Nu Skin 2010 Annual Report - Direct Selling News

Nu Skin 2010 Annual Report - Direct Selling News

Nu Skin 2010 Annual Report - Direct Selling News

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NU SKIN ENTERPRISES, INC.<br />

Notes to Consolidated Financial Statements<br />

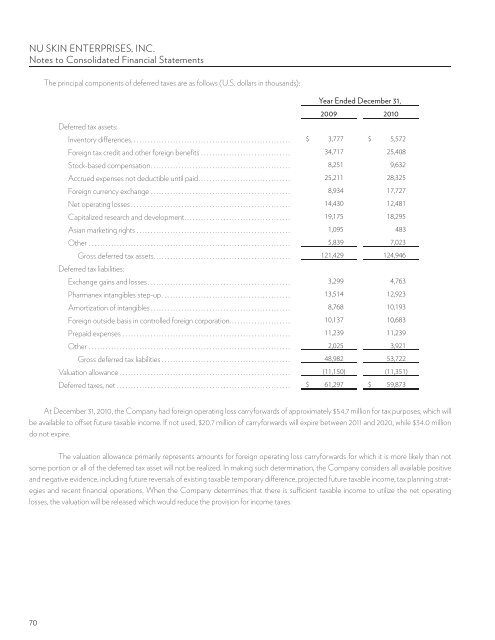

The principal components of deferred taxes are as follows (U.S. dollars in thousands):<br />

Year Ended December 31,<br />

2009 <strong>2010</strong><br />

Deferred tax assets:<br />

Inventory differences . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,777 $ 5,572<br />

Foreign tax credit and other foreign benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34,717 25,408<br />

Stock-based compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,251 9,632<br />

Accrued expenses not deductible until paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25,211 28,325<br />

Foreign currency exchange . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,934 17,727<br />

Net operating losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14,430 12,481<br />

Capitalized research and development . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19,175 18,295<br />

Asian marketing rights . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,095 483<br />

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,839 7,023<br />

Gross deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 121,429 124,946<br />

Deferred tax liabilities:<br />

Exchange gains and losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,299 4,763<br />

Pharmanex intangibles step-up . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13,514 12,923<br />

Amortization of intangibles . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,768 10,193<br />

Foreign outside basis in controlled foreign corporation . . . . . . . . . . . . . . . . . . . . . . 10,137 10,683<br />

Prepaid expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11,239 11,239<br />

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,025 3,921<br />

Gross deferred tax liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48,982 53,722<br />

Valuation allowance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (11,150) (11,351)<br />

Deferred taxes, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 61,297 $ 59,873<br />

At December 31, <strong>2010</strong>, the Company had foreign operating loss carryforwards of approximately $54.7 million for tax purposes, which will<br />

be available to offset future taxable income. If not used, $20.7 million of carryforwards will expire between 2011 and 2020, while $34.0 million<br />

do not expire.<br />

The valuation allowance primarily represents amounts for foreign operating loss carryforwards for which it is more likely than not<br />

some portion or all of the deferred tax asset will not be realized. In making such determination, the Company considers all available positive<br />

and negative evidence, including future reversals of existing taxable temporary difference, projected future taxable income, tax planning strategies<br />

and recent financial operations. When the Company determines that there is sufficient taxable income to utilize the net operating<br />

losses, the valuation will be released which would reduce the provision for income taxes.<br />

70