Investment Policy Review - Rwanda - UNCTAD Virtual Institute

Investment Policy Review - Rwanda - UNCTAD Virtual Institute

Investment Policy Review - Rwanda - UNCTAD Virtual Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Investment</strong> <strong>Policy</strong> <strong>Review</strong> of <strong>Rwanda</strong><br />

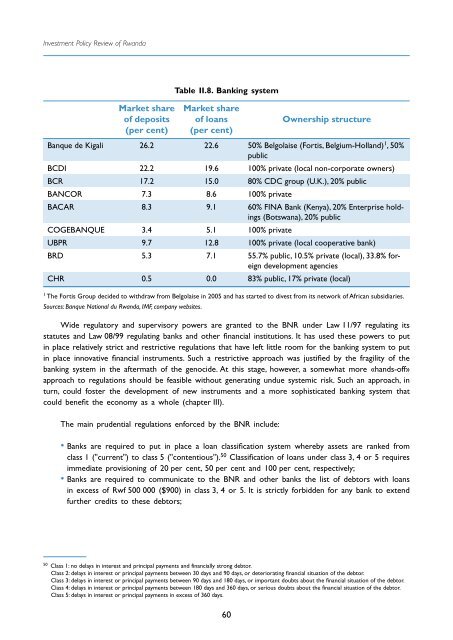

Table II.8. Banking system<br />

Market share<br />

of deposits<br />

(per cent)<br />

Market share<br />

of loans<br />

(per cent)<br />

Ownership structure<br />

Banque de Kigali 26.2 22.6 50% Belgolaise (Fortis, Belgium-Holland) 1 , 50%<br />

public<br />

BCDI 22.2 19.6 100% private (local non-corporate owners)<br />

BCR 17.2 15.0 80% CDC group (U.K.), 20% public<br />

BANCOR 7.3 8.6 100% private<br />

BACAR 8.3 9.1 60% FINA Bank (Kenya), 20% Enterprise holdings<br />

(Botswana), 20% public<br />

COGEBANQUE 3.4 5.1 100% private<br />

UBPR 9.7 12.8 100% private (local cooperative bank)<br />

BRD 5.3 7.1 55.7% public, 10.5% private (local), 33.8% foreign<br />

development agencies<br />

CHR 0.5 0.0 83% public, 17% private (local)<br />

1<br />

The Fortis Group decided to withdraw from Belgolaise in 2005 and has started to divest from its network of African subsidiaries.<br />

Sources: Banque National du <strong>Rwanda</strong>, IMF, company websites.<br />

Wide regulatory and supervisory powers are granted to the BNR under Law 11/97 regulating its<br />

statutes and Law 08/99 regulating banks and other financial institutions. It has used these powers to put<br />

in place relatively strict and restrictive regulations that have left little room for the banking system to put<br />

in place innovative financial instruments. Such a restrictive approach was justified by the fragility of the<br />

banking system in the aftermath of the genocide. At this stage, however, a somewhat more «hands-off»<br />

approach to regulations should be feasible without generating undue systemic risk. Such an approach, in<br />

turn, could foster the development of new instruments and a more sophisticated banking system that<br />

could benefit the economy as a whole (chapter III).<br />

The main prudential regulations enforced by the BNR include:<br />

• Banks are required to put in place a loan classification system whereby assets are ranked from<br />

class 1 ("current") to class 5 ("contentious"). 50 Classification of loans under class 3, 4 or 5 requires<br />

immediate provisioning of 20 per cent, 50 per cent and 100 per cent, respectively;<br />

• Banks are required to communicate to the BNR and other banks the list of debtors with loans<br />

in excess of Rwf 500 000 ($900) in class 3, 4 or 5. It is strictly forbidden for any bank to extend<br />

further credits to these debtors;<br />

50<br />

Class 1: no delays in interest and principal payments and financially strong debtor.<br />

Class 2: delays in interest or principal payments between 30 days and 90 days, or deteriorating financial situation of the debtor.<br />

Class 3: delays in interest or principal payments between 90 days and 180 days, or important doubts about the financial situation of the debtor.<br />

Class 4: delays in interest or principal payments between 180 days and 360 days, or serious doubts about the financial situation of the debtor.<br />

Class 5: delays in interest or principal payments in excess of 360 days.<br />

60