annual report - Hypo Real Estate Holding AG

annual report - Hypo Real Estate Holding AG

annual report - Hypo Real Estate Holding AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management Discussion – Segments<br />

benchmarks is slightly in excess of €24.5 billion equivalent.<br />

DEPFA’s activities in the primary markets this year led<br />

to the Bank being recognised by EUROMONEY as<br />

“Best Covered Bond Borrower 2007”.<br />

DEPFA’s US$ benchmarks are largely placed outside<br />

Europe (on average 70%), reflecting the strength of<br />

DEPFA’s global investor name recognition. As the USA<br />

is a region where the Bank has seen, and anticipates<br />

further, significant asset growth, DEPFA is committed<br />

to further expanding its US$ funding base with other<br />

capital markets products, including the recently<br />

established AAA 144A USMTN programme.<br />

Investors in DEPFA’s ACS benchmarks are attracted by<br />

the high quality and liquidity of these instruments and<br />

the positive spread to sovereign and agency paper.<br />

Despite the global credit and liquidity crisis, the secondary<br />

market for public sector-backed covered bonds<br />

22<br />

has remained remarkably stable in contrast to other<br />

asset classes. DEPFA was a beneficiary of the stability<br />

in this asset class and was therefore well positioned to<br />

access the primary markets during the second half of<br />

2007.<br />

DEPFA is also an active issuer of EMTN notes, both<br />

secured and unsecured in a wide variety of structures,<br />

currencies and maturities either as private placements<br />

or as public transactions. 2007 was a very strong year<br />

for these markets, with two-thirds of DEPFA’s longterm<br />

funding being sourced in the private placement<br />

markets.<br />

The success of the funding strategy employed by<br />

DEPFA in 2007 is reflected in the fact that the Bank<br />

raised its targeted €13.5 billion of long-term funding at<br />

deeper sub-LIBOR levels than were achieved in 2006<br />

or at any stage in recent years. This was achieved<br />

whilst maintaining an average weighted tenor of new<br />

borrowings of approximately 9 years.<br />

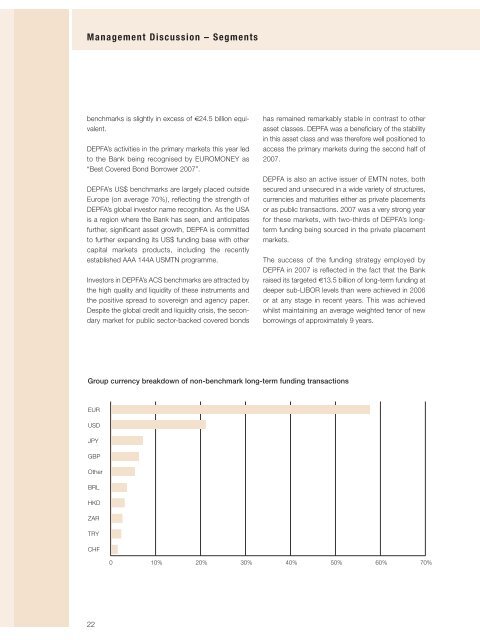

Group currency breakdown of non-benchmark long-term funding transactions<br />

EUR<br />

USD<br />

JPY<br />

GBP<br />

Other<br />

BRL<br />

HKD<br />

ZAR<br />

TRY<br />

CHF<br />

0 10% 20% 30% 40% 50% 60% 70%