2002 - 2003 Annual Report - Tourism Australia

2002 - 2003 Annual Report - Tourism Australia

2002 - 2003 Annual Report - Tourism Australia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to and forming part of the Financial Statements<br />

For the year ended 30 June <strong>2003</strong> <strong>Australia</strong>n Tourist Commission<br />

1.9 Financial instruments<br />

Accounting policies for financial instruments are stated at note 15.<br />

1.10 Property, plant and equipment<br />

Asset recognition threshold<br />

Purchases of property, plant and equipment are recognised initially at cost in the Statement of Financial Position, except for<br />

purchases costing less than $5,000, which are expended in the year of acquisition (other than where they form part of a group<br />

of similar items which are significant in total).<br />

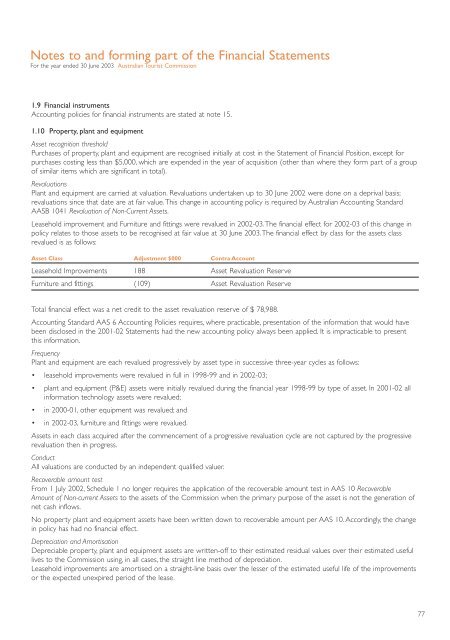

Revaluations<br />

Plant and equipment are carried at valuation. Revaluations undertaken up to 30 June <strong>2002</strong> were done on a deprival basis;<br />

revaluations since that date are at fair value.This change in accounting policy is required by <strong>Australia</strong>n Accounting Standard<br />

AASB 1041 Revaluation of Non-Current Assets.<br />

Leasehold improvement and Furniture and fittings were revalued in <strong>2002</strong>-03.The financial effect for <strong>2002</strong>-03 of this change in<br />

policy relates to those assets to be recognised at fair value at 30 June <strong>2003</strong>.The financial effect by class for the assets class<br />

revalued is as follows:<br />

Asset Class Adjustment $000 Contra Account<br />

Leasehold Improvements 188 Asset Revaluation Reserve<br />

Furniture and fittings (109) Asset Revaluation Reserve<br />

Total financial effect was a net credit to the asset revaluation reserve of $ 78,988.<br />

Accounting Standard AAS 6 Accounting Policies requires, where practicable, presentation of the information that would have<br />

been disclosed in the 2001-02 Statements had the new accounting policy always been applied. It is impracticable to present<br />

this information.<br />

Frequency<br />

Plant and equipment are each revalued progressively by asset type in successive three-year cycles as follows:<br />

• leasehold improvements were revalued in full in 1998-99 and in <strong>2002</strong>-03;<br />

• plant and equipment (P&E) assets were initially revalued during the financial year 1998-99 by type of asset. In 2001-02 all<br />

information technology assets were revalued;<br />

• in 2000-01, other equipment was revalued; and<br />

• in <strong>2002</strong>-03, furniture and fittings were revalued.<br />

Assets in each class acquired after the commencement of a progressive revaluation cycle are not captured by the progressive<br />

revaluation then in progress.<br />

Conduct<br />

All valuations are conducted by an independent qualified valuer.<br />

Recoverable amount test<br />

From 1 July <strong>2002</strong>, Schedule 1 no longer requires the application of the recoverable amount test in AAS 10 Recoverable<br />

Amount of Non-current Assets to the assets of the Commission when the primary purpose of the asset is not the generation of<br />

net cash inflows.<br />

No property plant and equipment assets have been written down to recoverable amount per AAS 10. Accordingly, the change<br />

in policy has had no financial effect.<br />

Depreciation and Amortisation<br />

Depreciable property, plant and equipment assets are written-off to their estimated residual values over their estimated useful<br />

lives to the Commission using, in all cases, the straight line method of depreciation.<br />

Leasehold improvements are amortised on a straight-line basis over the lesser of the estimated useful life of the improvements<br />

or the expected unexpired period of the lease.<br />

77