So ist das Leben /That's life / C'est la vie / Así es la vida / È la vita ...

So ist das Leben /That's life / C'est la vie / Así es la vida / È la vita ...

So ist das Leben /That's life / C'est la vie / Así es la vida / È la vita ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

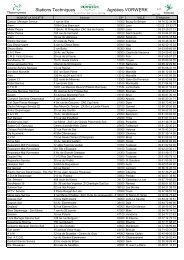

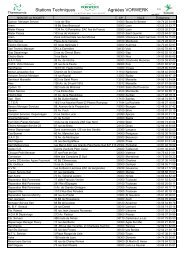

Derivative Financial Instruments<br />

Net<br />

carrying<br />

Pr<strong>es</strong>ent value<br />

as of 31.12.2011<br />

in € 000 Nominal value value Positive Negative<br />

Currency options 20,936 -88 255 -88<br />

Currency futur<strong>es</strong> 39,832 -269 216 -269<br />

Inter<strong>es</strong>t rate swaps 321,163 0 1,758 -3,227<br />

Inter<strong>es</strong>t rate options 235,000 311 88 -2,871<br />

Currency swaps 4,906 0 0 0<br />

Commodity swaps 4,177 -596 0 -596<br />

Provisions for onerous loss<strong>es</strong> in the amount of EUR 0.95<br />

million have been formed to cover specific currency futur<strong>es</strong>,<br />

commodity swaps and on account of negative market valu<strong>es</strong><br />

for the inter<strong>es</strong>t-rate swaps entered into by way of a hedge at the<br />

portfolio level and which are not combined in a valuation unit.<br />

Option premiums to the amount of EUR 0.3 million have been<br />

reported under other assets.<br />

The nominal value of the derivative financial instruments is<br />

determined using the exchange rat<strong>es</strong> on the closing date.<br />

The pr<strong>es</strong>ent valu<strong>es</strong> of currency futur<strong>es</strong> and currency swaps<br />

are determined according to the closing rate as of the<br />

ba<strong>la</strong>nce sheet date, taking forward discounts and premiums<br />

into account. The pr<strong>es</strong>ent valu<strong>es</strong> of currency options are<br />

ass<strong>es</strong>sed on the basis of option price models pursuant to<br />

B<strong>la</strong>ck & Schol<strong>es</strong>. The pr<strong>es</strong>ent valu<strong>es</strong> of inter<strong>es</strong>t-rate hedging<br />

instruments (inter<strong>es</strong>t-rate swaps and options) as well as<br />

commodity swaps are determined on the basis of discounted,<br />

anticipated future cash flows with the current market<br />

inter<strong>es</strong>t-rat<strong>es</strong> or market rat<strong>es</strong> for raw materials for the<br />

remaining term of the financial instruments being applied.<br />

To hedge the inter<strong>es</strong>t risks in its banking book from payment<br />

fluctuations in its inv<strong>es</strong>tment book, the akf group appli<strong>es</strong><br />

portfolio hedg<strong>es</strong> cons<strong>ist</strong>ing of inter<strong>es</strong>t-rate swaps, caps and<br />

col<strong>la</strong>rs with a nominal value of EUR 486.6 million. Th<strong>es</strong>e are<br />

combined with liabiliti<strong>es</strong> in the amount of EUR 540.3 million<br />

into valuation units as defined by § 254 HGB. There was a<br />

negative market value of the derivativ<strong>es</strong> used as of the<br />

ba<strong>la</strong>nce sheet date of EUR 5.7 million, a sum that is not<br />

considered in the ba<strong>la</strong>nce sheet on account of the valuation<br />

Consolidated Financial Statements / Exp<strong>la</strong>natory Not<strong>es</strong> / 59<br />

unit created and the application of the net hedge pr<strong>es</strong>entation<br />

method. Likewise, there are positive differenc<strong>es</strong> to the<br />

amount of EUR 1.8 million that are not reported either.<br />

Since the liabiliti<strong>es</strong> and the derivat<strong>es</strong> are exposed to the<br />

same inter<strong>es</strong>t risk, the chang<strong>es</strong> in cash flows are offset from<br />

opposite effects. The effectiven<strong>es</strong>s of the hedging re<strong>la</strong>tionships<br />

is determined regu<strong>la</strong>rly by prospective regr<strong>es</strong>sion<br />

analys<strong>es</strong>.<br />

6. Information on Shar<strong>es</strong> in Inv<strong>es</strong>tment Funds<br />

Vorwerk & Co. KG holds 100 percent of the units of the VWUC<br />

Fund. The VWUC Fund has mixed fund assets pursuant to<br />

German inv<strong>es</strong>tment <strong>la</strong>w.<br />

The target of the inv<strong>es</strong>tment policy is to generate an attractive<br />

increase in value in euro with a longer-term strategy. To<br />

achieve this inv<strong>es</strong>tment objective, the assets are inv<strong>es</strong>ted in<br />

fixed-inter<strong>es</strong>t securiti<strong>es</strong> as well as in money market instruments<br />

and liquid funds. Moreover, the Fund can inv<strong>es</strong>t in securiti<strong>es</strong><br />

on the equity markets and in units of open and closed<br />

inv<strong>es</strong>tment funds (shar<strong>es</strong>, commoditi<strong>es</strong> and real <strong>es</strong>tate). To<br />

secure as well as to inv<strong>es</strong>t and efficiently manage the assets, the<br />

Fund may, in addition, also deploy derivativ<strong>es</strong> and other techniqu<strong>es</strong><br />

and instruments as well as securiti<strong>es</strong> lending.<br />

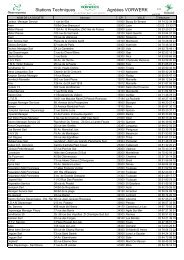

Value of the Units and Variance to the Book Value<br />

in € 000 Book value Market value Variance<br />

VWUC Fund 325,718 362,752 37,034<br />

Vorwerk & Co. KG received a gross dividend of EUR 5.175 million<br />

(EUR 2.5872 per unit) for the Fund’s busin<strong>es</strong>s year (1 December<br />

2010–30 November 2011).<br />

The Fund’s units could be redeemed on any stock exchange<br />

trading day in the year. In the year under re<strong>vie</strong>w special fund<br />

units were sold at a book value of EUR 114.3 million. Vorwerk<br />

achieved a profit of EUR 38.0 million from this transaction.<br />

The Fund’s units were evaluated throughout the entire year in<br />

accordance with the lower of cost or market.