ANNUAL REPORT 2011 - Magyar Fejlesztési Bank Zrt.

ANNUAL REPORT 2011 - Magyar Fejlesztési Bank Zrt.

ANNUAL REPORT 2011 - Magyar Fejlesztési Bank Zrt.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

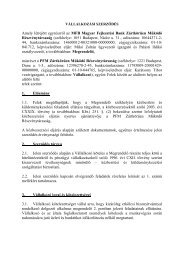

Income Statement ❙<br />

MFB HUNGARIAN DEVELOPMENT BANK PRIVATE LIMITED COMPANY<br />

INCOME STATEMENT ACCORDING TO HUNGARIAN ACCOUNTING STANDARDS<br />

INCOME STATEMENT<br />

DATA in HUF million<br />

31.12.2010<br />

Adjustment of<br />

previous years<br />

31.12.<strong>2011</strong><br />

1. Interests received and similar income 53 273 0 58 061<br />

2. Interest paid and similar charges 32 906 0 37 524<br />

BALANCE(1-2) 20 367 0 20 537<br />

3. Income from securities 15 0 15<br />

4. Commissions and fees received or due 820 -4 818<br />

5. Commissions and fees paid or payable 1 425 0 962<br />

6. Net profit or net loss on financial operations 658 -1 -4 835<br />

7. Other operating income 1 248 0 1 778<br />

8. General administrative expenses 7 602 -322 6 683<br />

9. Depreciation 980 -3 976<br />

10. Other operating charges 5 812 9 5 345<br />

11. Value adjustments in respect of loans and advances and risk<br />

provisions for contingent liabilities and for future commitments 38 359 0 43 296<br />

12. Value readjustments in respect of loans and advances and risk<br />

provisions for contingent liabilities and for future commitments 8 511 0 8 960<br />

12/A Difference between formation and utilisation of general risk provision 637 0 -7 019<br />

13. Value adjustments in respect of transferable debt securities held as<br />

financial fixed assets, shares and participations in affiliated companies and<br />

in other companies linked by virtue of participating interests 4 115 0 1 559<br />

14. Value readjustments in respect of transferable debt securities held<br />

as financial fixed assets, shares and participations in affiliated<br />

companies and in other companies linked by virtue of participating interests 538 0 280<br />

15. Profit or loss on ordinary activities -25 499 311 -38 287<br />

16. Extraordinary income 65 0 0<br />

17. Extraordinary charges 400 0 334<br />

18. Extraordinary profit or loss (16-17) -335 0 -334<br />

19. Profit or loss before tax (±15±18) -25 834 311 -38 621<br />

20. Taxes on income -10 2 0<br />

21. Profit or loss after tax(±19-20) -25 824 309 -38 621<br />

22. General reserve (±) 6 250 0 0<br />

23. Profit reserves used for dividends and profit sharing 0 0 0<br />

24. Dividends and profit sharing payable 0 0 0<br />

PROFIT 0R L0SS FOR THE FINANCIAL YEAR (±21±22+23-24) -19 574 309 -38 621<br />

MFB <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2011</strong> 21