Investment Policy Review - Rwanda - UNCTAD Virtual Institute

Investment Policy Review - Rwanda - UNCTAD Virtual Institute

Investment Policy Review - Rwanda - UNCTAD Virtual Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Investment</strong> <strong>Policy</strong> <strong>Review</strong> of <strong>Rwanda</strong><br />

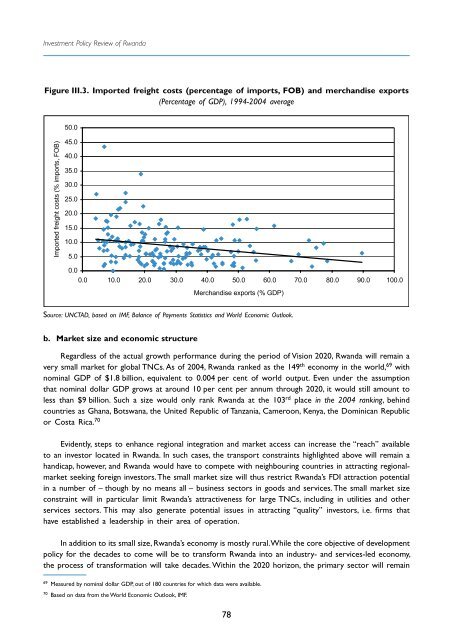

Figure III.3. Imported freight costs (percentage of imports, FOB) and merchandise exports<br />

(Percentage of GDP), 1994-2004 average<br />

50.0<br />

Imported freight costs (% imports, FOB)<br />

45.0<br />

40.0<br />

35.0<br />

30.0<br />

25.0<br />

20.0<br />

15.0<br />

10.0<br />

5.0<br />

0.0<br />

0.0 10.0 20.0 30.0 40.0 50.0 60.0 70.0 80.0 90.0 100.0<br />

Merchandise exports (% GDP)<br />

Source: <strong>UNCTAD</strong>, based on IMF, Balance of Payments Statistics and World Economic Outlook.<br />

b. Market size and economic structure<br />

Regardless of the actual growth performance during the period of Vision 2020, <strong>Rwanda</strong> will remain a<br />

very small market for global TNCs. As of 2004, <strong>Rwanda</strong> ranked as the 149 th economy in the world, 69 with<br />

nominal GDP of $1.8 billion, equivalent to 0.004 per cent of world output. Even under the assumption<br />

that nominal dollar GDP grows at around 10 per cent per annum through 2020, it would still amount to<br />

less than $9 billion. Such a size would only rank <strong>Rwanda</strong> at the 103 rd place in the 2004 ranking, behind<br />

countries as Ghana, Botswana, the United Republic of Tanzania, Cameroon, Kenya, the Dominican Republic<br />

or Costa Rica. 70<br />

Evidently, steps to enhance regional integration and market access can increase the “reach” available<br />

to an investor located in <strong>Rwanda</strong>. In such cases, the transport constraints highlighted above will remain a<br />

handicap, however, and <strong>Rwanda</strong> would have to compete with neighbouring countries in attracting regionalmarket<br />

seeking foreign investors. The small market size will thus restrict <strong>Rwanda</strong>’s FDI attraction potential<br />

in a number of – though by no means all – business sectors in goods and services. The small market size<br />

constraint will in particular limit <strong>Rwanda</strong>’s attractiveness for large TNCs, including in utilities and other<br />

services sectors. This may also generate potential issues in attracting “quality” investors, i.e. firms that<br />

have established a leadership in their area of operation.<br />

In addition to its small size, <strong>Rwanda</strong>’s economy is mostly rural. While the core objective of development<br />

policy for the decades to come will be to transform <strong>Rwanda</strong> into an industry- and services-led economy,<br />

the process of transformation will take decades. Within the 2020 horizon, the primary sector will remain<br />

69<br />

Measured by nominal dollar GDP, out of 180 countries for which data were available.<br />

70<br />

Based on data from the World Economic Outlook, IMF.<br />

78