annual report - Hypo Real Estate Holding AG

annual report - Hypo Real Estate Holding AG

annual report - Hypo Real Estate Holding AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Risikoberichtbericht<br />

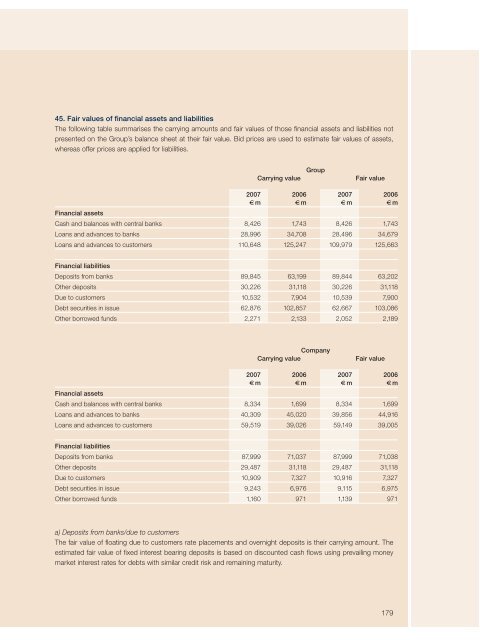

45. Fair values of financial assets and liabilities<br />

The following table summarises the carrying amounts and fair values of those financial assets and liabilities not<br />

presented on the Group’s balance sheet at their fair value. Bid prices are used to estimate fair values of assets,<br />

whereas offer prices are applied for liabilities.<br />

Group<br />

Carrying value Fair value<br />

2007 2006 2007 2006<br />

€ m € m € m € m<br />

Financial assets<br />

Cash and balances with central banks 8,426 1,743 8,426 1,743<br />

Loans and advances to banks 28,996 34,708 28,496 34,679<br />

Loans and advances to customers 110,648 125,247 109,979 125,663<br />

Financial liabilities<br />

Deposits from banks 89,845 63,199 89,844 63,202<br />

Other deposits 30,226 31,118 30,226 31,118<br />

Due to customers 10,532 7,904 10,539 7,900<br />

Debt securities in issue 62,876 102,857 62,667 103,086<br />

Other borrowed funds 2,271 2,133 2,052 2,189<br />

Company<br />

Carrying value Fair value<br />

2007 2006 2007 2006<br />

€ m € m € m € m<br />

Financial assets<br />

Cash and balances with central banks 8,334 1,699 8,334 1,699<br />

Loans and advances to banks 40,309 45,020 39,856 44,916<br />

Loans and advances to customers 59,519 39,026 59,149 39,005<br />

Financial liabilities<br />

Deposits from banks 87,999 71,037 87,999 71,038<br />

Other deposits 29,487 31,118 29,487 31,118<br />

Due to customers 10,909 7,327 10,916 7,327<br />

Debt securities in issue 9,243 6,976 9,115 6,975<br />

Other borrowed funds 1,160 971 1,139 971<br />

a) Deposits from banks/due to customers<br />

The fair value of floating due to customers rate placements and overnight deposits is their carrying amount. The<br />

estimated fair value of fixed interest bearing deposits is based on discounted cash flows using prevailing money<br />

market interest rates for debts with similar credit risk and remaining maturity.<br />

179