FORM 10-K CONTANGO OIL & GAS COMPANY

FORM 10-K CONTANGO OIL & GAS COMPANY

FORM 10-K CONTANGO OIL & GAS COMPANY

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

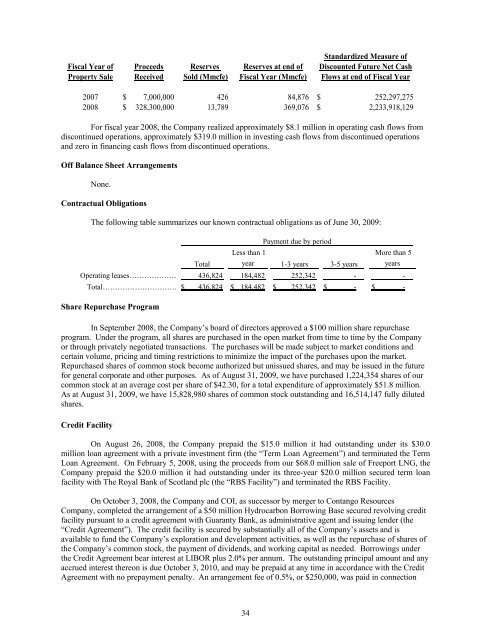

Standardized Measure of<br />

Fiscal Year of Proceeds Reserves Reserves at end of Discounted Future Net Cash<br />

Property Sale Received Sold (Mmcfe) Fiscal Year (Mmcfe) Flows at end of Fiscal Year<br />

2007 $ 7,000,000<br />

426 84,876 $<br />

252,297,275<br />

2008 $ 328,300,000 13,789 369,076 $<br />

2,233,918,129<br />

For fiscal year 2008, the Company realized approximately $8.1 million in operating cash flows from<br />

discontinued operations, approximately $319.0 million in investing cash flows from discontinued operations<br />

and zero in financing cash flows from discontinued operations.<br />

Off Balance Sheet Arrangements<br />

None.<br />

Contractual Obligations<br />

The following table summarizes our known contractual obligations as of June 30, 2009:<br />

Payment due by period<br />

Total<br />

Less than 1<br />

year 1-3 years 3-5 years<br />

More than 5<br />

years<br />

Operating leases………………… 436,824 184,482 252,342 - -<br />

Total………………………… $ 436,824 $ 184,482 $ 252,342 $ - $ -<br />

Share Repurchase Program<br />

In September 2008, the Company’s board of directors approved a $<strong>10</strong>0 million share repurchase<br />

program. Under the program, all shares are purchased in the open market from time to time by the Company<br />

or through privately negotiated transactions. The purchases will be made subject to market conditions and<br />

certain volume, pricing and timing restrictions to minimize the impact of the purchases upon the market.<br />

Repurchased shares of common stock become authorized but unissued shares, and may be issued in the future<br />

for general corporate and other purposes. As of August 31, 2009, we have purchased 1,224,354 shares of our<br />

common stock at an average cost per share of $42.30, for a total expenditure of approximately $51.8 million.<br />

As at August 31, 2009, we have 15,828,980 shares of common stock outstanding and 16,514,147 fully diluted<br />

shares.<br />

Credit Facility<br />

On August 26, 2008, the Company prepaid the $15.0 million it had outstanding under its $30.0<br />

million loan agreement with a private investment firm (the “Term Loan Agreement”) and terminated the Term<br />

Loan Agreement. On February 5, 2008, using the proceeds from our $68.0 million sale of Freeport LNG, the<br />

Company prepaid the $20.0 million it had outstanding under its three-year $20.0 million secured term loan<br />

facility with The Royal Bank of Scotland plc (the “RBS Facility”) and terminated the RBS Facility.<br />

On October 3, 2008, the Company and COI, as successor by merger to Contango Resources<br />

Company, completed the arrangement of a $50 million Hydrocarbon Borrowing Base secured revolving credit<br />

facility pursuant to a credit agreement with Guaranty Bank, as administrative agent and issuing lender (the<br />

“Credit Agreement”). The credit facility is secured by substantially all of the Company’s assets and is<br />

available to fund the Company’s exploration and development activities, as well as the repurchase of shares of<br />

the Company’s common stock, the payment of dividends, and working capital as needed. Borrowings under<br />

the Credit Agreement bear interest at LIBOR plus 2.0% per annum. The outstanding principal amount and any<br />

accrued interest thereon is due October 3, 20<strong>10</strong>, and may be prepaid at any time in accordance with the Credit<br />

Agreement with no prepayment penalty. An arrangement fee of 0.5%, or $250,000, was paid in connection<br />

34