Credit Union and Cooperative Patronage Refunds - Filene ...

Credit Union and Cooperative Patronage Refunds - Filene ...

Credit Union and Cooperative Patronage Refunds - Filene ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

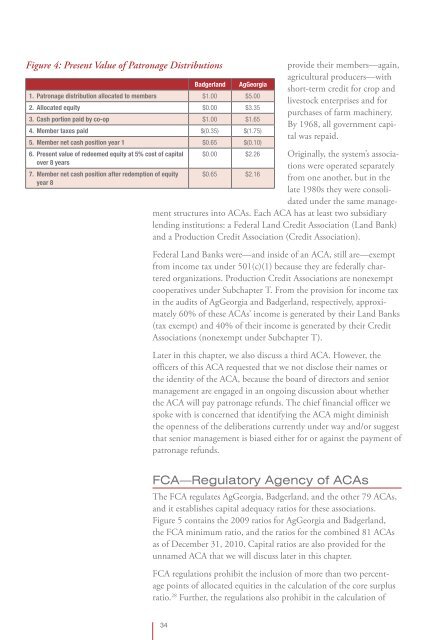

Figure 4: Present Value of <strong>Patronage</strong> Distributions<br />

Badgerl<strong>and</strong> AgGeorgia<br />

1. <strong>Patronage</strong> distribution allocated to members $1.00 $5.00<br />

2. Allocated equity $0.00 $3.35<br />

3. Cash portion paid by co-op $1.00 $1.65<br />

4. Member taxes paid $(0.35) $(1.75)<br />

5. Member net cash position year 1 $0.65 $(0.10)<br />

6. Present value of redeemed equity at 5% cost of capital $0.00 $2.26<br />

over 8 years<br />

7. Member net cash position after redemption of equity<br />

year 8<br />

$0.65 $2.16<br />

provide their members—again,<br />

agricultural producers—with<br />

short-term credit for crop <strong>and</strong><br />

livestock enterprises <strong>and</strong> for<br />

purchases of farm machinery.<br />

By 1968, all government capital<br />

was repaid.<br />

Originally, the system’s associations<br />

were operated separately<br />

from one another, but in the<br />

late 1980s they were consolidated<br />

under the same management<br />

structures into ACAs. Each ACA has at least two subsidiary<br />

lending institutions: a Federal L<strong>and</strong> <strong>Credit</strong> Association (L<strong>and</strong> Bank)<br />

<strong>and</strong> a Production <strong>Credit</strong> Association (<strong>Credit</strong> Association).<br />

Federal L<strong>and</strong> Banks were—<strong>and</strong> inside of an ACA, still are—exempt<br />

from income tax under 501(c)(1) because they are federally chartered<br />

organizations. Production <strong>Credit</strong> Associations are nonexempt<br />

cooperatives under Subchapter T. From the provision for income tax<br />

in the audits of AgGeorgia <strong>and</strong> Badgerl<strong>and</strong>, respectively, approximately<br />

60% of these ACAs’ income is generated by their L<strong>and</strong> Banks<br />

(tax exempt) <strong>and</strong> 40% of their income is generated by their <strong>Credit</strong><br />

Associations (nonexempt under Subchapter T).<br />

Later in this chapter, we also discuss a third ACA. However, the<br />

officers of this ACA requested that we not disclose their names or<br />

the identity of the ACA, because the board of directors <strong>and</strong> senior<br />

management are engaged in an ongoing discussion about whether<br />

the ACA will pay patronage refunds. The chief financial officer we<br />

spoke with is concerned that identifying the ACA might diminish<br />

the openness of the deliberations currently under way <strong>and</strong>/or suggest<br />

that senior management is biased either for or against the payment of<br />

patronage refunds.<br />

FCA—Regulatory Agency of ACAs<br />

The FCA regulates AgGeorgia, Badgerl<strong>and</strong>, <strong>and</strong> the other 79 ACAs,<br />

<strong>and</strong> it establishes capital adequacy ratios for these associations.<br />

Figure 5 contains the 2009 ratios for AgGeorgia <strong>and</strong> Badgerl<strong>and</strong>,<br />

the FCA minimum ratio, <strong>and</strong> the ratios for the combined 81 ACAs<br />

as of December 31, 2010. Capital ratios are also provided for the<br />

unnamed ACA that we will discuss later in this chapter.<br />

FCA regulations prohibit the inclusion of more than two percentage<br />

points of allocated equities in the calculation of the core surplus<br />

ratio. 28 Further, the regulations also prohibit in the calculation of<br />

34