FORM 10-K CONTANGO OIL & GAS COMPANY

FORM 10-K CONTANGO OIL & GAS COMPANY

FORM 10-K CONTANGO OIL & GAS COMPANY

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>CONTANGO</strong> <strong>OIL</strong> & <strong>GAS</strong> <strong>COMPANY</strong> AND SUBSIDIARIES<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (continued)<br />

Holders of common stock and holders of Series E preferred stock vote as one class for the election of<br />

directors and most other matters. Upon any liquidation or dissolution of the Company, the holders of common stock<br />

are entitled to receive a pro rata share of all of the assets remaining available for distribution to shareholders after<br />

settlement of all liabilities and liquidating preferences of preferred stockholders.<br />

During the quarter ended March 31, 2008, four Series E preferred stockholders voluntarily elected to<br />

convert a total of 2,400 shares of Series E preferred stock to 315,786 shares of our common stock. The converted<br />

shares of Series E preferred stock had a face value of $12.0 million. During the quarter ended June 30, 2008, the<br />

final three Series E preferred stockholders voluntarily elected to convert a total of 3,600 shares of Series E preferred<br />

stock to 473,682 shares of our common stock. The converted shares of Series E preferred stock had a face value of<br />

$18.0 million.<br />

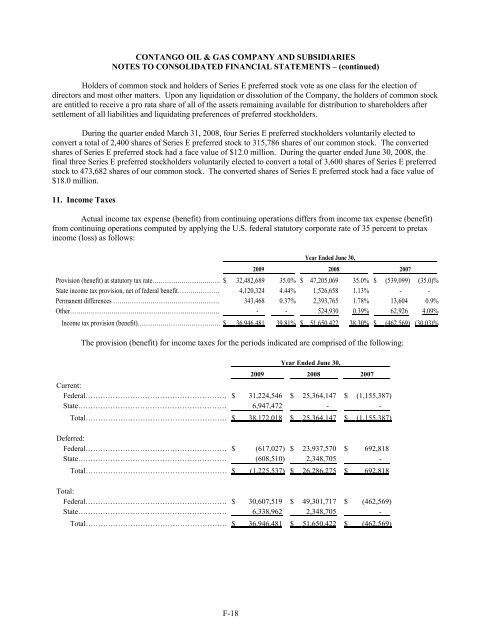

11. Income Taxes<br />

Actual income tax expense (benefit) from continuing operations differs from income tax expense (benefit)<br />

from continuing operations computed by applying the U.S. federal statutory corporate rate of 35 percent to pretax<br />

income (loss) as follows:<br />

Year Ended June 30,<br />

2009 2008 2007<br />

Provision (benefit) at statutory tax rate…………………………… $ 32,482,689 35.0% $ 47,205,069 35.0% $ (539,099) (35.0)%<br />

State income tax provision, net of federal benefit………………… 4,120,324 4.44% 1,526,658 1.13% - -<br />

Permanent differences …………………………………………… 343,468 0.37% 2,393,765 1.78% 13,604 0.9%<br />

Other……………………………………………………………… - - 524,930 0.39% 62,926 4.09%<br />

Income tax provision (benefit)…………………………………… $ 36,946,481 39.81% $ 51,650,422 38.30% $ (462,569) (30.03)%<br />

The provision (benefit) for income taxes for the periods indicated are comprised of the following:<br />

Year Ended June 30,<br />

2009 2008 2007<br />

Current:<br />

Federal………………………………………………… $ 31,224,546 $ 25,364,147 $ (1,155,387)<br />

State…………………………………………………… 6,947,472 - -<br />

Total………………………………………………… $ 38,172,018 $ 25,364,147 $ (1,155,387)<br />

Deferred:<br />

Federal………………………………………………… $ (617,027) $ 23,937,570 $ 692,818<br />

State…………………………………………………… (608,5<strong>10</strong>) 2,348,705 -<br />

Total………………………………………………… $ (1,225,537) $ 26,286,275 $ 692,818<br />

Total:<br />

Federal………………………………………………… $ 30,607,519 $ 49,301,717 $ (462,569)<br />

State…………………………………………………… 6,338,962 2,348,705 -<br />

Total………………………………………………… $ 36,946,481 $ 51,650,422 $ (462,569)<br />

DB2/2<strong>10</strong>43537.7 F-18