Download - Ferrovial - Annual Report 2012

Download - Ferrovial - Annual Report 2012

Download - Ferrovial - Annual Report 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Consolidated financial statements at 31 December 2011<br />

<strong>Ferrovial</strong> S.A. and Subsidiaries<br />

c. Held-to-maturity investments and accounts<br />

receivable:<br />

Financial asset model provided for in IFRIC 12<br />

This line item includes the service concession<br />

arrangements related to infrastructure in which the<br />

consideration consists of an unconditional contractual right<br />

to receive cash or another financial asset, either because<br />

the grantor guarantees to pay the operators specified or<br />

determinable amounts or because it guarantees to pay the<br />

operator the shortfall between amounts received from<br />

users of the public service and specified or determinable<br />

amounts. Therefore, these are concession arrangements in<br />

which demand risk is borne in full by the grantor. In these<br />

cases, the amount payable by the grantor is recognised in<br />

assets in the consolidated statements of financial position<br />

as a loan or a receivable.<br />

To calculate the amount payable by the grantor, the value<br />

of the construction, operation and/or maintenance services<br />

provided and the interest implicit in arrangements of this<br />

nature are taken into consideration.<br />

Revenue from the services provided in each period<br />

increases the amount of the related receivables with a<br />

credit to sales. The interest on the consideration for the<br />

services provided increases the amount of the receivables<br />

with a credit to other operating income. Amounts received<br />

from the grantor reduce the total receivable with a charge<br />

to cash.<br />

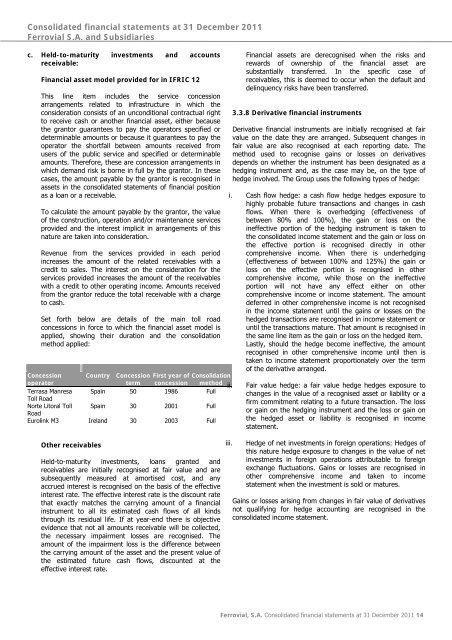

Set forth below are details of the main toll road<br />

concessions in force to which the financial asset model is<br />

applied, showing their duration and the consolidation<br />

method applied:<br />

Concession Country Concession First year of Consolidation<br />

operator<br />

term concession method ii.<br />

Terrasa Manresa Spain 50 1986 Full<br />

Toll Road<br />

Norte Litoral Toll Spain 30 2001 Full<br />

Road<br />

Eurolink M3 Ireland 30 2003 Full<br />

Financial assets are derecognised when the risks and<br />

rewards of ownership of the financial asset are<br />

substantially transferred. In the specific case of<br />

receivables, this is deemed to occur when the default and<br />

delinquency risks have been transferred.<br />

3.3.8 Derivative financial instruments<br />

Derivative financial instruments are initially recognised at fair<br />

value on the date they are arranged. Subsequent changes in<br />

fair value are also recognised at each reporting date. The<br />

method used to recognise gains or losses on derivatives<br />

depends on whether the instrument has been designated as a<br />

hedging instrument and, as the case may be, on the type of<br />

hedge involved. The Group uses the following types of hedge:<br />

i. Cash flow hedge: a cash flow hedge hedges exposure to<br />

highly probable future transactions and changes in cash<br />

flows. When there is overhedging (effectiveness of<br />

between 80% and 100%), the gain or loss on the<br />

ineffective portion of the hedging instrument is taken to<br />

the consolidated income statement and the gain or loss on<br />

the effective portion is recognised directly in other<br />

comprehensive income. When there is underhedging<br />

(effectiveness of between 100% and 125%) the gain or<br />

loss on the effective portion is recognised in other<br />

comprehensive income, while those on the ineffective<br />

portion will not have any effect either on other<br />

comprehensive income or income statement. The amount<br />

deferred in other comprehensive income is not recognised<br />

in the income statement until the gains or losses on the<br />

hedged transactions are recognised in income statement or<br />

until the transactions mature. That amount is recognised in<br />

the same line item as the gain or loss on the hedged item.<br />

Lastly, should the hedge become ineffective, the amount<br />

recognised in other comprehensive income until then is<br />

taken to income statement proportionately over the term<br />

of the derivative arranged.<br />

Fair value hedge: a fair value hedge hedges exposure to<br />

changes in the value of a recognised asset or liability or a<br />

firm commitment relating to a future transaction. The loss<br />

or gain on the hedging instrument and the loss or gain on<br />

the hedged asset or liability is recognised in income<br />

statement.<br />

Other receivables<br />

Held-to-maturity investments, loans granted and<br />

receivables are initially recognised at fair value and are<br />

subsequently measured at amortised cost, and any<br />

accrued interest is recognised on the basis of the effective<br />

interest rate. The effective interest rate is the discount rate<br />

that exactly matches the carrying amount of a financial<br />

instrument to all its estimated cash flows of all kinds<br />

through its residual life. If at year-end there is objective<br />

evidence that not all amounts receivable will be collected,<br />

the necessary impairment losses are recognised. The<br />

amount of the impairment loss is the difference between<br />

the carrying amount of the asset and the present value of<br />

the estimated future cash flows, discounted at the<br />

effective interest rate.<br />

iii.<br />

Hedge of net investments in foreign operations: Hedges of<br />

this nature hedge exposure to changes in the value of net<br />

investments in foreign operations attributable to foreign<br />

exchange fluctuations. Gains or losses are recognised in<br />

other comprehensive income and taken to income<br />

statement when the investment is sold or matures.<br />

Gains or losses arising from changes in fair value of derivatives<br />

not qualifying for hedge accounting are recognised in the<br />

consolidated income statement.<br />

<strong>Ferrovial</strong>, S.A. Consolidated financial statements at 31 December 2011 14