2002 - 2003 Annual Report - Tourism Australia

2002 - 2003 Annual Report - Tourism Australia

2002 - 2003 Annual Report - Tourism Australia

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

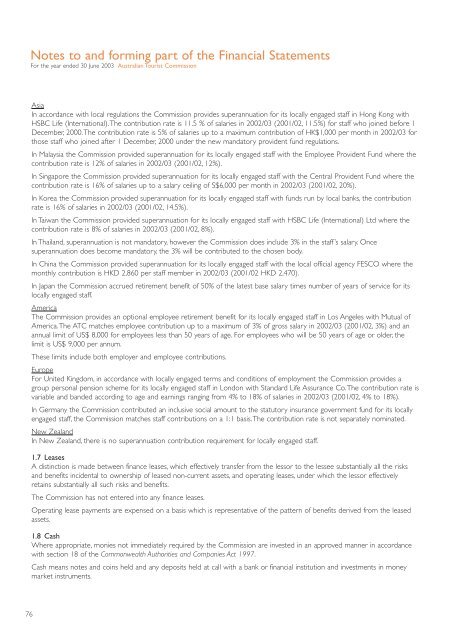

Notes to and forming part of the Financial Statements<br />

For the year ended 30 June <strong>2003</strong> <strong>Australia</strong>n Tourist Commission<br />

Asia<br />

In accordance with local regulations the Commission provides superannuation for its locally engaged staff in Hong Kong with<br />

HSBC Life (International).The contribution rate is 11.5 % of salaries in <strong>2002</strong>/03 (2001/02, 11.5%) for staff who joined before 1<br />

December, 2000.The contribution rate is 5% of salaries up to a maximum contribution of HK$1,000 per month in <strong>2002</strong>/03 for<br />

those staff who joined after 1 December, 2000 under the new mandatory provident fund regulations.<br />

In Malaysia the Commission provided superannuation for its locally engaged staff with the Employee Provident Fund where the<br />

contribution rate is 12% of salaries in <strong>2002</strong>/03 (2001/02, 12%).<br />

In Singapore the Commission provided superannuation for its locally engaged staff with the Central Provident Fund where the<br />

contribution rate is 16% of salaries up to a salary ceiling of S$6,000 per month in <strong>2002</strong>/03 (2001/02, 20%).<br />

In Korea the Commission provided superannuation for its locally engaged staff with funds run by local banks, the contribution<br />

rate is 16% of salaries in <strong>2002</strong>/03 (2001/02, 14.5%).<br />

In Taiwan the Commission provided superannuation for its locally engaged staff with HSBC Life (International) Ltd where the<br />

contribution rate is 8% of salaries in <strong>2002</strong>/03 (2001/02, 8%).<br />

In Thailand, superannuation is not mandatory, however the Commission does include 3% in the staff’s salary. Once<br />

superannuation does become mandatory, the 3% will be contributed to the chosen body.<br />

In China the Commission provided superannuation for its locally engaged staff with the local official agency FESCO where the<br />

monthly contribution is HKD 2,860 per staff member in <strong>2002</strong>/03 (2001/02 HKD 2,470).<br />

In Japan the Commission accrued retirement benefit of 50% of the latest base salary times number of years of service for its<br />

locally engaged staff.<br />

America<br />

The Commission provides an optional employee retirement benefit for its locally engaged staff in Los Angeles with Mutual of<br />

America.The ATC matches employee contribution up to a maximum of 3% of gross salary in <strong>2002</strong>/03 (2001/02, 3%) and an<br />

annual limit of US$ 8,000 for employees less than 50 years of age. For employees who will be 50 years of age or older, the<br />

limit is US$ 9,000 per annum.<br />

These limits include both employer and employee contributions.<br />

Europe<br />

For United Kingdom, in accordance with locally engaged terms and conditions of employment the Commission provides a<br />

group personal pension scheme for its locally engaged staff in London with Standard Life Assurance Co.The contribution rate is<br />

variable and banded according to age and earnings ranging from 4% to 18% of salaries in <strong>2002</strong>/03 (2001/02, 4% to 18%).<br />

In Germany the Commission contributed an inclusive social amount to the statutory insurance government fund for its locally<br />

engaged staff, the Commission matches staff contributions on a 1:1 basis.The contribution rate is not separately nominated.<br />

New Zealand<br />

In New Zealand, there is no superannuation contribution requirement for locally engaged staff.<br />

1.7 Leases<br />

A distinction is made between finance leases, which effectively transfer from the lessor to the lessee substantially all the risks<br />

and benefits incidental to ownership of leased non-current assets, and operating leases, under which the lessor effectively<br />

retains substantially all such risks and benefits.<br />

The Commission has not entered into any finance leases.<br />

Operating lease payments are expensed on a basis which is representative of the pattern of benefits derived from the leased<br />

assets.<br />

1.8 Cash<br />

Where appropriate, monies not immediately required by the Commission are invested in an approved manner in accordance<br />

with section 18 of the Commonwealth Authorities and Companies Act 1997.<br />

Cash means notes and coins held and any deposits held at call with a bank or financial institution and investments in money<br />

market instruments.<br />

76