- Page 1 and 2:

2007 DEPFA BANK plc annual report

- Page 3 and 4:

Profile ❚ The only globally opera

- Page 5 and 6:

■ Europe incl. EMEA and CIS (Lond

- Page 7 and 8:

Risikoberichtbericht Accounts 76 Di

- Page 9 and 10:

Millau Viaduct, France

- Page 11:

Client: The Region of Campania, Ita

- Page 14 and 15:

Corporate Highlights 2007 10 10 Q1:

- Page 16 and 17:

John Kirwan: “This award winning

- Page 18 and 19:

Executive Directors 14 Paul Leather

- Page 20 and 21:

Dr. Christian Kummert: “Probably

- Page 22 and 23:

Management Discussion - Segments Ma

- Page 24 and 25:

Management Discussion - Segments co

- Page 26 and 27:

Management Discussion - Segments be

- Page 28 and 29:

Management Discussion - Segments Di

- Page 30 and 31:

Management Discussion - Segments in

- Page 32 and 33:

Capital Beltway HOT Lanes in Virgin

- Page 34 and 35:

Aguas de Portugal (AdP), Portugal

- Page 36 and 37:

Public Sector and Infrastructure Fi

- Page 38 and 39:

Public Sector and Infrastructure Fi

- Page 40 and 41:

Public Sector and Infrastructure Fi

- Page 42 and 43:

Vincent Matrone: “We were the lea

- Page 44 and 45:

Marnin Lebovits: “The State of Mi

- Page 46 and 47:

Public Sector and Infrastructure Fi

- Page 48 and 49:

Public Sector and Infrastructure Fi

- Page 50 and 51:

Export-Import Bank of Korea

- Page 52 and 53:

Public Sector and Infrastructure Fi

- Page 54 and 55:

Sam Miller: “The transaction with

- Page 56 and 57:

Puerto Rico Sales Tax Financing Cor

- Page 58 and 59:

Energinet, Denmark

- Page 60 and 61:

Management Discussion - Segments Cl

- Page 62 and 63:

Management Discussion - Segments DE

- Page 64 and 65:

Management Discussion - Segments Re

- Page 66 and 67:

Management Discussion - Segments Th

- Page 68 and 69:

Project Omega, Northern Ireland

- Page 70 and 71:

Business Performance Business Perfo

- Page 72 and 73:

Business Performance Balance Sheet

- Page 74:

Business Performance forms of capit

- Page 77 and 78:

Client: Bulgarian State Railways (B

- Page 79 and 80:

Client: Royal BAM (BAM PPP Limited)

- Page 81 and 82:

Risk Committee Ms. B. von Oesterrei

- Page 83 and 84:

Directors’ and Secretary’s inte

- Page 85 and 86:

Risikoberichtbericht The credit pro

- Page 87 and 88:

Risikoberichtbericht Branches outsi

- Page 89 and 90:

Risikoberichtbericht Independent Au

- Page 91 and 92:

Risikoberichtbericht We have obtain

- Page 93 and 94:

Risikoberichtbericht Consolidated b

- Page 95 and 96:

Consolidated statement of changes i

- Page 97 and 98:

Consolidated cash flow statement Ca

- Page 99 and 100:

Notes to the consolidated financial

- Page 101 and 102:

Risikoberichtbericht Expenses incur

- Page 103 and 104:

Risikoberichtbericht (b) Loans and

- Page 105 and 106:

Risikoberichtbericht Hedging deriva

- Page 107 and 108:

Risikoberichtbericht (vi) observabl

- Page 109 and 110:

Risikoberichtbericht Cash and cash

- Page 111 and 112:

Risikoberichtbericht Share capital

- Page 113 and 114:

Risikoberichtbericht Standards, ame

- Page 115 and 116:

Risikoberichtbericht Credit Committ

- Page 117 and 118:

Risikoberichtbericht Asset and Liab

- Page 119 and 120:

Risikoberichtbericht The portfolio

- Page 121 and 122:

Risikoberichtbericht Assessing cred

- Page 123 and 124: Company On-Balance Sheet December 2

- Page 125 and 126: Company On-Balance Sheet December 2

- Page 127 and 128: DEPFA’s Counterparty Risk Pools R

- Page 129 and 130: Risikoberichtbericht Credit Risk Ma

- Page 131 and 132: Risikoberichtbericht Further Credit

- Page 133 and 134: DEPFA Deutsche Pfandbriefbank AG

- Page 135 and 136: Risikoberichtbericht As can be seen

- Page 137 and 138: The HRE Group risk management commi

- Page 139 and 140: Risikoberichtbericht As at 31 Decem

- Page 141 and 142: Risikoberichtbericht As at 31 Decem

- Page 143 and 144: Risikoberichtbericht 5. Operational

- Page 145 and 146: Risikoberichtbericht 7. Compliance

- Page 147 and 148: Risikoberichtbericht Taxation The t

- Page 149 and 150: Risikoberichtbericht Corporate Infr

- Page 151 and 152: 6. Net interest income Interest and

- Page 153 and 154: 10. Other operating income Other op

- Page 155 and 156: Risikoberichtbericht 14. Result fro

- Page 157 and 158: Risikoberichtbericht Operating expe

- Page 159 and 160: Cashflows from discontinued operati

- Page 161 and 162: 17. Trading assets 18. Derivative f

- Page 163 and 164: Risikoberichtbericht Futures are st

- Page 165 and 166: Risikoberichtbericht At 31 December

- Page 167 and 168: Allowance for losses on loans and a

- Page 169 and 170: Shares in Group undertakings are in

- Page 171 and 172: 24. Property, plant and equipment R

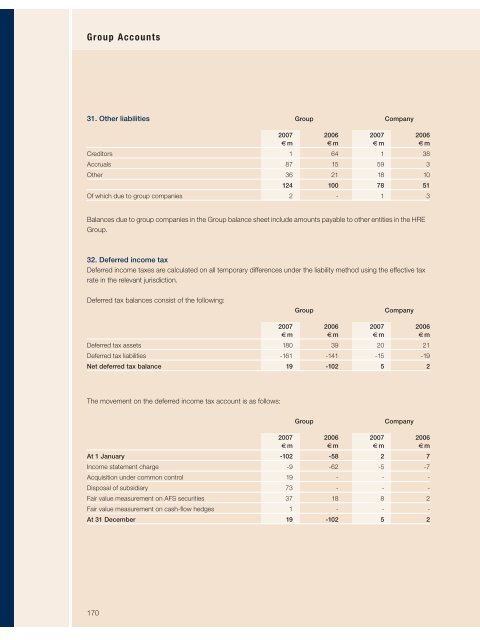

- Page 173: 29. Debt securities in issue 30. Ot

- Page 177 and 178: (b) Loan commitments Risikoberichtb

- Page 179 and 180: Details of the share awards of Hypo

- Page 181 and 182: 40. Other reserves Unrealised gains

- Page 183 and 184: Risikoberichtbericht 45. Fair value

- Page 185 and 186: Company 2007 Risikoberichtbericht F

- Page 187 and 188: Risikoberichtbericht 47. Acquisitio

- Page 189 and 190: Risikoberichtbericht 49. Capital ma

- Page 191 and 192: Nicosia Branch 10 Diomidous Street,

- Page 193: DEPFA BANK plc Member of Hypo Real