FORM 10-K CONTANGO OIL & GAS COMPANY

FORM 10-K CONTANGO OIL & GAS COMPANY

FORM 10-K CONTANGO OIL & GAS COMPANY

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>CONTANGO</strong> <strong>OIL</strong> & <strong>GAS</strong> <strong>COMPANY</strong> AND SUBSIDIARIES<br />

SUPPLEMENTAL <strong>OIL</strong> AND <strong>GAS</strong> DISCLOSURES (Unaudited)<br />

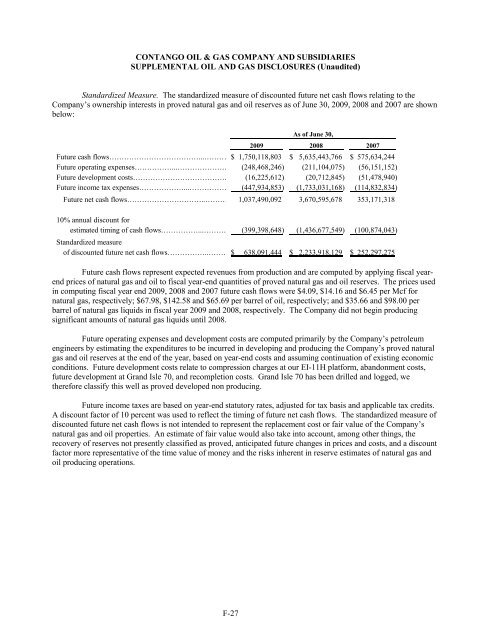

Standardized Measure. The standardized measure of discounted future net cash flows relating to the<br />

Company’s ownership interests in proved natural gas and oil reserves as of June 30, 2009, 2008 and 2007 are shown<br />

below:<br />

As of June 30,<br />

2009 2008 2007<br />

Future cash flows………………………………...……… $ 1,750,118,803 $ 5,635,443,766 $ 575,634,244<br />

Future operating expenses……………...………………… (248,468,246) (211,<strong>10</strong>4,075) (56,151,152)<br />

Future development costs………………………………… (16,225,612) (20,712,845) (51,478,940)<br />

Future income tax expenses………………...…………… (447,934,853) (1,733,031,168) (114,832,834)<br />

Future net cash flows…………………………..……… 1,037,490,092 3,670,595,678 353,171,318<br />

<strong>10</strong>% annual discount for<br />

estimated timing of cash flows……………...……… (399,398,648) (1,436,677,549) (<strong>10</strong>0,874,043)<br />

Standardized measure<br />

of discounted future net cash flows……………..……… $ 638,091,444 $ 2,233,918,129 $ 252,297,275<br />

Future cash flows represent expected revenues from production and are computed by applying fiscal yearend<br />

prices of natural gas and oil to fiscal year-end quantities of proved natural gas and oil reserves. The prices used<br />

in computing fiscal year end 2009, 2008 and 2007 future cash flows were $4.09, $14.16 and $6.45 per Mcf for<br />

natural gas, respectively; $67.98, $142.58 and $65.69 per barrel of oil, respectively; and $35.66 and $98.00 per<br />

barrel of natural gas liquids in fiscal year 2009 and 2008, respectively. The Company did not begin producing<br />

significant amounts of natural gas liquids until 2008.<br />

Future operating expenses and development costs are computed primarily by the Company’s petroleum<br />

engineers by estimating the expenditures to be incurred in developing and producing the Company’s proved natural<br />

gas and oil reserves at the end of the year, based on year-end costs and assuming continuation of existing economic<br />

conditions. Future development costs relate to compression charges at our EI-11H platform, abandonment costs,<br />

future development at Grand Isle 70, and recompletion costs. Grand Isle 70 has been drilled and logged, we<br />

therefore classify this well as proved developed non producing.<br />

Future income taxes are based on year-end statutory rates, adjusted for tax basis and applicable tax credits.<br />

A discount factor of <strong>10</strong> percent was used to reflect the timing of future net cash flows. The standardized measure of<br />

discounted future net cash flows is not intended to represent the replacement cost or fair value of the Company’s<br />

natural gas and oil properties. An estimate of fair value would also take into account, among other things, the<br />

recovery of reserves not presently classified as proved, anticipated future changes in prices and costs, and a discount<br />

factor more representative of the time value of money and the risks inherent in reserve estimates of natural gas and<br />

oil producing operations.<br />

DB2/2<strong>10</strong>43537.7 F-27