Operations and Business Environment - Fresenius Medical Care

Operations and Business Environment - Fresenius Medical Care

Operations and Business Environment - Fresenius Medical Care

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

02. 2<br />

Our Fiscal year<br />

72<br />

Earnings<br />

EBITDA. Earnings before Interest, Taxes, Depreciation<br />

<strong>and</strong> Amortization (EBITDA) were $ 1.63 billion in 2006,<br />

an increase of 37 % over the $1.19 billion of the previous<br />

year. The EBITDA includes the effects of the costs<br />

of an accounting change for stock options, one-time<br />

effects, restructuring costs <strong>and</strong> in-process R & D, <strong>and</strong> the<br />

costs of the transformation of the legal form <strong>and</strong> preference<br />

share conversion, as well as the gain from the<br />

divestiture of clinics in connection with the acquisition<br />

of Renal <strong>Care</strong> Group amounting to $11 million. Excluding<br />

these one-time effects <strong>and</strong> the accounting change,<br />

our EBITDA increased by 35 % to $1.64 billion.<br />

Operating Income (EBIT). Operating income (Earnings<br />

before Interest <strong>and</strong> Taxes – EBIT) also increased in 2006,<br />

rising by 40 % to $1.32 billion. The aforementioned<br />

one-time effects <strong>and</strong> the change of accounting principles<br />

accounted for $11 million. Excluding one-time items<br />

<strong>and</strong> the accounting change, operating income rose by<br />

38 % to $1.33 billion in 2006. This represents an EBIT<br />

margin of 15.6 % compared with 14.2 % in 2005. The<br />

significantly better operating margin is the result of<br />

a considerably higher gross profit margin as well as<br />

stable selling <strong>and</strong> administrative costs as a percentage<br />

of sales.<br />

Excluding one-time effects, operating income in North<br />

America rose by 49 % to $ 958 million last year after<br />

EBIT of $ 644 million in 2005. The operating margin<br />

also improved, excluding one-time costs, from 14. in<br />

2005 to 15.9 % in 2006. The primary reasons for this<br />

increase are the result of the improvement in<br />

revenue rates, increased treatment volume, effects of<br />

the RCG acquisition net of divestitures <strong>and</strong> increased<br />

product sales, partially offset by higher personnel<br />

expenses.<br />

In the International region, comprising all areas outside<br />

North America, we also recorded significant earnings<br />

growth in 2006. Operating income in this region increased<br />

by 22 %, rising from $ 362 million in 2005 to<br />

$ 440 million in the year under review. We were able to<br />

improve the operating margin from 16.5 % to 17.8 %.<br />

This was primarily due to accelerated purchases of<br />

product by German customers as a result of an increase<br />

by 3 % of the German value added tax (VAT) in<br />

2007, improvements in our operations in Latin America<br />

<strong>and</strong> Asia Pacific, collections on previously written off<br />

receivables, lower bad debt expense <strong>and</strong> the impact of<br />

restructuring costs in Japan in 2005. These effects were<br />

partially offset by income received in 2005 associated<br />

with the cancellation of a distribution agreement <strong>and</strong><br />

with a patent litigation settlement.<br />

Corporate costs for our central administration rose considerably<br />

in 2006. These are not included in the calculations<br />

for EBITDA <strong>and</strong> EBIT (operating income of the<br />

operating segments). <strong>Fresenius</strong> <strong>Medical</strong> <strong>Care</strong> believes<br />

these costs are not within the control of the individual<br />

segments. These corporate costs relate mainly to certain<br />

headquarters overhead charges such as accounting<br />

<strong>and</strong> finance as well as other staff functions. The total<br />

corporate operating cost was $ 87 million in 2006 compared<br />

to $ 67 million in 2005. The primary reasons for<br />

this increase are related to the accounting change<br />

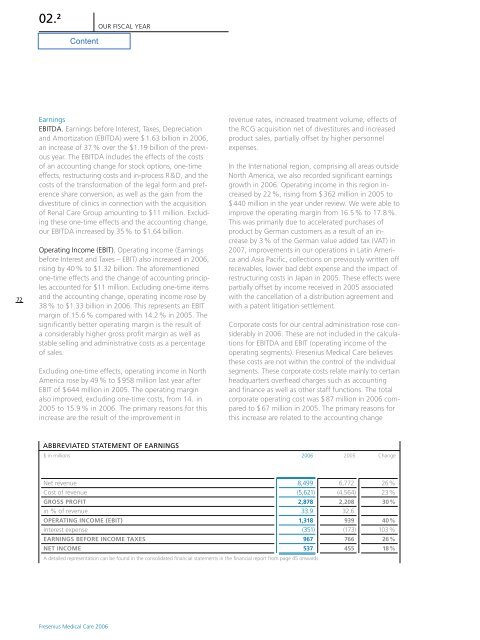

Abbreviated Statement of Earnings<br />

$ in millions 2006 2005 Change<br />

Net revenue<br />

Cost of revenue<br />

Gross profit<br />

in % of revenue<br />

Operating income (EBIT)<br />

Interest expense<br />

Earnings before income taxes<br />

Net income<br />

8,499<br />

(5,621)<br />

2,878<br />

33.9<br />

1,318<br />

(351)<br />

967<br />

537<br />

A detailed representation can be found in the consolidated financial statements in the financial report from page 45 onwards.<br />

6,772<br />

(4,564)<br />

2,208<br />

32.6<br />

939<br />

(173)<br />

766<br />

455<br />

26 %<br />

23 %<br />

30 %<br />

40 %<br />

103 %<br />

26 %<br />

18 %<br />

<strong>Fresenius</strong> <strong>Medical</strong> <strong>Care</strong> 2006