FORM 10-K CONTANGO OIL & GAS COMPANY

FORM 10-K CONTANGO OIL & GAS COMPANY

FORM 10-K CONTANGO OIL & GAS COMPANY

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

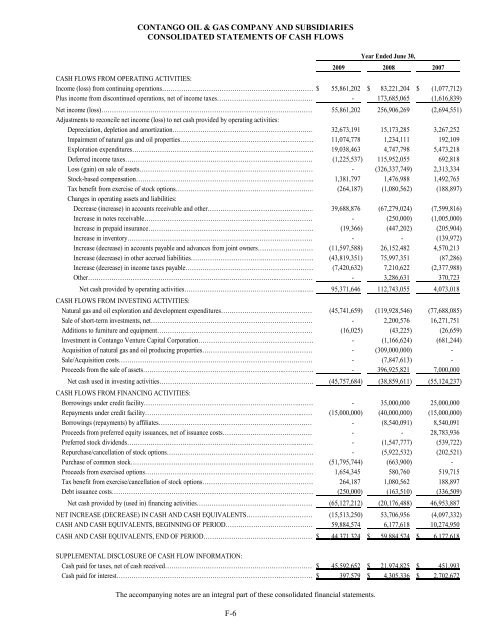

<strong>CONTANGO</strong> <strong>OIL</strong> & <strong>GAS</strong> <strong>COMPANY</strong> AND SUBSIDIARIES<br />

CONSOLIDATED STATEMENTS OF CASH FLOWS<br />

F-6<br />

Year Ended June 30,<br />

2009 2008 2007<br />

CASH FLOWS FROM OPERATING ACTIVITIES:<br />

Income (loss) from continuing operations……………………………………………………………… $ 55,861,202 $ 83,221,204 $ (1,077,712)<br />

Plus income from discontinued operations, net of income taxes……………………………………… - 173,685,065 (1,616,839)<br />

Net income (loss)……………………………………………………………………………………… 55,861,202 256,906,269 (2,694,551)<br />

Adjustments to reconcile net income (loss) to net cash provided by operating activities:<br />

Depreciation, depletion and amortization………………………………………………………..… 32,673,191 15,173,285 3,267,252<br />

Impairment of natural gas and oil properties…………………………………………..…………… 11,074,778 1,234,111 192,<strong>10</strong>9<br />

Exploration expenditures………………………….……………………………………..………… 19,038,463 4,747,798 5,473,218<br />

Deferred income taxes…………………………………………………………..…..……………… (1,225,537) 115,952,055 692,818<br />

Loss (gain) on sale of assets…………………………………………………………..…………… - (326,337,749) 2,313,334<br />

Stock-based compensation………………….…………………………………………………….. 1,381,797 1,476,988 1,492,765<br />

Tax benefit from exercise of stock options………………………………………………………… (264,187) (1,080,562) (188,897)<br />

Changes in operating assets and liabilities:<br />

Decrease (increase) in accounts receivable and other…………………………………………… 39,688,876 (67,279,024) (7,599,816)<br />

Increase in notes receivable……………………………………………………………………… - (250,000) (1,005,000)<br />

Increase in prepaid insurance………………………………………………..…………………… (19,366) (447,202) (205,904)<br />

Increase in inventory…………………………………………………………………………… - - (139,972)<br />

Increase (decrease) in accounts payable and advances from joint owners……………………… (11,597,588) 26,152,482 4,570,213<br />

Increase (decrease) in other accrued liabilities……………………………..…………………… (43,819,351) 75,997,351 (87,286)<br />

Increase (decrease) in income taxes payable…………………………………………………… (7,420,632) 7,2<strong>10</strong>,622 (2,377,988)<br />

Other………………………………………………………...…………………...……………… - 3,286,631 370,723<br />

Net cash provided by operating activities………………………………………………..…… 95,371,646 112,743,055 4,073,018<br />

CASH FLOWS FROM INVESTING ACTIVITIES:<br />

Natural gas and oil exploration and development expenditures…………….……………………… (45,741,659) (119,928,546) (77,688,085)<br />

Sale of short-term investments, net…………………………………………………………………… - 2,200,576 16,271,751<br />

Additions to furniture and equipment………………………………………………………………. (16,025) (43,225) (26,659)<br />

Investment in Contango Venture Capital Corporation……………………………………………… - (1,166,624) (681,244)<br />

Acquisition of natural gas and oil producing properties…………………………………….……… - (309,000,000) -<br />

Sale/Acquisition costs………………………………………………………………………………… - (7,847,613) -<br />

Proceeds from the sale of assets……………..…………………………………………..…………… - 396,925,821 7,000,000<br />

Net cash used in investing activities…………………………………………..…………………… (45,757,684) (38,859,611) (55,124,237)<br />

CASH FLOWS FROM FINANCING ACTIVITIES:<br />

Borrowings under credit facility………………………………………………………………..…… - 35,000,000 25,000,000<br />

Repayments under credit facility………………………………………………………………..…… (15,000,000) (40,000,000) (15,000,000)<br />

Borrowings (repayments) by affiliates……………………………………………………………… - (8,540,091) 8,540,091<br />

Proceeds from preferred equity issuances, net of issuance costs…………………………………… - - 28,783,936<br />

Preferred stock dividends……………………………………………………………………...……… - (1,547,777) (539,722)<br />

Repurchase/cancellation of stock options…………………………………………………………… - (5,922,532) (202,521)<br />

Purchase of common stock…………………………………………………………………………… (51,795,744) (663,900) -<br />

Proceeds from exercised options……………………………………………………………………… 1,654,345 580,760 519,715<br />

Tax benefit from exercise/cancellation of stock options……………………………………………… 264,187 1,080,562 188,897<br />

Debt issuance costs…………………………………………………………………………..……… (250,000) (163,5<strong>10</strong>) (336,509)<br />

Net cash provided by (used in) financing activities…………………………………...…………… (65,127,212) (20,176,488) 46,953,887<br />

NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS…………………………… (15,513,250) 53,706,956 (4,097,332)<br />

CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD…………………………………… 59,884,574 6,177,618 <strong>10</strong>,274,950<br />

CASH AND CASH EQUIVALENTS, END OF PERIOD…………………………………………… $ 44,371,324 $ 59,884,574 $ 6,177,618<br />

SUPPLEMENTAL DISCLOSURE OF CASH FLOW IN<strong>FORM</strong>ATION:<br />

Cash paid for taxes, net of cash received…………………………………………………………… $ 45,592,652 $ 21,974,825 $ 451,993<br />

Cash paid for interest………………………………………………………………………………… $ 397,579 $ 4,305,336 $ 2,702,672<br />

The accompanying notes are an integral part of these consolidated financial statements.