02_Installation Setup.fm - Drake Software Support

02_Installation Setup.fm - Drake Software Support

02_Installation Setup.fm - Drake Software Support

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Drake</strong> <strong>Software</strong> User’s Manual<br />

Making Changes on the Fly<br />

Customized<br />

Greeting<br />

The default greeting for all letters is set in Letters <strong>Setup</strong>. To override the greeting for a<br />

return, go to the LTR screen and enter a new greeting in the Personalized letter<br />

greeting text box.<br />

NOTE<br />

To begin the greeting for the letter with one return with “Dear,” enter the<br />

greeting, along with the name, in the Personalized letter greeting<br />

field. To have all letters for a package type begin with “Dear” (or<br />

another greeting of your choice), make the change in the actual template<br />

in <strong>Setup</strong> > Letters.<br />

Adding a<br />

Custom<br />

Paragraph<br />

To add a custom paragraph to a letter, write the paragraph in the Custom Paragraph<br />

field of the LTR screen. By default, the paragraph is printed at the bottom of the letter.<br />

To have a custom paragraph appear somewhere else within the letter:<br />

1. From the <strong>Drake</strong> Home window, go to <strong>Setup</strong> > Letters.<br />

2. Click Open and select the package and letter to be generated for the client.<br />

3. Place the cursor on the line where you want the custom paragraph to appear.<br />

4. Click the plus [+] sign next to Miscellaneous in the tree directory (left column of<br />

window).<br />

5. Double-click the keyword. The keyword<br />

appears in the letter template.<br />

6. Click Save.<br />

When the return is generated, the letter displays the custom paragraph as directed.<br />

E-filing or<br />

Paper-filing<br />

If a return has an EF message when calculated, the return is considered ineligible for<br />

e-file and the program generates a result letter for a paper-filed return. If the return is<br />

considered eligible for e-file, a letter for an e-filed return is generated. You can override<br />

these defaults for the federal and state tax returns and extension applications.<br />

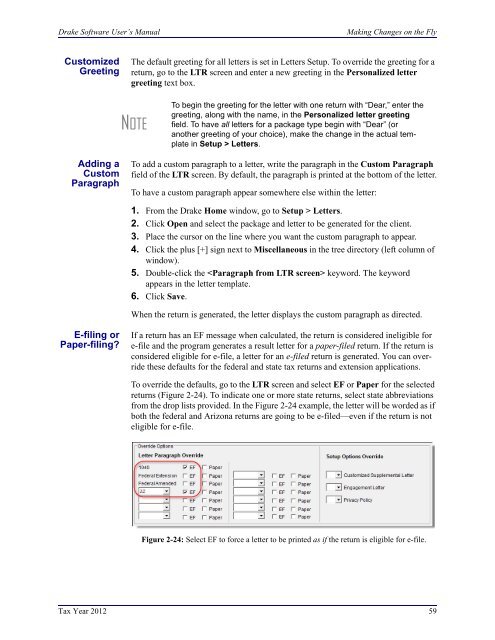

To override the defaults, go to the LTR screen and select EF or Paper for the selected<br />

returns (Figure 2-24). To indicate one or more state returns, select state abbreviations<br />

from the drop lists provided. In the Figure 2-24 example, the letter will be worded as if<br />

both the federal and Arizona returns are going to be e-filed—even if the return is not<br />

eligible for e-file.<br />

Figure 2-24: Select EF to force a letter to be printed as if the return is eligible for e-file.<br />

Tax Year 2012 59