annual report - Hypo Real Estate Holding AG

annual report - Hypo Real Estate Holding AG

annual report - Hypo Real Estate Holding AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management Discussion – Segments<br />

Distribution<br />

DEPFA’s Global Sales team consolidated their position<br />

as a leading provider of liquidity to the Group, in both<br />

short-term and long-term products. Against a backdrop<br />

of shrinking liquidity and declining investor<br />

appetite, the Bank directly placed over €232 billion (vs.<br />

€190 billion in 2006) in short-term liquidity instruments<br />

across 8 funding platforms. Meanwhile, the Bank also<br />

increased its sale of long-term covered bonds and<br />

public sector assets from €3.2 billion in 2006 to €3.4<br />

billion in 2007. Participating in over 10 roadshows,<br />

DEPFA attracted over 40 new clients, to enhance its<br />

client base, diversified across Central Banks, Private<br />

Banks, Asset Managers and Building Societies as well<br />

as Corporate Treasuries. For the first time, the Bank<br />

achieved a #1 position on its own Capital Markets<br />

dealer group, distributing €1.45 billion (almost double<br />

the volume of 2006 at €745 million.)<br />

Results*<br />

Net interest income, generated through DEPFA’s<br />

stable, long-term asset and liability base, amounted to<br />

€348 million in 2007, (compared to €356m in 2006), a<br />

2 % decrease on the previous year. This change is<br />

partly because of increased asset sales (taking advantage<br />

of favourable market prices), which accordingly<br />

Budget Finance<br />

24<br />

removed the contribution to net interest income from<br />

such assets sold. Non-interest revenues, generated<br />

through fees from US Liquidity Facilities, the active<br />

management of the Budget Finance asset portfolio<br />

and other activities increased to €368 million in 2007,<br />

(compared to €283 million in 2006), a 30% increase<br />

on the previous year. New business in the mature<br />

markets, most notably in the USA and Italy was<br />

particularly strong. The U.S. now contributes 25% of<br />

the overall budget financing volume of DEPFA whilst<br />

also enhancing the credit quality of the portfolio.<br />

DEPFA’s funding activities remained strong, meeting<br />

and exceeding the Bank’s targets for its long- and<br />

short-term funding mix and enhancing/reducing the<br />

overall cost of funding in 2007. Profit before taxes in<br />

this segment totaled €613 million in 2007.<br />

Outlook<br />

The outlook for 2008 is volatile but not without profitable<br />

opportunities. For those institutions like DEPFA,<br />

which have the ability to utilise their reputation as a<br />

balance sheet investor, operating within high quality<br />

credit (Government and tax-revenue backed) markets,<br />

there may indeed be opportunities to further enhance<br />

the portfolio’s efficient frontier in terms of risk adjusted<br />

return.<br />

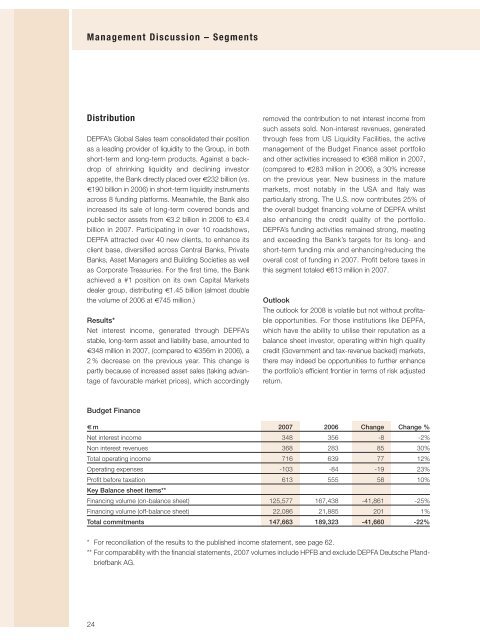

€ m 2007 2006 Change Change %<br />

Net interest income 348 356 -8 -2%<br />

Non interest revenues 368 283 85 30%<br />

Total operating income 716 639 77 12%<br />

Operating expenses -103 -84 -19 23%<br />

Profit before taxation 613 555 58 10%<br />

Key Balance sheet items**<br />

Financing volume (on-balance sheet) 125,577 167,438 -41,861 -25%<br />

Financing volume (off-balance sheet) 22,086 21,885 201 1%<br />

Total commitments 147,663 189,323 -41,660 -22%<br />

* For reconciliation of the results to the published in come statement, see page 62.<br />

** For comparability with the financial statements, 2007 volumes include HPFB and exclude DEPFA Deutsche Pfandbriefbank<br />

<strong>AG</strong>.