annual report - Hypo Real Estate Holding AG

annual report - Hypo Real Estate Holding AG

annual report - Hypo Real Estate Holding AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

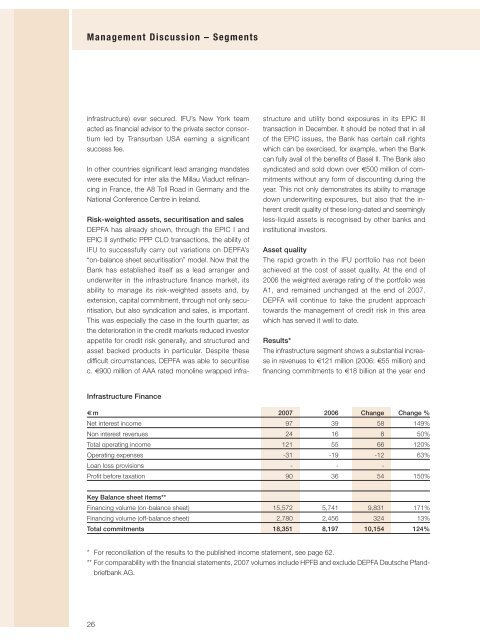

Management Discussion – Segments<br />

infrastructure) ever secured. IFU’s New York team<br />

acted as financial advisor to the private sector consortium<br />

led by Transurban USA earning a significant<br />

success fee.<br />

In other countries significant lead arranging mandates<br />

were executed for inter alia the Millau Viaduct refinancing<br />

in France, the A8 Toll Road in Germany and the<br />

National Conference Centre in Ireland.<br />

Risk-weighted assets, securitisation and sales<br />

DEPFA has already shown, through the EPIC I and<br />

EPIC II synthetic PPP CLO transactions, the ability of<br />

IFU to successfully carry out variations on DEPFA’s<br />

“on-balance sheet securitisation” model. Now that the<br />

Bank has established itself as a lead arranger and<br />

underwriter in the infrastructure finance market, its<br />

ability to manage its risk-weighted assets and, by<br />

extension, capital commitment, through not only securitisation,<br />

but also syndication and sales, is important.<br />

This was especially the case in the fourth quarter, as<br />

the deterioration in the credit markets reduced investor<br />

appetite for credit risk generally, and structured and<br />

asset backed products in particular. Despite these<br />

difficult circumstances, DEPFA was able to securitise<br />

c. €900 million of AAA rated monoline wrapped infra-<br />

Infrastructure Finance<br />

26<br />

structure and utility bond exposures in its EPIC III<br />

transaction in December. It should be noted that in all<br />

of the EPIC issues, the Bank has certain call rights<br />

which can be exercised, for example, when the Bank<br />

can fully avail of the benefits of Basel II. The Bank also<br />

syndicated and sold down over €500 million of commitments<br />

without any form of discounting during the<br />

year. This not only demonstrates its ability to manage<br />

down underwriting exposures, but also that the in -<br />

herent credit quality of these long-dated and seemingly<br />

less-liquid assets is recognised by other banks and<br />

institutional investors.<br />

Asset quality<br />

The rapid growth in the IFU portfolio has not been<br />

achieved at the cost of asset quality. At the end of<br />

2006 the weighted average rating of the portfolio was<br />

A1, and remained unchanged at the end of 2007.<br />

DEPFA will continue to take the prudent approach<br />

towards the management of credit risk in this area<br />

which has served it well to date.<br />

Results*<br />

The infrastructure segment shows a substantial increase<br />

in revenues to €121 million (2006: €55 million) and<br />

financing commitments to €18 billion at the year end<br />

€ m 2007 2006 Change Change %<br />

Net interest income 97 39 58 149%<br />

Non interest revenues 24 16 8 50%<br />

Total operating income 121 55 66 120%<br />

Operating expenses -31 -19 -12 63%<br />

Loan loss provisions - - -<br />

Profit before taxation 90 36 54 150%<br />

Key Balance sheet items**<br />

Financing volume (on-balance sheet) 15,572 5,741 9,831 171%<br />

Financing volume (off-balance sheet) 2,780 2,456 324 13%<br />

Total commitments 18,351 8,197 10,154 124%<br />

* For reconciliation of the results to the published in come statement, see page 62.<br />

** For comparability with the financial statements, 2007 volumes include HPFB and exclude DEPFA Deutsche Pfandbriefbank<br />

<strong>AG</strong>.