So ist das Leben /That's life / C'est la vie / Así es la vida / È la vita ...

So ist das Leben /That's life / C'est la vie / Así es la vida / È la vita ...

So ist das Leben /That's life / C'est la vie / Así es la vida / È la vita ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

58 / Consolidated Financial Statements / Exp<strong>la</strong>natory Not<strong>es</strong><br />

VI. Other Statutory Disclosur<strong>es</strong> Pursuant to § 314 HGB and<br />

Exp<strong>la</strong>natory Not<strong>es</strong> to Various Items in the Consolidated<br />

Ba<strong>la</strong>nce Sheet and Consolidated Profit and Loss Account<br />

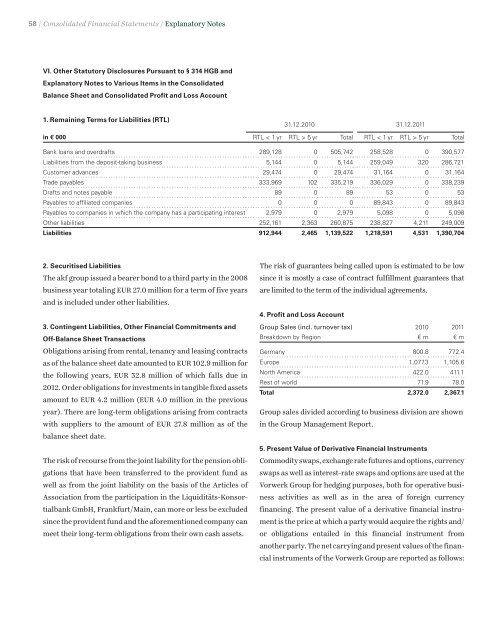

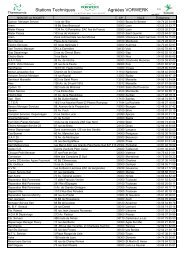

1. Remaining Terms for Liabiliti<strong>es</strong> (RTL)<br />

2. Securitised Liabiliti<strong>es</strong><br />

The akf group issued a bearer bond to a third party in the 2008<br />

busin<strong>es</strong>s year totaling EUR 27.0 million for a term of five years<br />

and is included under other liabiliti<strong>es</strong>.<br />

3. Contingent Liabiliti<strong>es</strong>, Other Financial Commitments and<br />

Off-Ba<strong>la</strong>nce Sheet Transactions<br />

Obligations arising from rental, tenancy and leasing contracts<br />

as of the ba<strong>la</strong>nce sheet date amounted to EUR 102.9 million for<br />

the following years, EUR 32.8 million of which falls due in<br />

2012. Order obligations for inv<strong>es</strong>tments in tangible fixed assets<br />

amount to EUR 4.2 million (EUR 4.0 million in the previous<br />

year). There are long-term obligations arising from contracts<br />

with suppliers to the amount of EUR 27.8 million as of the<br />

ba<strong>la</strong>nce sheet date.<br />

The risk of recourse from the joint liability for the pension obligations<br />

that have been transferred to the provident fund as<br />

well as from the joint liability on the basis of the Articl<strong>es</strong> of<br />

Association from the participation in the Liquiditäts-Konsortialbank<br />

GmbH, Frankfurt/Main, can more or l<strong>es</strong>s be excluded<br />

since the provident fund and the aforementioned company can<br />

meet their long-term obligations from their own cash assets.<br />

31.12.2010 31.12.2011<br />

in € 000 RTL < 1 yr RTL > 5 yr Total RTL < 1 yr RTL > 5 yr Total<br />

Bank loans and overdrafts 289,128 0 505,742 258,528 0 390,577<br />

Liabiliti<strong>es</strong> from the deposit-taking busin<strong>es</strong>s 5,144 0 5,144 259,049 320 286,721<br />

Customer advanc<strong>es</strong> 29,474 0 29,474 31,164 0 31,164<br />

Trade payabl<strong>es</strong> 333,969 102 335,219 336,029 0 338,239<br />

Drafts and not<strong>es</strong> payable 89 0 89 53 0 53<br />

Payabl<strong>es</strong> to affiliated compani<strong>es</strong> 0 0 0 89,843 0 89,843<br />

Payabl<strong>es</strong> to compani<strong>es</strong> in which the company has a participating inter<strong>es</strong>t 2,979 0 2,979 5,098 0 5,098<br />

Other liabiliti<strong>es</strong> 252,161 2,363 260,875 238,827 4,211 249,009<br />

Liabiliti<strong>es</strong> 912,944 2,465 1,139,522 1,218,591 4,531 1,390,704<br />

The risk of guarante<strong>es</strong> being called upon is <strong>es</strong>timated to be low<br />

since it is mostly a case of contract fulfillment guarante<strong>es</strong> that<br />

are limited to the term of the individual agreements.<br />

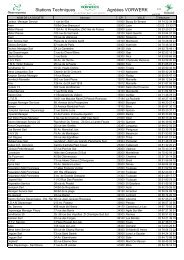

4. Profit and Loss Account<br />

Group Sal<strong>es</strong> (incl. turnover tax) 2010 2011<br />

Breakdown by Region € m € m<br />

Germany 800.8 772.4<br />

Europe 1,077.3 1,105.6<br />

North America 422.0 411.1<br />

R<strong>es</strong>t of world 71.9 78.0<br />

Total 2,372.0 2,367.1<br />

Group sal<strong>es</strong> divided according to busin<strong>es</strong>s division are shown<br />

in the Group Management Report.<br />

5. Pr<strong>es</strong>ent Value of Derivative Financial Instruments<br />

Commodity swaps, exchange rate futur<strong>es</strong> and options, currency<br />

swaps as well as inter<strong>es</strong>t-rate swaps and options are used at the<br />

Vorwerk Group for hedging purpos<strong>es</strong>, both for operative busin<strong>es</strong>s<br />

activiti<strong>es</strong> as well as in the area of foreign currency<br />

financing. The pr<strong>es</strong>ent value of a derivative financial instrument<br />

is the price at which a party would acquire the rights and/<br />

or obligations entailed in this financial instrument from<br />

another party. The net carrying and pr<strong>es</strong>ent valu<strong>es</strong> of the financial<br />

instruments of the Vorwerk Group are reported as follows: