FORM 10-K CONTANGO OIL & GAS COMPANY

FORM 10-K CONTANGO OIL & GAS COMPANY

FORM 10-K CONTANGO OIL & GAS COMPANY

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>CONTANGO</strong> <strong>OIL</strong> & <strong>GAS</strong> <strong>COMPANY</strong> AND SUBSIDIARIES<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (continued)<br />

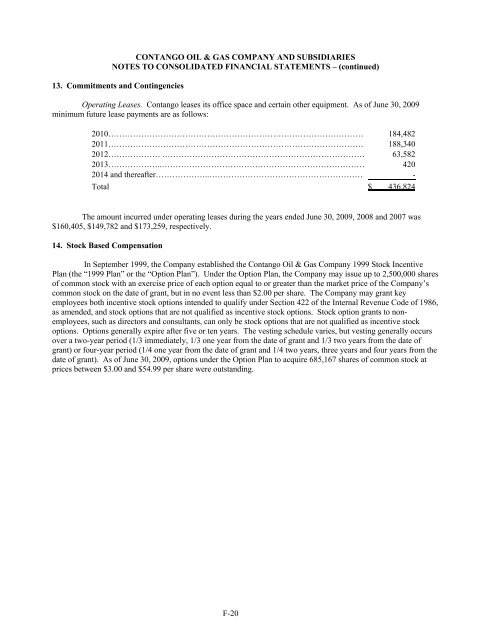

13. Commitments and Contingencies<br />

Operating Leases. Contango leases its office space and certain other equipment. As of June 30, 2009<br />

minimum future lease payments are as follows:<br />

20<strong>10</strong>………………………………………………………………………………… 184,482<br />

2011………………………………………………………………………………… 188,340<br />

2012…………………………………………………………………………………… 63,582<br />

2013………………..………………………………………………………………… 420<br />

2014 and thereafter………………..………………………………………………… -<br />

Total $ 436,824<br />

The amount incurred under operating leases during the years ended June 30, 2009, 2008 and 2007 was<br />

$160,405, $149,782 and $173,259, respectively.<br />

14. Stock Based Compensation<br />

In September 1999, the Company established the Contango Oil & Gas Company 1999 Stock Incentive<br />

Plan (the “1999 Plan” or the “Option Plan”). Under the Option Plan, the Company may issue up to 2,500,000 shares<br />

of common stock with an exercise price of each option equal to or greater than the market price of the Company’s<br />

common stock on the date of grant, but in no event less than $2.00 per share. The Company may grant key<br />

employees both incentive stock options intended to qualify under Section 422 of the Internal Revenue Code of 1986,<br />

as amended, and stock options that are not qualified as incentive stock options. Stock option grants to nonemployees,<br />

such as directors and consultants, can only be stock options that are not qualified as incentive stock<br />

options. Options generally expire after five or ten years. The vesting schedule varies, but vesting generally occurs<br />

over a two-year period (1/3 immediately, 1/3 one year from the date of grant and 1/3 two years from the date of<br />

grant) or four-year period (1/4 one year from the date of grant and 1/4 two years, three years and four years from the<br />

date of grant). As of June 30, 2009, options under the Option Plan to acquire 685,167 shares of common stock at<br />

prices between $3.00 and $54.99 per share were outstanding.<br />

DB2/2<strong>10</strong>43537.7 F-20