to download the PDF for MFMA Mangaung In ... - Mangaung.co.za

to download the PDF for MFMA Mangaung In ... - Mangaung.co.za

to download the PDF for MFMA Mangaung In ... - Mangaung.co.za

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

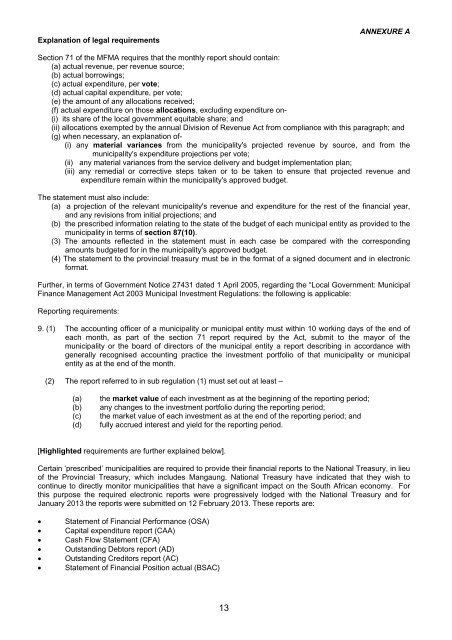

Explanation of legal requirements<br />

ANNEXURE A<br />

Section 71 of <strong>the</strong> <strong>MFMA</strong> requires that <strong>the</strong> monthly report should <strong>co</strong>ntain:<br />

(a) actual revenue, per revenue source;<br />

(b) actual borrowings;<br />

(c) actual expenditure, per vote;<br />

(d) actual capital expenditure, per vote;<br />

(e) <strong>the</strong> amount of any allocations received;<br />

(f) actual expenditure on those allocations, excluding expenditure on-<br />

(i) its share of <strong>the</strong> local government equitable share; and<br />

(ii) allocations exempted by <strong>the</strong> annual Division of Revenue Act from <strong>co</strong>mpliance with this paragraph; and<br />

(g) when necessary, an explanation of-<br />

(i) any material variances from <strong>the</strong> municipality's projected revenue by source, and from <strong>the</strong><br />

municipality's expenditure projections per vote;<br />

(ii) any material variances from <strong>the</strong> service delivery and budget implementation plan;<br />

(iii) any remedial or <strong>co</strong>rrective steps taken or <strong>to</strong> be taken <strong>to</strong> ensure that projected revenue and<br />

expenditure remain within <strong>the</strong> municipality's approved budget.<br />

The statement must also include:<br />

(a) a projection of <strong>the</strong> relevant municipality's revenue and expenditure <strong>for</strong> <strong>the</strong> rest of <strong>the</strong> financial year,<br />

and any revisions from initial projections; and<br />

(b) <strong>the</strong> prescribed in<strong>for</strong>mation relating <strong>to</strong> <strong>the</strong> state of <strong>the</strong> budget of each municipal entity as provided <strong>to</strong> <strong>the</strong><br />

municipality in terms of section 87(10).<br />

(3) The amounts reflected in <strong>the</strong> statement must in each case be <strong>co</strong>mpared with <strong>the</strong> <strong>co</strong>rresponding<br />

amounts budgeted <strong>for</strong> in <strong>the</strong> municipality's approved budget.<br />

(4) The statement <strong>to</strong> <strong>the</strong> provincial treasury must be in <strong>the</strong> <strong>for</strong>mat of a signed document and in electronic<br />

<strong>for</strong>mat.<br />

Fur<strong>the</strong>r, in terms of Government Notice 27431 dated 1 April 2005, regarding <strong>the</strong> “Local Government: Municipal<br />

Finance Management Act 2003 Municipal <strong>In</strong>vestment Regulations: <strong>the</strong> following is applicable:<br />

Reporting requirements:<br />

9. (1) The ac<strong>co</strong>unting officer of a municipality or municipal entity must within 10 working days of <strong>the</strong> end of<br />

each month, as part of <strong>the</strong> section 71 report required by <strong>the</strong> Act, submit <strong>to</strong> <strong>the</strong> mayor of <strong>the</strong><br />

municipality or <strong>the</strong> board of direc<strong>to</strong>rs of <strong>the</strong> municipal entity a report describing in ac<strong>co</strong>rdance with<br />

generally re<strong>co</strong>gnised ac<strong>co</strong>unting practice <strong>the</strong> investment portfolio of that municipality or municipal<br />

entity as at <strong>the</strong> end of <strong>the</strong> month.<br />

(2) The report referred <strong>to</strong> in sub regulation (1) must set out at least –<br />

(a)<br />

(b)<br />

(c)<br />

(d)<br />

<strong>the</strong> market value of each investment as at <strong>the</strong> beginning of <strong>the</strong> reporting period;<br />

any changes <strong>to</strong> <strong>the</strong> investment portfolio during <strong>the</strong> reporting period;<br />

<strong>the</strong> market value of each investment as at <strong>the</strong> end of <strong>the</strong> reporting period; and<br />

fully accrued interest and yield <strong>for</strong> <strong>the</strong> reporting period.<br />

[Highlighted requirements are fur<strong>the</strong>r explained below].<br />

Certain ‘prescribed’ municipalities are required <strong>to</strong> provide <strong>the</strong>ir financial reports <strong>to</strong> <strong>the</strong> National Treasury, in lieu<br />

of <strong>the</strong> Provincial Treasury, which includes <strong>Mangaung</strong>. National Treasury have indicated that <strong>the</strong>y wish <strong>to</strong><br />

<strong>co</strong>ntinue <strong>to</strong> directly moni<strong>to</strong>r municipalities that have a significant impact on <strong>the</strong> South African e<strong>co</strong>nomy. For<br />

this purpose <strong>the</strong> required electronic reports were progressively lodged with <strong>the</strong> National Treasury and <strong>for</strong><br />

January 2013 <strong>the</strong> reports were submitted on 12 February 2013. These reports are:<br />

<br />

<br />

<br />

<br />

<br />

<br />

Statement of Financial Per<strong>for</strong>mance (OSA)<br />

Capital expenditure report (CAA)<br />

Cash Flow Statement (CFA)<br />

Outstanding Deb<strong>to</strong>rs report (AD)<br />

Outstanding Credi<strong>to</strong>rs report (AC)<br />

Statement of Financial Position actual (BSAC)<br />

13