Investment Policy Review - Rwanda - UNCTAD Virtual Institute

Investment Policy Review - Rwanda - UNCTAD Virtual Institute

Investment Policy Review - Rwanda - UNCTAD Virtual Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Investment</strong> <strong>Policy</strong> <strong>Review</strong> of <strong>Rwanda</strong><br />

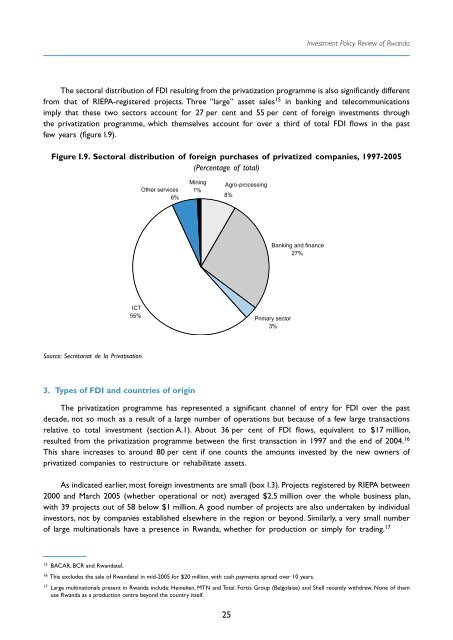

The sectoral distribution of FDI resulting from the privatization programme is also significantly different<br />

from that of RIEPA-registered projects. Three “large” asset sales 15 in banking and telecommunications<br />

imply that these two sectors account for 27 per cent and 55 per cent of foreign investments through<br />

the privatization programme, which themselves account for over a third of total FDI flows in the past<br />

few years (figure I.9).<br />

Figure I.9. Sectoral distribution of foreign purchases of privatized companies, 1997-2005<br />

(Percentage of total)<br />

Other services<br />

6%<br />

Mining<br />

1%<br />

Agro-processing<br />

8%<br />

Banking and finance<br />

27%<br />

ICT<br />

55%<br />

Primary sector<br />

3%<br />

Source: Secrétariat de la Privatisation.<br />

3. Types of FDI and countries of origin<br />

The privatization programme has represented a significant channel of entry for FDI over the past<br />

decade, not so much as a result of a large number of operations but because of a few large transactions<br />

relative to total investment (section A.1). About 36 per cent of FDI flows, equivalent to $17 million,<br />

resulted from the privatization programme between the first transaction in 1997 and the end of 2004. 16<br />

This share increases to around 80 per cent if one counts the amounts invested by the new owners of<br />

privatized companies to restructure or rehabilitate assets.<br />

As indicated earlier, most foreign investments are small (box I.3). Projects registered by RIEPA between<br />

2000 and March 2005 (whether operational or not) averaged $2.5 million over the whole business plan,<br />

with 39 projects out of 58 below $1 million. A good number of projects are also undertaken by individual<br />

investors, not by companies established elsewhere in the region or beyond. Similarly, a very small number<br />

of large multinationals have a presence in <strong>Rwanda</strong>, whether for production or simply for trading. 17<br />

15<br />

BACAR, BCR and <strong>Rwanda</strong>tel.<br />

16<br />

This excludes the sale of <strong>Rwanda</strong>tel in mid-2005 for $20 million, with cash payments spread over 10 years.<br />

17<br />

Large multinationals present in <strong>Rwanda</strong> include: Heineken, MTN and Total. Fortis Group (Belgolaise) and Shell recently withdrew. None of them<br />

use <strong>Rwanda</strong> as a production centre beyond the country itself.<br />

25