

53