India's largest coal handling agency - Mjunction

India's largest coal handling agency - Mjunction

India's largest coal handling agency - Mjunction

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Cover Story<br />

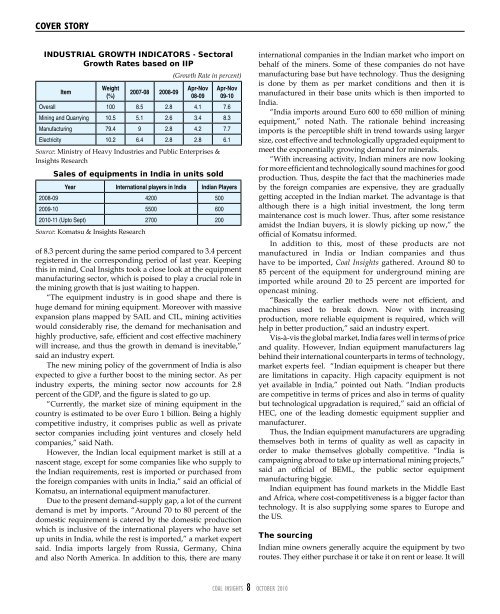

INDUSTRIAL GROWTH INDICATORS - Sectoral<br />

Growth Rates based on IIP<br />

(Growth Rate in percent)<br />

Item<br />

Weight<br />

(%)<br />

2007-08 2008-09<br />

Apr-Nov<br />

08-09<br />

Apr-Nov<br />

09-10<br />

Overall 100 8.5 2.8 4.1 7.6<br />

Mining and Quarrying 10.5 5.1 2.6 3.4 8.3<br />

Manufacturing 79.4 9 2.8 4.2 7.7<br />

Electricity 10.2 6.4 2.8 2.8 6.1<br />

Source: Ministry of Heavy Industries and Public Enterprises &<br />

Insights Research<br />

Sales of equipments in India in units sold<br />

Year International players in India Indian Players<br />

2008-09 4200 500<br />

2009-10 5500 600<br />

2010-11 (Upto Sept) 2700 200<br />

Source: Komatsu & Insights Research<br />

of 8.3 percent during the same period compared to 3.4 percent<br />

registered in the corresponding period of last year. Keeping<br />

this in mind, Coal Insights took a close look at the equipment<br />

manufacturing sector, which is poised to play a crucial role in<br />

the mining growth that is just waiting to happen.<br />

“The equipment industry is in good shape and there is<br />

huge demand for mining equipment. Moreover with massive<br />

expansion plans mapped by SAIL and CIL, mining activities<br />

would considerably rise, the demand for mechanisation and<br />

highly productive, safe, efficient and cost effective machinery<br />

will increase, and thus the growth in demand is inevitable,”<br />

said an industry expert.<br />

The new mining policy of the government of India is also<br />

expected to give a further boost to the mining sector. As per<br />

industry experts, the mining sector now accounts for 2.8<br />

percent of the GDP, and the figure is slated to go up.<br />

“Currently, the market size of mining equipment in the<br />

country is estimated to be over Euro 1 billion. Being a highly<br />

competitive industry, it comprises public as well as private<br />

sector companies including joint ventures and closely held<br />

companies,” said Nath.<br />

However, the Indian local equipment market is still at a<br />

nascent stage, except for some companies like who supply to<br />

the Indian requirements, rest is imported or purchased from<br />

the foreign companies with units in India,” said an official of<br />

Komatsu, an international equipment manufacturer.<br />

Due to the present demand-supply gap, a lot of the current<br />

demand is met by imports. “Around 70 to 80 percent of the<br />

domestic requirement is catered by the domestic production<br />

which is inclusive of the international players who have set<br />

up units in India, while the rest is imported,” a market expert<br />

said. India imports largely from Russia, Germany, China<br />

and also North America. In addition to this, there are many<br />

international companies in the Indian market who import on<br />

behalf of the miners. Some of these companies do not have<br />

manufacturing base but have technology. Thus the designing<br />

is done by them as per market conditions and then it is<br />

manufactured in their base units which is then imported to<br />

India.<br />

“India imports around Euro 600 to 650 million of mining<br />

equipment,” noted Nath. The rationale behind increasing<br />

imports is the perceptible shift in trend towards using larger<br />

size, cost effective and technologically upgraded equipment to<br />

meet the exponentially growing demand for minerals.<br />

“With increasing activity, Indian miners are now looking<br />

for more efficient and technologically sound machines for good<br />

production. Thus, despite the fact that the machineries made<br />

by the foreign companies are expensive, they are gradually<br />

getting accepted in the Indian market. The advantage is that<br />

although there is a high initial investment, the long term<br />

maintenance cost is much lower. Thus, after some resistance<br />

amidst the Indian buyers, it is slowly picking up now,” the<br />

official of Komatsu informed.<br />

In addition to this, most of these products are not<br />

manufactured in India or Indian companies and thus<br />

have to be imported, Coal Insights gathered. Around 80 to<br />

85 percent of the equipment for underground mining are<br />

imported while around 20 to 25 percent are imported for<br />

opencast mining.<br />

“Basically the earlier methods were not efficient, and<br />

machines used to break down. Now with increasing<br />

production, more reliable equipment is required, which will<br />

help in better production,” said an industry expert.<br />

Vis-à-vis the global market, India fares well in terms of price<br />

and quality. However, Indian equipment manufacturers lag<br />

behind their international counterparts in terms of technology,<br />

market experts feel. “Indian equipment is cheaper but there<br />

are limitations in capacity. High capacity equipment is not<br />

yet available in India,” pointed out Nath. “Indian products<br />

are competitive in terms of prices and also in terms of quality<br />

but technological upgradation is required,” said an official of<br />

HEC, one of the leading domestic equipment supplier and<br />

manufacturer.<br />

Thus, the Indian equipment manufacturers are upgrading<br />

themselves both in terms of quality as well as capacity in<br />

order to make themselves globally competitive. “India is<br />

campaigning abroad to take up international mining projects,”<br />

said an official of BEML, the public sector equipment<br />

manufacturing biggie.<br />

Indian equipment has found markets in the Middle East<br />

and Africa, where cost-competitiveness is a bigger factor than<br />

technology. It is also supplying some spares to Europe and<br />

the US.<br />

The sourcing<br />

Indian mine owners generally acquire the equipment by two<br />

routes. They either purchase it or take it on rent or lease. It will<br />

COAL INSIGHTS 8 October 2010