Investment Policy Review - Rwanda - UNCTAD Virtual Institute

Investment Policy Review - Rwanda - UNCTAD Virtual Institute

Investment Policy Review - Rwanda - UNCTAD Virtual Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Investment</strong> <strong>Policy</strong> <strong>Review</strong> of <strong>Rwanda</strong><br />

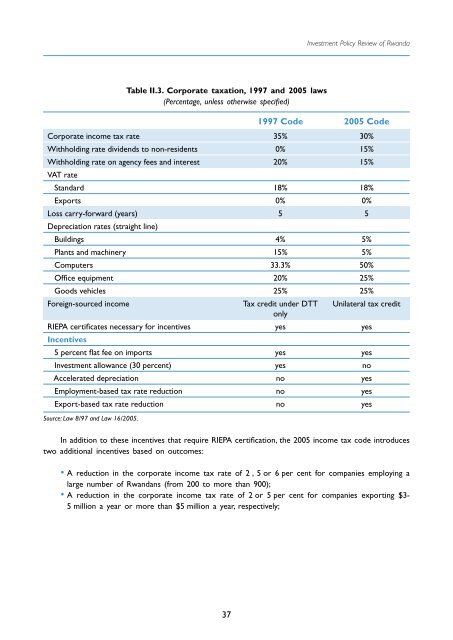

Table II.3. Corporate taxation, 1997 and 2005 laws<br />

(Percentage, unless otherwise specified)<br />

1997 Code 2005 Code<br />

Corporate income tax rate 35% 30%<br />

Withholding rate dividends to non-residents 0% 15%<br />

Withholding rate on agency fees and interest 20% 15%<br />

VAT rate<br />

Standard 18% 18%<br />

Exports 0% 0%<br />

Loss carry-forward (years) 5 5<br />

Depreciation rates (straight line)<br />

Buildings 4% 5%<br />

Plants and machinery 15% 5%<br />

Computers 33.3% 50%<br />

Office equipment 20% 25%<br />

Goods vehicles 25% 25%<br />

Foreign-sourced income<br />

Tax credit under DTT Unilateral tax credit<br />

only<br />

RIEPA certificates necessary for incentives yes yes<br />

Incentives<br />

5 percent flat fee on imports yes yes<br />

<strong>Investment</strong> allowance (30 percent) yes no<br />

Accelerated depreciation no yes<br />

Employment-based tax rate reduction no yes<br />

Export-based tax rate reduction no yes<br />

Source: Law 8/97 and Law 16/2005.<br />

In addition to these incentives that require RIEPA certification, the 2005 income tax code introduces<br />

two additional incentives based on outcomes:<br />

• A reduction in the corporate income tax rate of 2 , 5 or 6 per cent for companies employing a<br />

large number of <strong>Rwanda</strong>ns (from 200 to more than 900);<br />

• A reduction in the corporate income tax rate of 2 or 5 per cent for companies exporting $3-<br />

5 million a year or more than $5 million a year, respectively;<br />

37