Investment Policy Review - Rwanda - UNCTAD Virtual Institute

Investment Policy Review - Rwanda - UNCTAD Virtual Institute

Investment Policy Review - Rwanda - UNCTAD Virtual Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Investment</strong> <strong>Policy</strong> <strong>Review</strong> of <strong>Rwanda</strong><br />

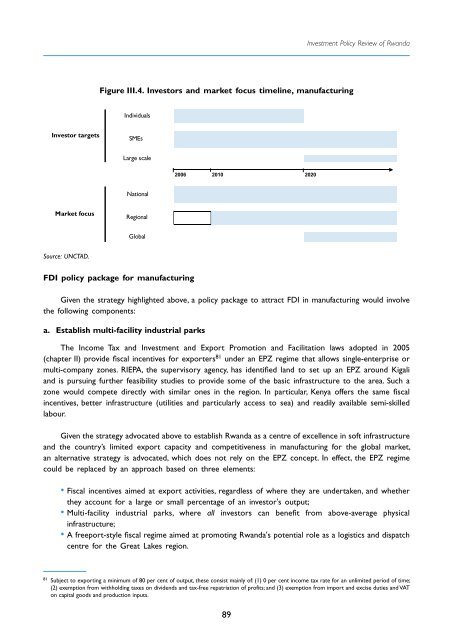

Figure III.4. Investors and market focus timeline, manufacturing<br />

Individuals<br />

Investor targets<br />

SMEs<br />

Large scale<br />

2006<br />

2010<br />

2020<br />

National<br />

Market focus<br />

Regional<br />

Global<br />

Source: <strong>UNCTAD</strong>.<br />

FDI policy package for manufacturing<br />

Given the strategy highlighted above, a policy package to attract FDI in manufacturing would involve<br />

the following components:<br />

a. Establish multi-facility industrial parks<br />

The Income Tax and <strong>Investment</strong> and Export Promotion and Facilitation laws adopted in 2005<br />

(chapter II) provide fiscal incentives for exporters 81 under an EPZ regime that allows single-enterprise or<br />

multi-company zones. RIEPA, the supervisory agency, has identified land to set up an EPZ around Kigali<br />

and is pursuing further feasibility studies to provide some of the basic infrastructure to the area. Such a<br />

zone would compete directly with similar ones in the region. In particular, Kenya offers the same fiscal<br />

incentives, better infrastructure (utilities and particularly access to sea) and readily available semi-skilled<br />

labour.<br />

Given the strategy advocated above to establish <strong>Rwanda</strong> as a centre of excellence in soft infrastructure<br />

and the country’s limited export capacity and competitiveness in manufacturing for the global market,<br />

an alternative strategy is advocated, which does not rely on the EPZ concept. In effect, the EPZ regime<br />

could be replaced by an approach based on three elements:<br />

• Fiscal incentives aimed at export activities, regardless of where they are undertaken, and whether<br />

they account for a large or small percentage of an investor's output;<br />

• Multi-facility industrial parks, where all investors can benefit from above-average physical<br />

infrastructure;<br />

• A freeport-style fiscal regime aimed at promoting <strong>Rwanda</strong>'s potential role as a logistics and dispatch<br />

centre for the Great Lakes region.<br />

81<br />

Subject to exporting a minimum of 80 per cent of output, these consist mainly of: (1) 0 per cent income tax rate for an unlimited period of time;<br />

(2) exemption from withholding taxes on dividends and tax-free repatriation of profits; and (3) exemption from import and excise duties and VAT<br />

on capital goods and production inputs.<br />

89