FORM 10-K CONTANGO OIL & GAS COMPANY

FORM 10-K CONTANGO OIL & GAS COMPANY

FORM 10-K CONTANGO OIL & GAS COMPANY

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>CONTANGO</strong> <strong>OIL</strong> & <strong>GAS</strong> <strong>COMPANY</strong> AND SUBSIDIARIES<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (continued)<br />

three companies, one of them was the managing member of REX, who exchanged an ownership interest in REX for<br />

a direct working interest in Dutch and Mary Rose. The Company purchased a 2.45% working interest in Dutch and<br />

a 2.68% working interest in Mary Rose from this company for approximately $58.9 million. The effective date of<br />

the transactions was January 1, 2008.<br />

On February 8, 2008, the Company acquired a 0.3% overriding royalty interest in the Dutch and Mary Rose<br />

discoveries for $9.0 million in a like-kind exchange, using funds from the sale of its Eastern core Arkansas<br />

Fayetteville Shale properties held by a qualified intermediary. We allocated 60%, or $5.4 million, of the purchase<br />

price to Dutch, and the remaining 40%, or $3.6 million, to Mary Rose.<br />

On April 3, 2008, the Company acquired additional working interests in the Dutch and Mary Rose<br />

discoveries in a like-kind exchange, using funds from the sale of its Eastern core Arkansas Fayetteville Shale<br />

properties held by a qualified intermediary. The Company purchased an additional 4.17% working interest and<br />

3.33% net revenue interest in Dutch and an additional average 4.56% working interest and 3.33% net revenue<br />

interest in Mary Rose from two different companies for $<strong>10</strong>0 million. The effective date of the transaction is<br />

January 1, 2008.<br />

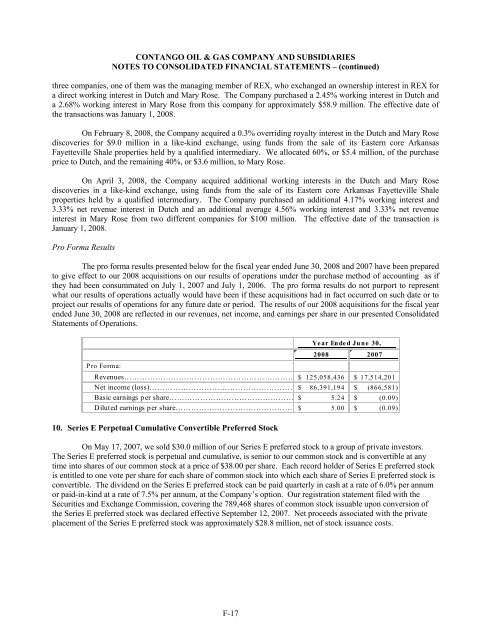

Pro Forma Results<br />

The pro forma results presented below for the fiscal year ended June 30, 2008 and 2007 have been prepared<br />

to give effect to our 2008 acquisitions on our results of operations under the purchase method of accounting as if<br />

they had been consummated on July 1, 2007 and July 1, 2006. The pro forma results do not purport to represent<br />

what our results of operations actually would have been if these acquisitions had in fact occurred on such date or to<br />

project our results of operations for any future date or period. The results of our 2008 acquisitions for the fiscal year<br />

ended June 30, 2008 are reflected in our revenues, net income, and earnings per share in our presented Consolidated<br />

Statements of Operations.<br />

Year Ended June 30,<br />

2008 2007<br />

Pro Forma:<br />

Revenues………………………………………………………… $ 125,058,436 $ 17,514,201<br />

Net income (loss)………………………………………………… $ 86,391,194 $ (866,581)<br />

Basic earnings per share………………………………………… $ 5.24 $ (0.09)<br />

Diluted earnings per share……………………………………… $ 5.00 $ (0.09)<br />

<strong>10</strong>. Series E Perpetual Cumulative Convertible Preferred Stock<br />

On May 17, 2007, we sold $30.0 million of our Series E preferred stock to a group of private investors.<br />

The Series E preferred stock is perpetual and cumulative, is senior to our common stock and is convertible at any<br />

time into shares of our common stock at a price of $38.00 per share. Each record holder of Series E preferred stock<br />

is entitled to one vote per share for each share of common stock into which each share of Series E preferred stock is<br />

convertible. The dividend on the Series E preferred stock can be paid quarterly in cash at a rate of 6.0% per annum<br />

or paid-in-kind at a rate of 7.5% per annum, at the Company’s option. Our registration statement filed with the<br />

Securities and Exchange Commission, covering the 789,468 shares of common stock issuable upon conversion of<br />

the Series E preferred stock was declared effective September 12, 2007. Net proceeds associated with the private<br />

placement of the Series E preferred stock was approximately $28.8 million, net of stock issuance costs.<br />

DB2/2<strong>10</strong>43537.7 F-17