FORM 10-K CONTANGO OIL & GAS COMPANY

FORM 10-K CONTANGO OIL & GAS COMPANY

FORM 10-K CONTANGO OIL & GAS COMPANY

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

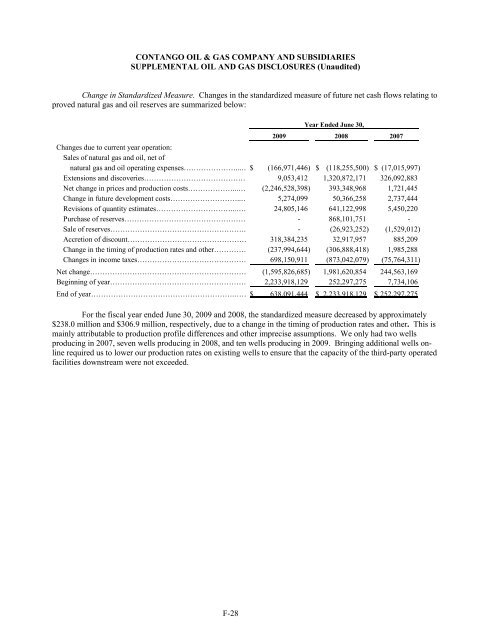

<strong>CONTANGO</strong> <strong>OIL</strong> & <strong>GAS</strong> <strong>COMPANY</strong> AND SUBSIDIARIES<br />

SUPPLEMENTAL <strong>OIL</strong> AND <strong>GAS</strong> DISCLOSURES (Unaudited)<br />

Change in Standardized Measure. Changes in the standardized measure of future net cash flows relating to<br />

proved natural gas and oil reserves are summarized below:<br />

Year Ended June 30,<br />

2009 2008 2007<br />

Changes due to current year operation:<br />

Sales of natural gas and oil, net of<br />

natural gas and oil operating expenses…………………...… $ (166,971,446) $ (118,255,500) $ (17,015,997)<br />

Extensions and discoveries…………………………………… 9,053,412 1,320,872,171 326,092,883<br />

Net change in prices and production costs………………...… (2,246,528,398) 393,348,968 1,721,445<br />

Change in future development costs………………………..… 5,274,099 50,366,258 2,737,444<br />

Revisions of quantity estimates…………………………...…… 24,805,146 641,122,998 5,450,220<br />

Purchase of reserves…………………………………………… - 868,<strong>10</strong>1,751 -<br />

Sale of reserves………………………………………………. - (26,923,252) (1,529,012)<br />

Accretion of discount………………………………………… 318,384,235 32,917,957 885,209<br />

Change in the timing of production rates and other…………… (237,994,644) (306,888,418) 1,985,288<br />

Changes in income taxes……………………………………… 698,150,911 (873,042,079) (75,764,311)<br />

Net change……………………………………………………… (1,595,826,685) 1,981,620,854 244,563,169<br />

Beginning of year………………………………………………… 2,233,918,129 252,297,275 7,734,<strong>10</strong>6<br />

End of year………………………………………………….…… $ 638,091,444 $ 2,233,918,129 $ 252,297,275<br />

For the fiscal year ended June 30, 2009 and 2008, the standardized measure decreased by approximately<br />

$238.0 million and $306.9 million, respectively, due to a change in the timing of production rates and other. This is<br />

mainly attributable to production profile differences and other imprecise assumptions. We only had two wells<br />

producing in 2007, seven wells producing in 2008, and ten wells producing in 2009. Bringing additional wells online<br />

required us to lower our production rates on existing wells to ensure that the capacity of the third-party operated<br />

facilities downstream were not exceeded.<br />

DB2/2<strong>10</strong>43537.7 F-28