annual report - Hypo Real Estate Holding AG

annual report - Hypo Real Estate Holding AG

annual report - Hypo Real Estate Holding AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Corporate Centre<br />

Introduction<br />

The Corporate Centre consists of various cost and revenue<br />

items that, due to their special character, do not<br />

fit into any particular business segment or can be seen<br />

as supporting the entire organization as a whole rather<br />

than individual segments.<br />

For example, support related costs cover Group<br />

functions like group accounting and <strong>report</strong>ing, opera -<br />

tions, corporate communications, internal audit and<br />

compliance among others. Items of special character<br />

include charitable donations and sponsorships, such<br />

as DEPFA’s ongoing relationship as corporate sponsor<br />

to the Irish charity Concern. The segment also includes<br />

residual property assets which have been a non-core<br />

activity since DEPFA decided to focus exclusively on<br />

public finance in 2002.<br />

Corporate Centre<br />

Results*<br />

The negative net interest income results from interest<br />

expenditure relating to subordinated debt (lower Tier II<br />

and profit participation certificates) which is charged in<br />

its entirety to the Corporate Centre. Non-interest<br />

revenues showed a positive result, mainly due to<br />

interest on tax refunds.<br />

The significant increase in operating expenses was due<br />

to exceptional merger related costs of €88 million and<br />

€23 million of a loss on disposal of DEPFA Deutsche<br />

Pfandbriefbank <strong>AG</strong> and also, to a lesser extent, higher<br />

direct costs. Included in the prior year are exceptional<br />

impacts relating to tax refunds and related interests<br />

from discontinued operations, consisting of €34 million<br />

under operating income and €41 million under<br />

operating expenses.<br />

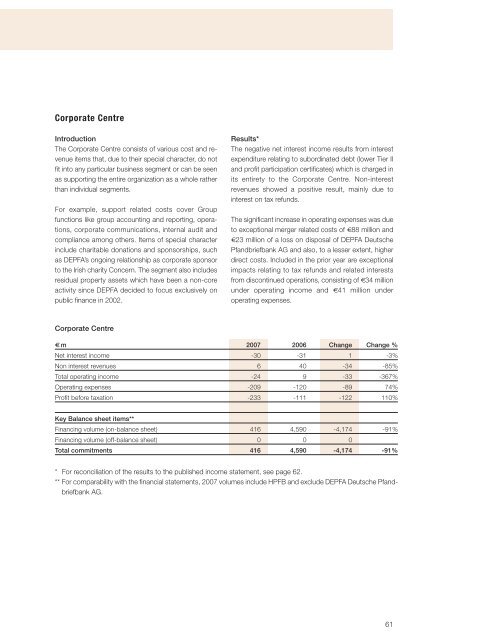

€ m 2007 2006 Change Change %<br />

Net interest income -30 -31 1 -3%<br />

Non interest revenues 6 40 -34 -85%<br />

Total operating income -24 9 -33 -367%<br />

Operating expenses -209 -120 -89 74%<br />

Profit before taxation -233 -111 -122 110%<br />

Key Balance sheet items**<br />

Financing volume (on-balance sheet) 416 4,590 -4,174 -91%<br />

Financing volume (off-balance sheet) 0 0 0<br />

Total commitments 416 4,590 -4,174 -91%<br />

* For reconciliation of the results to the published in come statement, see page 62.<br />

** For comparability with the financial statements, 2007 volumes include HPFB and exclude DEPFA Deutsche Pfandbriefbank<br />

<strong>AG</strong>.<br />

61