FORM 10-K CONTANGO OIL & GAS COMPANY

FORM 10-K CONTANGO OIL & GAS COMPANY

FORM 10-K CONTANGO OIL & GAS COMPANY

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>CONTANGO</strong> <strong>OIL</strong> & <strong>GAS</strong> <strong>COMPANY</strong> AND SUBSIDIARIES<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (continued)<br />

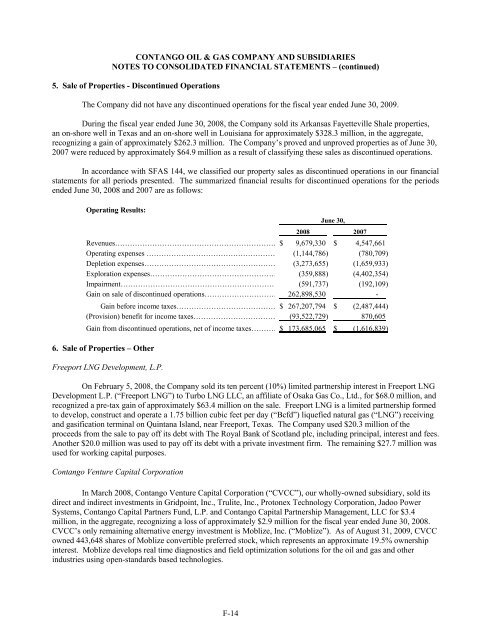

5. Sale of Properties - Discontinued Operations<br />

The Company did not have any discontinued operations for the fiscal year ended June 30, 2009.<br />

During the fiscal year ended June 30, 2008, the Company sold its Arkansas Fayetteville Shale properties,<br />

an on-shore well in Texas and an on-shore well in Louisiana for approximately $328.3 million, in the aggregate,<br />

recognizing a gain of approximately $262.3 million. The Company’s proved and unproved properties as of June 30,<br />

2007 were reduced by approximately $64.9 million as a result of classifying these sales as discontinued operations.<br />

In accordance with SFAS 144, we classified our property sales as discontinued operations in our financial<br />

statements for all periods presented. The summarized financial results for discontinued operations for the periods<br />

ended June 30, 2008 and 2007 are as follows:<br />

Operating Results:<br />

June 30,<br />

2008 2007<br />

Revenues………………………………………………………… $ 9,679,330 $ 4,547,661<br />

Operating expenses ……………………………………………… (1,144,786) (780,709)<br />

Depletion expenses……………………………………………… (3,273,655) (1,659,933)<br />

Exploration expenses…………………………………………… (359,888) (4,402,354)<br />

Impairment……………………………………………………… (591,737) (192,<strong>10</strong>9)<br />

Gain on sale of discontinued operations………………………… 262,898,530 -<br />

Gain before income taxes…………………………………… $ 267,207,794 $ (2,487,444)<br />

(Provision) benefit for income taxes…………………………… (93,522,729) 870,605<br />

Gain from discontinued operations, net of income taxes………… $ 173,685,065 $ (1,616,839)<br />

6. Sale of Properties – Other<br />

Freeport LNG Development, L.P.<br />

On February 5, 2008, the Company sold its ten percent (<strong>10</strong>%) limited partnership interest in Freeport LNG<br />

Development L.P. (“Freeport LNG”) to Turbo LNG LLC, an affiliate of Osaka Gas Co., Ltd., for $68.0 million, and<br />

recognized a pre-tax gain of approximately $63.4 million on the sale. Freeport LNG is a limited partnership formed<br />

to develop, construct and operate a 1.75 billion cubic feet per day (“Bcfd”) liquefied natural gas (“LNG”) receiving<br />

and gasification terminal on Quintana Island, near Freeport, Texas. The Company used $20.3 million of the<br />

proceeds from the sale to pay off its debt with The Royal Bank of Scotland plc, including principal, interest and fees.<br />

Another $20.0 million was used to pay off its debt with a private investment firm. The remaining $27.7 million was<br />

used for working capital purposes.<br />

Contango Venture Capital Corporation<br />

In March 2008, Contango Venture Capital Corporation (“CVCC”), our wholly-owned subsidiary, sold its<br />

direct and indirect investments in Gridpoint, Inc., Trulite, Inc., Protonex Technology Corporation, Jadoo Power<br />

Systems, Contango Capital Partners Fund, L.P. and Contango Capital Partnership Management, LLC for $3.4<br />

million, in the aggregate, recognizing a loss of approximately $2.9 million for the fiscal year ended June 30, 2008.<br />

CVCC’s only remaining alternative energy investment is Moblize, Inc. (“Moblize”). As of August 31, 2009, CVCC<br />

owned 443,648 shares of Moblize convertible preferred stock, which represents an approximate 19.5% ownership<br />

interest. Moblize develops real time diagnostics and field optimization solutions for the oil and gas and other<br />

industries using open-standards based technologies.<br />

DB2/2<strong>10</strong>43537.7 F-14