Operations and Business Environment - Fresenius Medical Care

Operations and Business Environment - Fresenius Medical Care

Operations and Business Environment - Fresenius Medical Care

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

02. 2<br />

Our Fiscal year<br />

74<br />

Based on our 2006 net income of $ 537 million, earnings<br />

per ordinary share rose to $ 5.47, an increase of 17 %<br />

compared to $ 4.68 in the previous year. Considering the<br />

preference dividend of $ 0.08, we were able to increase<br />

earnings per preference share to $ 5.55 from $ 4.75 in<br />

2005, an increase of 17 %.<br />

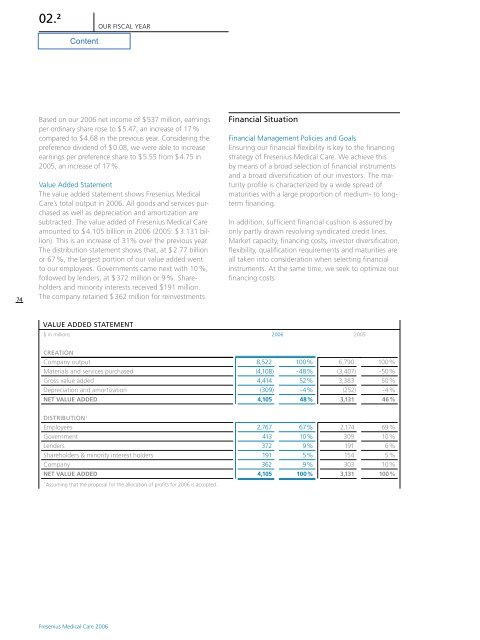

Value Added Statement<br />

The value added statement shows <strong>Fresenius</strong> <strong>Medical</strong><br />

<strong>Care</strong>’s total output in 2006. All goods <strong>and</strong> services purchased<br />

as well as depreciation <strong>and</strong> amortization are<br />

subtracted. The value added of <strong>Fresenius</strong> <strong>Medical</strong> <strong>Care</strong><br />

amounted to $ 4.105 billion in 2006 (2005: $ 3.131 billion).<br />

This is an increase of 31% over the previous year.<br />

The distribution statement shows that, at $ 2.77 billion<br />

or 67 %, the largest portion of our value added went<br />

to our employees. Governments came next with 10 %,<br />

followed by lenders, at $ 372 million or 9 %. Shareholders<br />

<strong>and</strong> minority interests received $191 million.<br />

The company retained $ 362 million for reinvestments.<br />

Financial Situation<br />

Financial Management Policies <strong>and</strong> Goals<br />

Ensuring our financial flexibility is key to the financing<br />

strategy of <strong>Fresenius</strong> <strong>Medical</strong> <strong>Care</strong>. We achieve this<br />

by means of a broad selection of financial instruments<br />

<strong>and</strong> a broad diversification of our investors. The maturity<br />

profile is characterized by a wide spread of<br />

maturities with a large proportion of medium- to longterm<br />

financing.<br />

In addition, sufficient financial cushion is assured by<br />

only partly drawn revolving syndicated credit lines.<br />

Market capacity, financing costs, investor diversification,<br />

flexibility, qualification requirements <strong>and</strong> maturities are<br />

all taken into consideration when selecting financial<br />

instruments. At the same time, we seek to optimize our<br />

financing costs.<br />

Value Added Statement<br />

$ in millions 2006 2005<br />

Creation<br />

Company output<br />

Materials <strong>and</strong> services purchased<br />

Gross value added<br />

Depreciation <strong>and</strong> amortization<br />

Net value added<br />

8,522<br />

(4,108)<br />

4,414<br />

(309)<br />

4,105<br />

100 %<br />

- 48 %<br />

52 %<br />

- 4 %<br />

48 %<br />

6,790<br />

(3,407)<br />

3,383<br />

(252)<br />

3,131<br />

100 %<br />

- 50 %<br />

50 %<br />

- 4 %<br />

46 %<br />

Distribution 1<br />

Employees<br />

Government<br />

Lenders<br />

Shareholders & minority interest holders<br />

Company<br />

Net value added<br />

2,767<br />

413<br />

372<br />

191<br />

362<br />

4,105<br />

67 %<br />

10 %<br />

9 %<br />

5 %<br />

9 %<br />

100 %<br />

2,174<br />

309<br />

191<br />

154<br />

303<br />

3,131<br />

69 %<br />

10 %<br />

6 %<br />

5 %<br />

10 %<br />

100 %<br />

1<br />

Assuming that the proposal for the allocation of profits for 2006 is accepted.<br />

<strong>Fresenius</strong> <strong>Medical</strong> <strong>Care</strong> 2006