annual report - Hypo Real Estate Holding AG

annual report - Hypo Real Estate Holding AG

annual report - Hypo Real Estate Holding AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Group Accounts<br />

b) Loans and advances to banks and customers<br />

Loans and advances are net of provisions for impairment. The estimated fair value of loans and advances represents<br />

the discounted amount of estimated future cash flows expected to be received. Expected cash flows are<br />

discounted at current market rates to determine fair value.<br />

c) Deposits and borrowings<br />

The estimated fair value of deposits with no stated maturity, which includes non interest bearing deposits, is the<br />

amount repayable on demand. The estimated fair value of fixed interest bearing deposits and other borrowings<br />

without a quoted market price is based on discounted cash flows using interest rates for new debts with similar<br />

remaining maturity.<br />

d) Debt securities in issue<br />

The aggregate fair values are calculated based on quoted market prices. For those notes where quoted market<br />

prices are not available, a discounted cash flow model is used based on a current yield curve appropriate for the<br />

remaining term to maturity for a similar credit rating.<br />

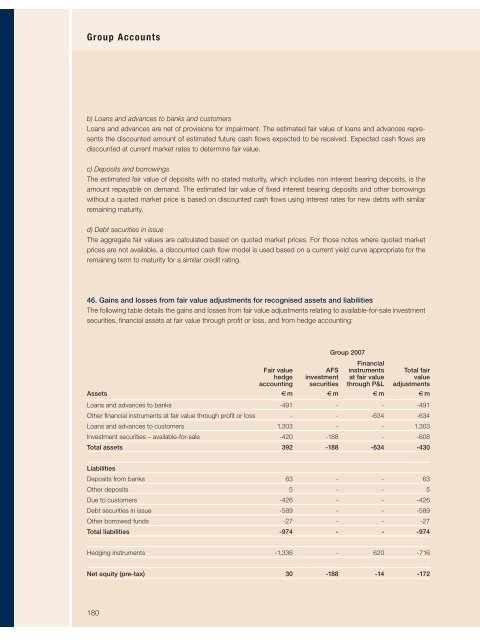

46. Gains and losses from fair value adjustments for recognised assets and liabilities<br />

The following table details the gains and losses from fair value adjustments relating to available-for-sale investment<br />

securities, financial assets at fair value through profit or loss, and from hedge accounting:<br />

Group 2007<br />

Financial<br />

Fair value AFS instruments Total fair<br />

hedge investment at fair value value<br />

accounting securities through P&L adjustments<br />

Assets € m € m € m € m<br />

Loans and advances to banks -491 - - -491<br />

Other financial instruments at fair value through profit or loss - - -634 -634<br />

Loans and advances to customers 1,303 - - 1,303<br />

Investment securities – available-for-sale -420 -188 - -608<br />

Total assets 392 -188 -634 -430<br />

Liabilities<br />

Deposits from banks 63 - - 63<br />

Other deposits 5 - - 5<br />

Due to customers -426 - - -426<br />

Debt securities in issue -589 - - -589<br />

Other borrowed funds -27 - - -27<br />

Total liabilities -974 - - -974<br />

Hedging instruments -1,336 - 620 -716<br />

Net equity (pre-tax) 30 -188 -14 -172<br />

180