FORM 10-K CONTANGO OIL & GAS COMPANY

FORM 10-K CONTANGO OIL & GAS COMPANY

FORM 10-K CONTANGO OIL & GAS COMPANY

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>CONTANGO</strong> <strong>OIL</strong> & <strong>GAS</strong> <strong>COMPANY</strong> AND SUBSIDIARIES<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (continued)<br />

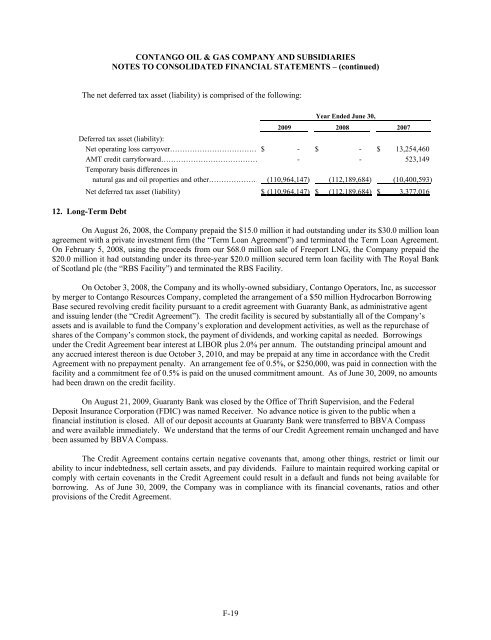

The net deferred tax asset (liability) is comprised of the following:<br />

Year Ended June 30,<br />

2009 2008 2007<br />

Deferred tax asset (liability):<br />

Net operating loss carryover……………………………… $ - $ - $ 13,254,460<br />

AMT credit carryforward………………………………… - - 523,149<br />

Temporary basis differences in<br />

natural gas and oil properties and other………………… (1<strong>10</strong>,964,147) (112,189,684) (<strong>10</strong>,400,593)<br />

Net deferred tax asset (liability) $ (1<strong>10</strong>,964,147) $ (112,189,684) $ 3,377,016<br />

12. Long-Term Debt<br />

On August 26, 2008, the Company prepaid the $15.0 million it had outstanding under its $30.0 million loan<br />

agreement with a private investment firm (the “Term Loan Agreement”) and terminated the Term Loan Agreement.<br />

On February 5, 2008, using the proceeds from our $68.0 million sale of Freeport LNG, the Company prepaid the<br />

$20.0 million it had outstanding under its three-year $20.0 million secured term loan facility with The Royal Bank<br />

of Scotland plc (the “RBS Facility”) and terminated the RBS Facility.<br />

On October 3, 2008, the Company and its wholly-owned subsidiary, Contango Operators, Inc, as successor<br />

by merger to Contango Resources Company, completed the arrangement of a $50 million Hydrocarbon Borrowing<br />

Base secured revolving credit facility pursuant to a credit agreement with Guaranty Bank, as administrative agent<br />

and issuing lender (the “Credit Agreement”). The credit facility is secured by substantially all of the Company’s<br />

assets and is available to fund the Company’s exploration and development activities, as well as the repurchase of<br />

shares of the Company’s common stock, the payment of dividends, and working capital as needed. Borrowings<br />

under the Credit Agreement bear interest at LIBOR plus 2.0% per annum. The outstanding principal amount and<br />

any accrued interest thereon is due October 3, 20<strong>10</strong>, and may be prepaid at any time in accordance with the Credit<br />

Agreement with no prepayment penalty. An arrangement fee of 0.5%, or $250,000, was paid in connection with the<br />

facility and a commitment fee of 0.5% is paid on the unused commitment amount. As of June 30, 2009, no amounts<br />

had been drawn on the credit facility.<br />

On August 21, 2009, Guaranty Bank was closed by the Office of Thrift Supervision, and the Federal<br />

Deposit Insurance Corporation (FDIC) was named Receiver. No advance notice is given to the public when a<br />

financial institution is closed. All of our deposit accounts at Guaranty Bank were transferred to BBVA Compass<br />

and were available immediately. We understand that the terms of our Credit Agreement remain unchanged and have<br />

been assumed by BBVA Compass.<br />

The Credit Agreement contains certain negative covenants that, among other things, restrict or limit our<br />

ability to incur indebtedness, sell certain assets, and pay dividends. Failure to maintain required working capital or<br />

comply with certain covenants in the Credit Agreement could result in a default and funds not being available for<br />

borrowing. As of June 30, 2009, the Company was in compliance with its financial covenants, ratios and other<br />

provisions of the Credit Agreement.<br />

DB2/2<strong>10</strong>43537.7 F-19