annual report - Hypo Real Estate Holding AG

annual report - Hypo Real Estate Holding AG

annual report - Hypo Real Estate Holding AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Group Accounts<br />

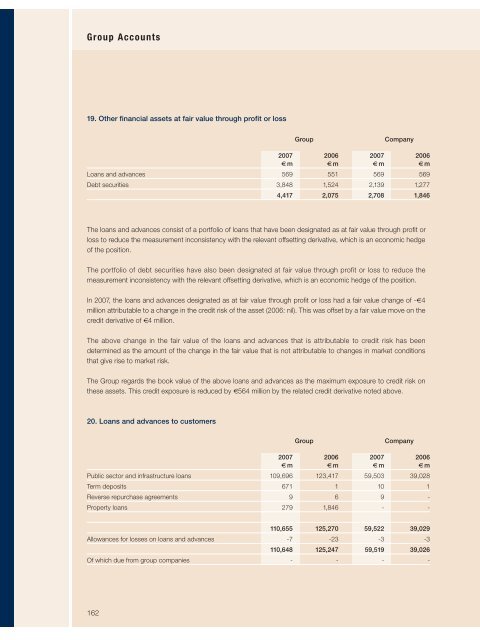

19. Other financial assets at fair value through profit or loss<br />

The loans and advances consist of a portfolio of loans that have been designated as at fair value through profit or<br />

loss to reduce the measurement inconsistency with the relevant offsetting derivative, which is an economic hedge<br />

of the position.<br />

The portfolio of debt securities have also been designated at fair value through profit or loss to reduce the<br />

measurement inconsistency with the relevant offsetting derivative, which is an economic hedge of the position.<br />

In 2007, the loans and advances designated as at fair value through profit or loss had a fair value change of -€4<br />

million attributable to a change in the credit risk of the asset (2006: nil). This was offset by a fair value move on the<br />

credit derivative of €4 million.<br />

The above change in the fair value of the loans and advances that is attributable to credit risk has been<br />

determined as the amount of the change in the fair value that is not attributable to changes in market conditions<br />

that give rise to market risk.<br />

The Group regards the book value of the above loans and advances as the maximum exposure to credit risk on<br />

these assets. This credit exposure is reduced by €564 million by the related credit derivative noted above.<br />

20. Loans and advances to customers<br />

162<br />

Group Company<br />

2007 2006 2007 2006<br />

€ m € m € m € m<br />

Loans and advances 569 551 569 569<br />

Debt securities 3,848 1,524 2,139 1,277<br />

4,417 2,075 2,708 1,846<br />

Group Company<br />

2007 2006 2007 2006<br />

€ m € m € m € m<br />

Public sector and infrastructure loans 109,696 123,417 59,503 39,028<br />

Term deposits 671 1 10 1<br />

Reverse repurchase agreements 9 6 9 -<br />

Property loans 279 1,846 - -<br />

110,655 125,270 59,522 39,029<br />

Allowances for losses on loans and advances -7 -23 -3 -3<br />

110,648 125,247 59,519 39,026<br />

Of which due from group companies - - - -