FORM 10-K CONTANGO OIL & GAS COMPANY

FORM 10-K CONTANGO OIL & GAS COMPANY

FORM 10-K CONTANGO OIL & GAS COMPANY

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>CONTANGO</strong> <strong>OIL</strong> & <strong>GAS</strong> <strong>COMPANY</strong> AND SUBSIDIARIES<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (continued)<br />

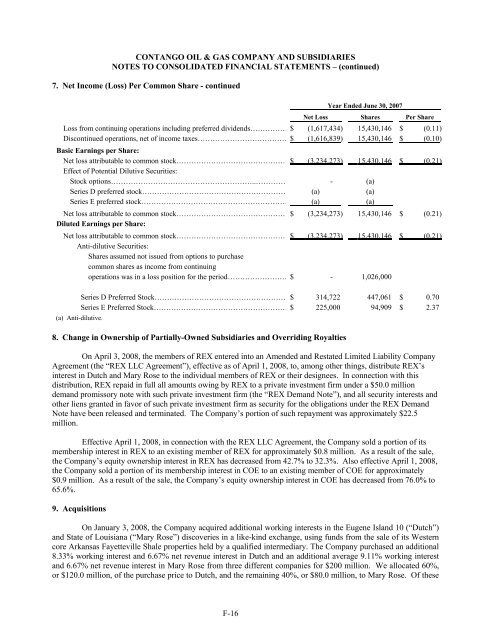

7. Net Income (Loss) Per Common Share - continued<br />

Year Ended June 30, 2007<br />

Net Loss Shares Per Share<br />

Loss from continuing operations including preferred dividends…………… $ (1,617,434) 15,430,146 $ (0.11)<br />

Discontinued operations, net of income taxes……………………………… $ (1,616,839) 15,430,146 $ (0.<strong>10</strong>)<br />

Basic Earnings per Share:<br />

Net loss attributable to common stock……………………………………… $ (3,234,273) 15,430,146 $ (0.21)<br />

Effect of Potential Dilutive Securities:<br />

Stock options…………………………………………………..………… - (a)<br />

Series D preferred stock…………………………………………………… (a) (a)<br />

Series E preferred stock…………………………………………………… (a) (a)<br />

Net loss attributable to common stock……………………………………… $ (3,234,273) 15,430,146 $ (0.21)<br />

Diluted Earnings per Share:<br />

Net loss attributable to common stock……………………………………… $ (3,234,273) 15,430,146 $ (0.21)<br />

Anti-dilutive Securities:<br />

Shares assumed not issued from options to purchase<br />

common shares as income from continuing<br />

operations was in a loss position for the period…………………… $ - 1,026,000<br />

Series D Preferred Stock……………………………………………… $ 314,722 447,061 $ 0.70<br />

Series E Preferred Stock……………………………………………… $ 225,000 94,909 $ 2.37<br />

(a) Anti-dilutive.<br />

8. Change in Ownership of Partially-Owned Subsidiaries and Overriding Royalties<br />

On April 3, 2008, the members of REX entered into an Amended and Restated Limited Liability Company<br />

Agreement (the “REX LLC Agreement”), effective as of April 1, 2008, to, among other things, distribute REX’s<br />

interest in Dutch and Mary Rose to the individual members of REX or their designees. In connection with this<br />

distribution, REX repaid in full all amounts owing by REX to a private investment firm under a $50.0 million<br />

demand promissory note with such private investment firm (the “REX Demand Note”), and all security interests and<br />

other liens granted in favor of such private investment firm as security for the obligations under the REX Demand<br />

Note have been released and terminated. The Company’s portion of such repayment was approximately $22.5<br />

million.<br />

Effective April 1, 2008, in connection with the REX LLC Agreement, the Company sold a portion of its<br />

membership interest in REX to an existing member of REX for approximately $0.8 million. As a result of the sale,<br />

the Company’s equity ownership interest in REX has decreased from 42.7% to 32.3%. Also effective April 1, 2008,<br />

the Company sold a portion of its membership interest in COE to an existing member of COE for approximately<br />

$0.9 million. As a result of the sale, the Company’s equity ownership interest in COE has decreased from 76.0% to<br />

65.6%.<br />

9. Acquisitions<br />

On January 3, 2008, the Company acquired additional working interests in the Eugene Island <strong>10</strong> (“Dutch”)<br />

and State of Louisiana (“Mary Rose”) discoveries in a like-kind exchange, using funds from the sale of its Western<br />

core Arkansas Fayetteville Shale properties held by a qualified intermediary. The Company purchased an additional<br />

8.33% working interest and 6.67% net revenue interest in Dutch and an additional average 9.11% working interest<br />

and 6.67% net revenue interest in Mary Rose from three different companies for $200 million. We allocated 60%,<br />

or $120.0 million, of the purchase price to Dutch, and the remaining 40%, or $80.0 million, to Mary Rose. Of these<br />

DB2/2<strong>10</strong>43537.7 F-16