Operations and Business Environment - Fresenius Medical Care

Operations and Business Environment - Fresenius Medical Care

Operations and Business Environment - Fresenius Medical Care

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

02. 2<br />

Our Fiscal year<br />

78<br />

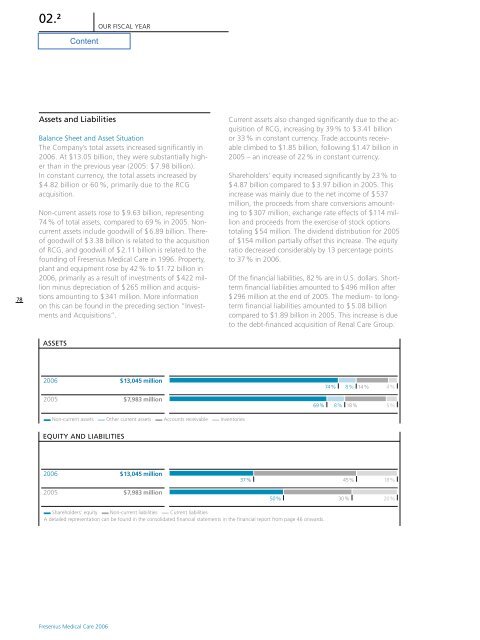

Assets <strong>and</strong> Liabilities<br />

Balance Sheet <strong>and</strong> Asset Situation<br />

The Company’s total assets increased significantly in<br />

2006. At $13.05 billion, they were substantially higher<br />

than in the previous year (2005: $ 7.98 billion).<br />

In constant currency, the total assets increased by<br />

$ 4.82 billion or 60 %, primarily due to the RCG<br />

acquisition.<br />

Non-current assets rose to $ 9.63 billion, representing<br />

74 % of total assets, compared to 69 % in 2005. Noncurrent<br />

assets include goodwill of $ 6.89 billion. Thereof<br />

goodwill of $ 3.38 billion is related to the acquisition<br />

of RCG, <strong>and</strong> goodwill of $ 2.11 billion is related to the<br />

founding of <strong>Fresenius</strong> <strong>Medical</strong> <strong>Care</strong> in 1996. Property,<br />

plant <strong>and</strong> equipment rose by 42 % to $1.72 billion in<br />

2006, primarily as a result of investments of $ 422 million<br />

minus depreciation of $ 265 million <strong>and</strong> acquisitions<br />

amounting to $ 341 million. More information<br />

on this can be found in the preceding section “Investments<br />

<strong>and</strong> Acquisitions”.<br />

Current assets also changed significantly due to the acquisition<br />

of RCG, increasing by 39 % to $ 3.41 billion<br />

or 33 % in constant currency. Trade accounts receivable<br />

climbed to $1.85 billion, following $1.47 billion in<br />

2005 – an increase of 22 % in constant currency.<br />

Shareholders’ equity increased significantly by 23 % to<br />

$ 4.87 billion compared to $ 3.97 billion in 2005. This<br />

increase was mainly due to the net income of $ 537<br />

million, the proceeds from share conversions amounting<br />

to $ 307 million, exchange rate effects of $114 million<br />

<strong>and</strong> proceeds from the exercise of stock options<br />

totaling $ 54 million. The dividend distribution for 2005<br />

of $154 million partially offset this increase. The equity<br />

ratio decreased considerably by 13 percentage points<br />

to 37 % in 2006.<br />

Of the financial liabilities, 82 % are in U.S. dollars. Shortterm<br />

financial liabilities amounted to $ 496 million after<br />

$ 296 million at the end of 2005. The medium- to longterm<br />

financial liabilities amounted to $ 5.08 billion<br />

compared to $1.89 billion in 2005. This increase is due<br />

to the debt-financed acquisition of Renal <strong>Care</strong> Group.<br />

Assets<br />

2006<br />

2005<br />

$ 13,045 million<br />

$ 7,983 million<br />

74 % 8 % 14 % 4 %<br />

69 % 8 % 18 %<br />

5 %<br />

Non-current assets Other current assets Accounts receivable Inventories<br />

Equity <strong>and</strong> Liabilities<br />

2006<br />

$ 13,045 million<br />

37 % 45 %<br />

18 %<br />

2005<br />

$ 7,983 million<br />

50 % 30 %<br />

20 %<br />

Shareholders’ equity Non-current liabilities Current liabilities<br />

A detailed representation can be found in the consolidated financial statements in the financial report from page 46 onwards.<br />

<strong>Fresenius</strong> <strong>Medical</strong> <strong>Care</strong> 2006