FORM 10-K CONTANGO OIL & GAS COMPANY

FORM 10-K CONTANGO OIL & GAS COMPANY

FORM 10-K CONTANGO OIL & GAS COMPANY

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>CONTANGO</strong> <strong>OIL</strong> & <strong>GAS</strong> <strong>COMPANY</strong> AND SUBSIDIARIES<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (continued)<br />

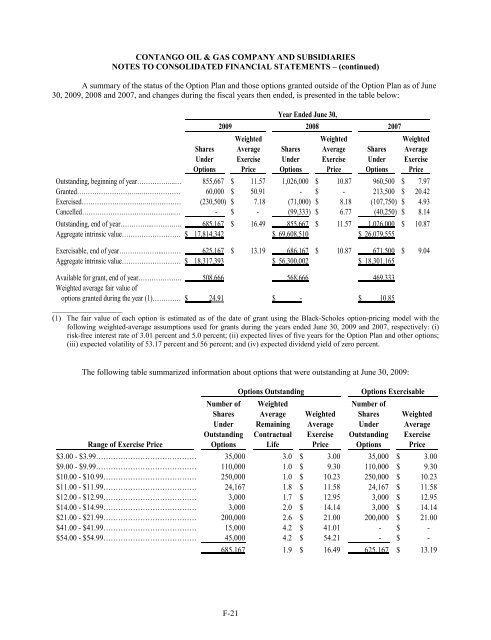

A summary of the status of the Option Plan and those options granted outside of the Option Plan as of June<br />

30, 2009, 2008 and 2007, and changes during the fiscal years then ended, is presented in the table below:<br />

Year Ended June 30,<br />

2009 2008 2007<br />

Weighted Weighted Weighted<br />

Shares Average Shares Average Shares Average<br />

Under Exercise Under Exercise Under Exercise<br />

Options Price Options Price Options Price<br />

Outstanding, beginning of year……………...… 855,667 $ 11.57 1,026,000 $ <strong>10</strong>.87 960,500 $ 7.97<br />

Granted………………………...……………… 60,000 $ 50.91<br />

- $ - 213,500 $ 20.42<br />

Exercised………………………..……………… (230,500) $ 7.18 (71,000) $ 8.18 (<strong>10</strong>7,750) $ 4.93<br />

Cancelled………………………….………...… - $ - (99,333) $ 6.77 (40,250) $ 8.14<br />

Outstanding, end of year…………...………….… 685,167 $ 16.49 855,667 $ 11.57 1,026,000 $ <strong>10</strong>.87<br />

Aggregate intrinsic value……………………… $ 17,814,342<br />

$ 69,608,5<strong>10</strong><br />

$ 26,079,555<br />

Exercisable, end of year………………...……… 625,167 $ 13.19 686,167 $ <strong>10</strong>.87 671,500 $ 9.04<br />

Aggregate intrinsic value……………………… $ 18,317,393<br />

$ 56,300,002<br />

$ 18,301,165<br />

Available for grant, end of year……………….. 508,666 568,666 469,333<br />

Weighted average fair value of<br />

options granted during the year (1)…………… $ 24.91<br />

$ -<br />

$ <strong>10</strong>.85<br />

_________________<br />

(1) The fair value of each option is estimated as of the date of grant using the Black-Scholes option-pricing model with the<br />

following weighted-average assumptions used for grants during the years ended June 30, 2009 and 2007, respectively: (i)<br />

risk-free interest rate of 3.01 percent and 5.0 percent; (ii) expected lives of five years for the Option Plan and other options;<br />

(iii) expected volatility of 53.17 percent and 56 percent; and (iv) expected dividend yield of zero percent.<br />

The following table summarized information about options that were outstanding at June 30, 2009:<br />

Options Outstanding<br />

Options Exercisable<br />

Number of Weighted Number of<br />

Shares Average Weighted Shares Weighted<br />

Under Remaining Average Under Average<br />

Outstanding Contractual Exercise Outstanding Exercise<br />

Range of Exercise Price Options Life Price Options Price<br />

$3.00 - $3.99…………………………………… 35,000 3.0 $ 3.00 35,000 $ 3.00<br />

$9.00 - $9.99…………………………………… 1<strong>10</strong>,000 1.0 $ 9.30 1<strong>10</strong>,000 $ 9.30<br />

$<strong>10</strong>.00 - $<strong>10</strong>.99………………………………… 250,000 1.0 $ <strong>10</strong>.23 250,000 $ <strong>10</strong>.23<br />

$11.00 - $11.99………………………………… 24,167 1.8 $ 11.58 24,167 $ 11.58<br />

$12.00 - $12.99………………………………… 3,000 1.7 $ 12.95 3,000 $ 12.95<br />

$14.00 - $14.99………………………………… 3,000 2.0 $ 14.14 3,000 $ 14.14<br />

$21.00 - $21.99………………………………… 200,000 2.6 $ 21.00 200,000 $ 21.00<br />

$41.00 - $41.99………………………………… 15,000 4.2 $ 41.01<br />

- $ -<br />

$54.00 - $54.99………………………………… 45,000 4.2 $ 54.21<br />

- $ -<br />

685,167 1.9 $ 16.49 625,167 $ 13.19<br />

DB2/2<strong>10</strong>43537.7 F-21