annual report - Hypo Real Estate Holding AG

annual report - Hypo Real Estate Holding AG

annual report - Hypo Real Estate Holding AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Business Performance<br />

Balance Sheet<br />

The on-balance sheet commitments fell by 12% to<br />

€171 billion. However this includes a net reduction of<br />

€34 billion as at 31 December 2007 from the disposal<br />

of DEPFA Deutsche Pfandbriefbank <strong>AG</strong>, net of the<br />

acquisition of HPFB. Excluding this exceptional effect,<br />

the on-balance sheet commitments grew by 6%.<br />

This shows that the Bank has been able to maintain its<br />

overall public sector financing volume at a virtually<br />

constant level despite significant asset sales activity<br />

during the course of the year involving over €30 billion<br />

of assets. Almost 50% of the drawn financing volume<br />

is made up of 0% risk-weighted sovereign borrowers,<br />

including central governments, government agencies,<br />

multilateral institutions as well as certain local and<br />

regional authorities.<br />

There has been a perceptible shift in 2007 towards<br />

20% risk-weighted borrowers reflecting the growth<br />

especially in the municipal business in the United<br />

States where local and regional authorities are<br />

assigned a 20% risk weighting, as well as the quasisovereign<br />

student loan market. The volume of 100%<br />

risk-weighted assets has grown to €19 billion but still<br />

represents a small portion (11%) of the drawn total.<br />

68<br />

Typi cally, this category refers in particular to public<br />

sector related concession based lending under Public<br />

Private Partnership (PPP) financing arrangements in<br />

which the Bank’s debt is often serviced by cash flows<br />

from the public sector (subject to satisfactory performance<br />

by the private sector partner).<br />

The Bank’s treasury management activities have continued<br />

to provide very stable support for the Bank’s<br />

asset side even in the very difficult market environment,<br />

which were evident since the summer. The success of<br />

the funding strategy employed by DEPFA in 2007 is<br />

reflected in the fact that the Bank raised its targeted<br />

€13.5 billion of long-term funding at deeper sub-LIBOR<br />

levels than was achieved in 2006 or at any stage in<br />

recent years. This was achieved whilst maintaining an<br />

average weighted tenor of new borrowings of approximately<br />

9 years. The public sector asset base of DEPFA<br />

was deployed to an increasing degree in the repo<br />

markets during the latter half of the year given the<br />

strong appetite among market participants for this<br />

asset class during the ongoing credit crisis, reflecting<br />

the flight to quality. The Bank’s total secured funding<br />

including covered bond issuance and repo finance<br />

amounted to 69% of total funding.<br />

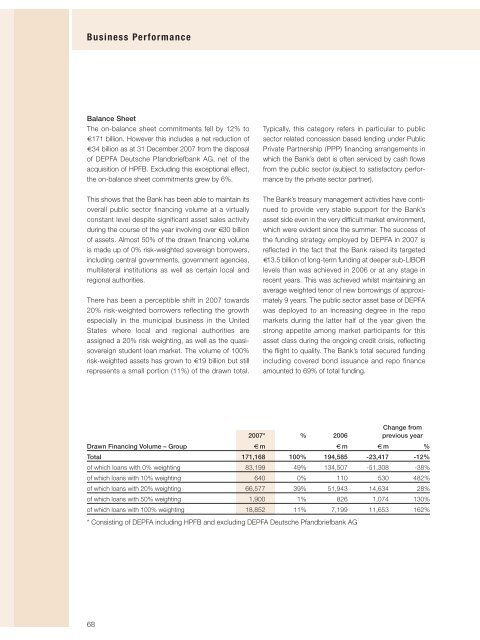

2007* % 2006<br />

Change from<br />

previous year<br />

Drawn Financing Volume – Group € m € m € m %<br />

Total 171,168 100% 194,585 -23,417 -12%<br />

of which loans with 0% weighting 83,199 49% 134,507 -51,308 -38%<br />

of which loans with 10% weighting 640 0% 110 530 482%<br />

of which loans with 20% weighting 66,577 39% 51,943 14,634 28%<br />

of which loans with 50% weighting 1,900 1% 826 1,074 130%<br />

of which loans with 100% weighting 18,852 11% 7,199 11,653 162%<br />

* Consisting of DEPFA including HPFB and excluding DEPFA Deutsche Pfandbriefbank <strong>AG</strong>