2002 - 2003 Annual Report - Tourism Australia

2002 - 2003 Annual Report - Tourism Australia

2002 - 2003 Annual Report - Tourism Australia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

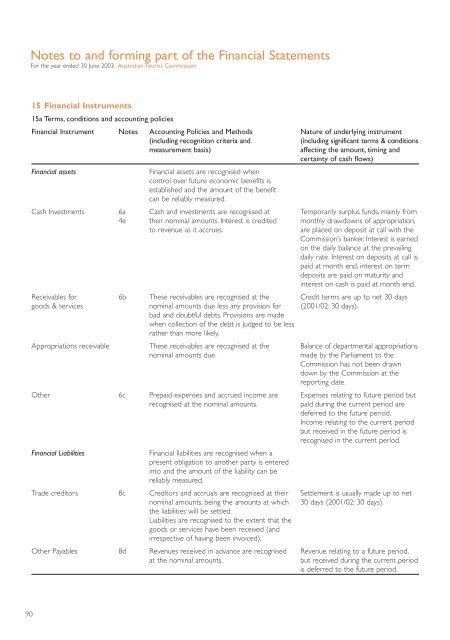

Notes to and forming part of the Financial Statements<br />

For the year ended 30 June <strong>2003</strong> <strong>Australia</strong>n Tourist Commission<br />

15 Financial Instruments<br />

15a Terms, conditions and accounting policies<br />

Financial Instrument Notes Accounting Policies and Methods Nature of underlying instrument<br />

(including recognition criteria and<br />

(including significant terms & conditions<br />

measurement basis)<br />

affecting the amount, timing and<br />

certainty of cash flows)<br />

Financial assets<br />

Financial assets are recognised when<br />

control over future economic benefits is<br />

established and the amount of the benefit<br />

can be reliably measured.<br />

Cash Investments 6a Cash and investments are recognised at Temporarily surplus funds, mainly from<br />

4e their nominal amounts. Interest is credited monthly drawdowns of appropriation,<br />

to revenue as it accrues.<br />

are placed on deposit at call with the<br />

Commission’s banker. Interest is earned<br />

on the daily balance at the prevailing<br />

daily rate. Interest on deposits at call is<br />

paid at month end, interest on term<br />

deposits are paid on maturity and<br />

interest on cash is paid at month end.<br />

Receivables for 6b These receivables are recognised at the Credit terms are up to net 30 days<br />

goods & services nominal amounts due less any provision for (2001/02: 30 days).<br />

bad and doubtful debts. Provisions are made<br />

when collection of the debt is judged to be less<br />

rather than more likely.<br />

Appropriations receivable These receivables are recognised at the Balance of departmental appropriations<br />

nominal amounts due.<br />

made by the Parliament to the<br />

Commission has not been drawn<br />

down by the Commission at the<br />

reporting date.<br />

Other 6c Prepaid expenses and accrued income are Expenses relating to future period but<br />

recognised at the nominal amounts.<br />

paid during the current period are<br />

deferred to the future period.<br />

Income relating to the current period<br />

but received in the future period is<br />

recognised in the current period.<br />

Financial Liabilities<br />

Financial liabilities are recognised when a<br />

present obligation to another party is entered<br />

into and the amount of the liability can be<br />

reliably measured.<br />

Trade creditors 8c Creditors and accruals are recognised at their Settlement is usually made up to net<br />

nominal amounts, being the amounts at which 30 days (2001/02: 30 days).<br />

the liabilities will be settled.<br />

Liabilities are recognised to the extent that the<br />

goods or services have been received (and<br />

irrespective of having been invoiced).<br />

Other Payables 8d Revenues received in advance are recognised Revenue relating to a future period,<br />

at the nominal amounts.<br />

but received during the current period<br />

is deferred to the future period.<br />

90