FORM 10-K CONTANGO OIL & GAS COMPANY

FORM 10-K CONTANGO OIL & GAS COMPANY

FORM 10-K CONTANGO OIL & GAS COMPANY

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>CONTANGO</strong> <strong>OIL</strong> & <strong>GAS</strong> <strong>COMPANY</strong> AND SUBSIDIARIES<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (continued)<br />

The Company accounts for employee stock-based compensation under the fair value method prescribed in<br />

SFAS 123. Prior to the adoption of SFAS 123(R), we presented all tax benefits resulting from the exercise of stock<br />

options as operating cash flows in the Consolidated Statement of Cash Flows. SFAS 123(R) requires that cash<br />

flows from the exercise of stock options resulting from tax benefits in excess of recognized cumulative<br />

compensation cost (excess tax benefits) be classified as financing cash flows. For the fiscal years ended June 30,<br />

2009, 2008 and 2007, approximately $0.3 million, $1.1 million and $0.2 million, respectively, of such excess tax<br />

benefits were classified as financing cash flows. See Note 2 – Summary of Significant Accounting Policies.<br />

All employee stock option grants are expensed over the stock options vesting period based on the fair value<br />

at the date the options are granted. The fair value of each option is estimated as of the date of grant using the Black-<br />

Scholes options-pricing model. During the fiscal year-ended June 30, 2009, 2008 and 2007, the Company recorded<br />

stock option expense of $1.1 million, $1.2 million and $1.3 million, respectively.<br />

As of June 30, 2009, we have approximately $1.5 million of total unrecognized compensation cost related<br />

to non-vested awards granted under our various share-based plans, which we expect to recognize over an average<br />

period of three years.<br />

The aggregate intrinsic values of the options exercised during fiscal years 2009, 2008 and 2007 were<br />

approximately $12.2 million, $1.9 million and $1.9 million, respectively.<br />

On November 11, 2008, the Company awarded a total of 3,088 shares of restricted stock under the 1999<br />

Plan to its board of directors. Of these 3,088 shares of restricted stock, 1,544 shares vest on the date of grant, and<br />

the remaining 1,544 shares vest one year thereafter. The fair value of restricted stock was approximately $144,000.<br />

On November 14, 2007, the Company awarded a total of 4,140 shares of restricted stock under the 1999 Plan to its<br />

board of directors. Of these 4,140 shares of restricted stock, 2,070 shares vest on the date of grant, and the<br />

remaining 2,070 shares vest one year thereafter. The fair value of restricted stock was approximately $180,000. On<br />

November 16, 2006, the Company’ awarded a total of 8,416 shares of restricted stock under the 1999 Plan to its<br />

board of directors. Of these 8,416 shares of restricted stock, 4,208 shares vest on the date of grant, and the<br />

remaining 4,208 shares vest one year thereafter. The fair value of restricted stock was approximately $144,000.<br />

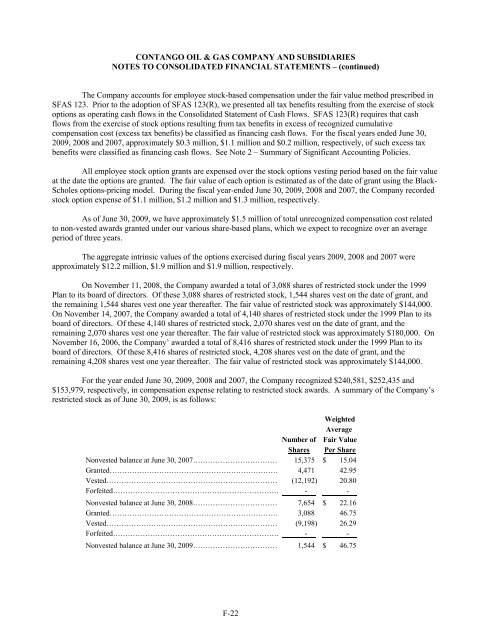

For the year ended June 30, 2009, 2008 and 2007, the Company recognized $240,581, $252,435 and<br />

$153,979, respectively, in compensation expense relating to restricted stock awards. A summary of the Company’s<br />

restricted stock as of June 30, 2009, is as follows:<br />

Weighted<br />

Average<br />

Number of Fair Value<br />

Shares Per Share<br />

Nonvested balance at June 30, 2007……………………………… 15,375 $ 15.04<br />

Granted…………………………………………………………… 4,471 42.95<br />

Vested…………………………………………………………… (12,192) 20.80<br />

Forfeited…………………………………………………………… - -<br />

Nonvested balance at June 30, 2008……………………………… 7,654 $ 22.16<br />

Granted…………………………………………………………… 3,088 46.75<br />

Vested…………………………………………………………… (9,198) 26.29<br />

Forfeited…………………………………………………………… - -<br />

Nonvested balance at June 30, 2009……………………………… 1,544 $ 46.75<br />

DB2/2<strong>10</strong>43537.7 F-22