annual report - Hypo Real Estate Holding AG

annual report - Hypo Real Estate Holding AG

annual report - Hypo Real Estate Holding AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Group Accounts<br />

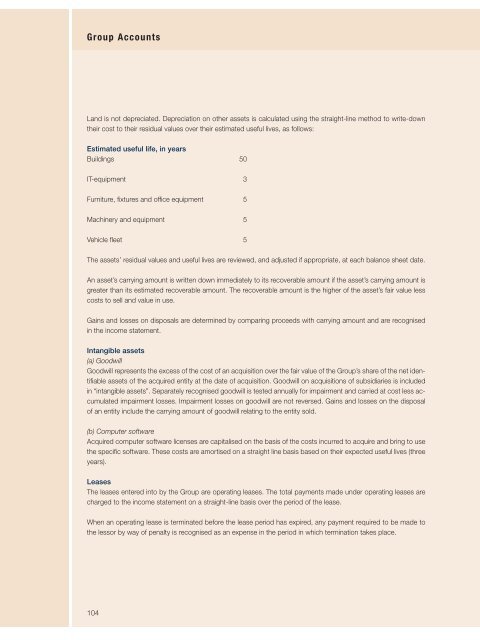

Land is not depreciated. Depreciation on other assets is calculated using the straight-line method to write-down<br />

their cost to their residual values over their estimated useful lives, as follows:<br />

Estimated useful life, in years<br />

Buildings 50<br />

IT-equipment 3<br />

Furniture, fixtures and office equipment 5<br />

Machinery and equipment 5<br />

Vehicle fleet 5<br />

The assets’ residual values and useful lives are reviewed, and adjusted if appropriate, at each balance sheet date.<br />

An asset’s carrying amount is written down immediately to its recoverable amount if the asset’s carrying amount is<br />

greater than its estimated recoverable amount. The recoverable amount is the higher of the asset’s fair value less<br />

costs to sell and value in use.<br />

Gains and losses on disposals are determined by comparing proceeds with carrying amount and are recognised<br />

in the income statement.<br />

Intangible assets<br />

(a) Goodwill<br />

Goodwill represents the excess of the cost of an acquisition over the fair value of the Group’s share of the net identifiable<br />

assets of the acquired entity at the date of acquisition. Goodwill on acquisitions of subsidiaries is included<br />

in “intangible assets”. Separately recognised goodwill is tested <strong>annual</strong>ly for impairment and carried at cost less accumulated<br />

impairment losses. Impairment losses on goodwill are not reversed. Gains and losses on the disposal<br />

of an entity include the carrying amount of goodwill relating to the entity sold.<br />

(b) Computer software<br />

Acquired computer software licenses are capitalised on the basis of the costs incurred to acquire and bring to use<br />

the specific software. These costs are amortised on a straight line basis based on their expected useful lives (three<br />

years).<br />

Leases<br />

The leases entered into by the Group are operating leases. The total payments made under operating leases are<br />

charged to the income statement on a straight-line basis over the period of the lease.<br />

When an operating lease is terminated before the lease period has expired, any payment required to be made to<br />

the lessor by way of penalty is recognised as an expense in the period in which termination takes place.<br />

104